Hana Tour and Modetour See Declining Results Due to Drop in Group Tour Travelers

Multiple Adverse Factors: State of Emergency, Airline Accident, and Economic Downturn

Package Tours Lose Appeal as Independent Travelers Increase

As overseas group tour demand rapidly declined, major travel agencies posted disappointing first-quarter results. The industry was unable to avoid a drop in performance due to several factors: the presidential impeachment crisis, the Jeju Air accident, worsening economic conditions, and a clear shift in consumer preference toward independent travel.

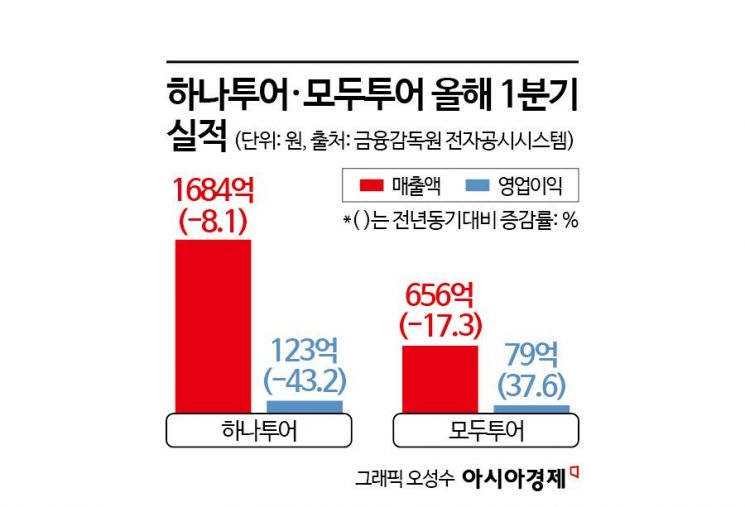

According to the Financial Supervisory Service's electronic disclosure system on May 22, Hana Tour, the largest travel agency in Korea, reported first-quarter revenue of 168.4 billion won, down 8.1% from the same period last year. Operating profit also fell by 43.2% to 12.3 billion won.

Hana Tour's poor performance was mainly due to a decline in the number of outbound travelers, as demand for package tours shrank. This was caused by political uncertainty stemming from the state of emergency at the end of last year, as well as unexpected external factors such as the Jeju Air accident. In fact, Hana Tour's total number of outbound package travelers in the first quarter was 560,000, a 4% decrease from 590,000 in the same period last year. The decline was especially pronounced in March, when the number of package travelers dropped 12% year-on-year to 150,000, significantly impacting revenue. In addition, the average selling price of packages fell by 2% to 1.03 million won.

Outbound traveler numbers decreased in most regions, including long-haul destinations such as the Americas and Europe, as well as Southeast Asia and Japan. China was the only exception. The number of outbound travelers to China in the first quarter increased by 61% year-on-year. This was attributed to the historic visa waiver implemented in November last year and the revitalization of exchanges between the two countries. This upward trend in demand is expected to continue for the time being.

While shrinking demand led to a general deterioration in profitability, the mid-to-high-priced package 'Hana Pack 2.0' continued to show growth. The proportion of gross merchandise value (GMV) from mid-to-high-priced packages in the first quarter rose to 47%, up 4 percentage points from 43% a year earlier. Hana Tour is pursuing a strategy to increase the average transaction value by focusing on Hana Pack 2.0, which emphasizes a 'no shopping, no tipping' policy. This suggests that, even amid a sluggish market, there remains demand from customers willing to pay higher prices for quality travel experiences.

Modetour managed to maintain profitability despite a decline in revenue, allowing for a slight smile. Modetour's consolidated revenue for the first quarter was 65.6 billion won, down 17.3% year-on-year, but operating profit increased by 37.6% to 7.9 billion won.

Modetour also could not avoid a drop in revenue as the number of overseas package travelers decreased. In the first quarter, Modetour sent 250,000 overseas package travelers, down 23.5% from the same period last year. This highlights the vulnerability of the package market, which relies heavily on demand from middle-aged customers, groups, and corporate clients.

According to the Korea Tourism Organization, the number of outbound travelers in the first quarter was 7.8 million, a 5% increase from 7.42 million in the same period last year. This indicates that, despite political uncertainty and external shocks such as airline accidents, demand for independent travel was largely unaffected. In contrast, the package market saw a decline of more than 20% in customer acquisition, moving away from being the core of travel demand.

However, operating profit increased significantly, resulting in improved profitability. The main factor behind this improvement in the first quarter was a reduction in hard block (guaranteed booking of rooms and seats) airline tickets. Last year, Modetour increased sales of hard block tickets to drive top-line growth, which had a somewhat negative impact on profitability. This year, the company focused on improving profitability by reducing hard block sales, and the resolution of refund issues with TMON and WEMAKEPRICE also contributed to better results.

The travel industry's sluggish performance is expected to continue through the second quarter. The second quarter is typically the off-season, and with the presidential election scheduled for early June, demand for key business-to-business (B2B) package products such as travel incentives and group training for public institutions is expected to shrink, making a strong rebound unlikely. However, from the third quarter, the industry will enter the peak summer vacation season, and in the fourth quarter, the longest-ever 10-day Chuseok holiday is scheduled, which could lead to improved results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.