Transpacific Ocean Freight Rates from China to the US Soar

Global Shipping Companies Raise Rates on US Routes

Cargo Volume Surge Raises Concerns over Bottlenecks

As the United States and China have agreed to temporarily suspend tariffs, transpacific ocean freight rates from China are soaring sharply. There are even forecasts that rates could more than double by the end of June, further increasing the logistics burden on import and export companies.

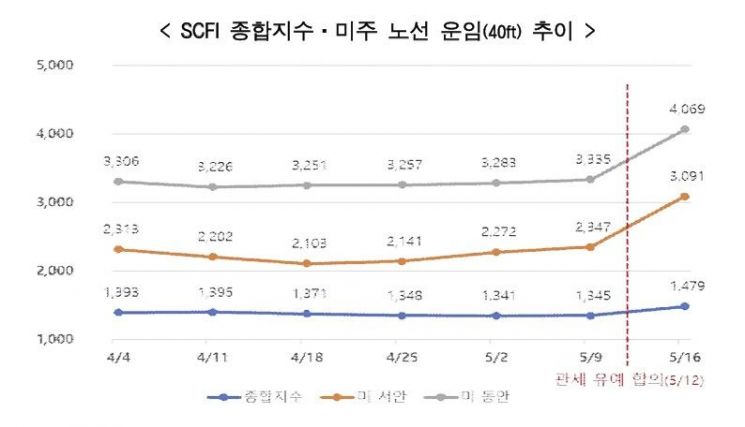

According to the Korea International Trade Association on May 21, the United States and China have each agreed to significantly reduce mutual tariffs for 90 days, causing ocean freight rates from China to the US to surge. According to the Shanghai Shipping Exchange (SSE), the 40-foot container rate for the US West Coast route jumped 31.7% from $2,347 on May 9, just before the tariff reduction announcement, to $3,091 in just one week. During the same period, rates for the US East Coast route also rose by 22.0%, surpassing $4,000. This marks the highest rate of increase since January last year, when the 'Red Sea crisis' occurred, based on the Shanghai Containerized Freight Index (SCFI).

This upward trend is expected to continue for the time being. Freight rates for transpacific routes from China are projected to rise by more than 100% by the end of next month. Global shipping companies plan to further increase transpacific route rates by up to $3,000 starting in June. In addition, they have announced that the peak season surcharge (PSS), which is usually applied in the second half of the year (July to October) and is at least $1,000, will also be charged separately from June.

There are also concerns about bottlenecks due to a surge in cargo volume. As the suspension of tariffs leads to concentrated import demand, congestion at US West Coast ports such as the Port of Los Angeles and the Port of Long Beach is rising sharply. Based on past cases, there are warnings that frequent delays in port entry and unloading, as well as bottlenecks in truck and rail transport at US West Coast ports, could cause delivery disruptions.

Shanghai Containerized Freight Index (SCFI) Composite Index, Transpacific Route Freight Rate Trends. Korea International Trade Association

Shanghai Containerized Freight Index (SCFI) Composite Index, Transpacific Route Freight Rate Trends. Korea International Trade Association

Global shipping companies are considering increasing transpacific shipping capacity, which had previously been reduced, but the Korea International Trade Association expects that this will take at least two to three weeks. As exports and imports between the two countries plummeted due to the US-China tariff war, shipping companies had temporarily suspended sailings or redeployed vessels, significantly reducing transpacific shipping capacity.

In response, the Korea International Trade Association plans to jointly implement a program with HMM to provide shipping capacity support and offer rates lower than market prices for transpacific and European routes. The association's supported rates are set at $3,000 for a 40-foot container on the US West Coast and $4,200 for the US East Coast, including a $1,000 peak season surcharge.

The 90-day tariff suspension between the US and China will remain in effect until August 10, and depending on the outcome of further negotiations, rates may fall again or stabilize at a certain level. The Korea International Trade Association stated, "After the global shipping companies redeploy their fleets at the end of June, the sharp increase in rates is expected to stop, and rates are projected to remain at end-of-June levels until the tariff suspension ends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)