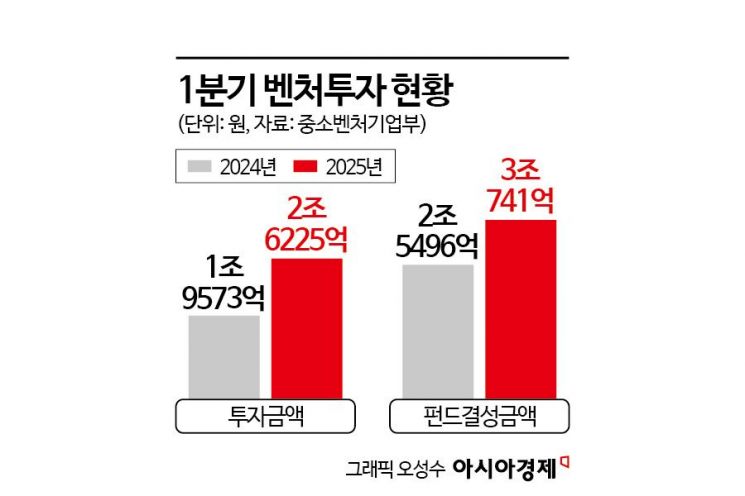

34% Increase Year-on-Year; Fund Formation Up 21%

Late-Stage Companies Still Dominate as Number of Investments Declines

Expansion of Private Capital; Higher Proportion from Pension Funds and Financial Institutions

In the first quarter of this year, the scale of venture investment reached KRW 2.6225 trillion, marking a 34% increase compared to the same period last year. Not only did the total investment amount grow, but the proportion of private capital also expanded, signaling signs of recovery in the venture investment market.

According to the "Trends in New Venture Investment and Venture Fund Formation in Q1 2025" announced by the Ministry of SMEs and Startups on May 20, the venture investment amount in the first quarter was KRW 2.6225 trillion, while the scale of venture fund formation reached KRW 3.0741 trillion. Compared to the same period last year, these figures represent increases of 34% and 21%, respectively.

This is the second-highest performance on record, following the boom year of 2022. However, the number of invested companies was 936 (including duplicates), which is a 12.8% decrease from the previous year. It was found that several large-scale investments concentrated in specific early-stage startups drove the overall statistics.

Investment in early-stage companies less than three years old amounted to KRW 725.2 billion, an 81.7% increase compared to the same period last year. In contrast, investment in companies aged three to seven years decreased by 1.6% to KRW 547.6 billion, while investment in late-stage companies over seven years old increased by 34.8% to KRW 1.3497 trillion. Investments in late-stage companies accounted for more than half (51.5%) of the total investment amount.

The Ministry of SMEs and Startups explained, "Because the sample size is relatively small, the scale or characteristics of individual investment cases can cause large fluctuations," adding, "Continuous monitoring is necessary."

The main investment fields were artificial intelligence (AI) and bio. Among the 26 unlisted companies that attracted investments of KRW 10 billion or more in the first quarter, 10 were startups based on AI or bio technology. In the AI sector, Ruten Technologies raised KRW 83 billion, while in the bio sector, Cellak Bio attracted KRW 17.1 billion.

Of the KRW 3.0741 trillion in venture fund formation in the first quarter, private capital accounted for KRW 2.5664 trillion, a 31.1% increase compared to the same period last year. Among these, investments from pension funds and mutual aid associations rose by 47.8%, and those from financial institutions increased by 41.4%. General corporate investments also grew by 37.7%. Analysts say that private capital, which had contracted last year due to a shrinking exit market and interest rate fluctuations, is now showing signs of recovery.

Kwak Jaekyung, Director of Investment Management and Supervision at the Ministry of SMEs and Startups, stated, "Since last year, the scale of venture investment has been on an upward trend, and the continued increase in both investment and funds in the first quarter of this year is a positive sign." He added, "Going forward, we will steadily promote institutional improvements and investments from the Korea Fund of Funds to ensure that active investment in deep tech startups continues and that private venture fund contributions can further expand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)