Sejong City Land Transactions Surge 147.9% Compared to March... "Capital Relocation Theory" Drives Market

Out-of-Town Buyers Account for Highest Share Nationwide... Demand Shifts to Land Due to Fewer Regulations Than Housing

Market Likely to Remain Strong for Now... "Investors Should Focus on Long-Term Rather Than Short-Term Gains"

While apartment sale prices in Sejong City have recorded the highest nationwide growth rate for four consecutive weeks, the land market is also experiencing increased activity. There is even an unusual trend of land transactions becoming more active than apartment transactions. Analysts attribute this to the "Sejong capital relocation theory" fueling interest in land investment.

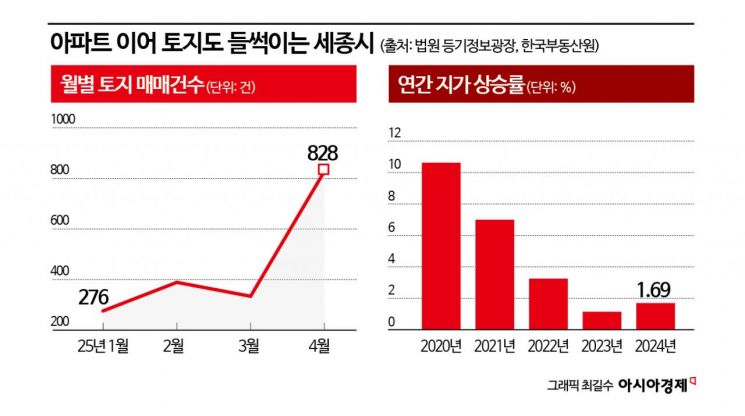

According to the "Status of Applications for Ownership Transfer Registration by Sale" from the Court Registration Information Plaza on May 22, the number of land sales in Sejong City last month totaled 828. This represents a 147.9% increase compared to March (334 transactions). It is the largest monthly figure in one year and three months, since January 2023 (1,772 transactions).

The sharp increase in monthly transaction volume last month?after remaining relatively steady from January to March this year at 276, 389, and 334 transactions, respectively?is attributed to the intensifying discussions around relocating the administrative capital, especially among political circles, including the "capital relocation theory."

As interest in land has grown, the number of land transactions surpassed transactions for collective buildings such as apartments, officetels, and commercial properties for the first time in 15 months. Last month, there were 601 collective building transactions, while land transactions reached 828, overtaking the former for the first time since January 2023. Sejong City also recorded the highest apartment price growth rate nationwide for four consecutive weeks as of the second week of this month.

An official at a real estate agency in Sejong City stated, "Apartment activity has actually slowed recently, while inquiries from out-of-town buyers looking for land have increased noticeably. Local investors are also becoming active." Last month, out-of-town buyers accounted for 42.5% of Sejong land transactions, the highest proportion nationwide. Sejong City is the only region with a share in the 40% range, whereas most other regions remain in the 20?30% range. Another real estate agent commented, "Many buyers are purchasing land for single-family homes or small-scale plots. As more sellers are listing their land, believing now is a good time to sell, transaction volumes have increased as well."

In addition to the "Sejong capital relocation theory," demand is also being driven to Sejong by strict regulations on owners of multiple homes, which make land appear more attractive than residential properties as an investment. For example, if a person with multiple homes purchases another apartment, the acquisition tax can be as high as 12%. In contrast, the acquisition tax for land is only about 4.6%. Furthermore, because land is traded less frequently, its officially assessed value is relatively low, resulting in a lighter comprehensive real estate tax burden. Unlike residential properties, there are also no legal restrictions on the loan-to-value (LTV) ratio for land, allowing buyers to borrow up to 80% of the appraised value from financial institutions.

For these reasons, land in Sejong City has remained popular even during periods when apartment prices were falling. In the past, politicians have repeatedly been embroiled in "land speculation scandals" related to the area. Since its official launch in 2012, Sejong City has ranked first in annual land price growth rate nine times (2012, 2013, 2014, 2017, 2018, 2020, 2021, 2022, and 2023). Last year, it recorded the fourth-highest growth rate nationwide, following Seoul, Gyeonggi, and Incheon.

Experts advise that while Sejong City's land market may remain strong for the time being, buoyed by demand from out-of-town buyers and policy expectations, investors should adopt a long-term perspective rather than seeking short-term gains. Yang Jiyeong, Head of Asset Management Consulting at Shinhan Investment & Securities, said, "Political and administrative developments seem to be fueling market optimism, resulting in a boom in both the apartment and land markets. However, since land is relatively illiquid, investors should focus on long-term strategies rather than short-term price gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.