An Additional 1.50% Interest Rate to Be Applied to All Household Loans

Regional Areas Exempted Until December

Interest Rate Surcharge for Unsecured Loans Exceeding 100 Million Won

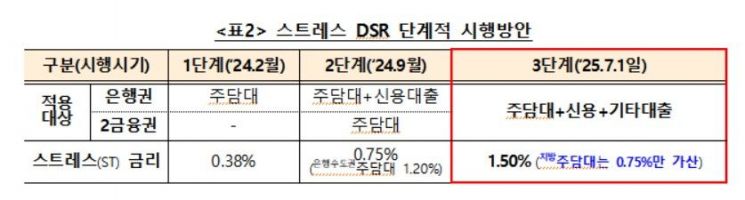

Starting in July, the third phase of the Stress Debt Service Ratio (DSR) will be fully implemented, which is expected to reduce the maximum amount available for mortgage loans. Essentially, a stress interest rate of 1.50% will be added to all household loans. In regional areas, however, the current interest rate level will be maintained for six months in consideration of the sluggish real estate market.

The Financial Services Commission held a household debt review meeting on May 20 and announced the implementation plan for the third phase of the Stress DSR. The stress interest rate for the third phase DSR is 1.50%. This rate will apply to mortgage loans from banks and secondary financial institutions, unsecured loans exceeding 100 million won, and other types of loans.

However, regional areas (excluding Seoul, Gyeonggi, and Incheon) will be exempted. The second phase stress interest rate of 0.75% will be applied until the end of December. Kwon Daeyoung, Secretary General of the Financial Services Commission, explained, "The proportion of regional mortgage loans in new mortgage originations has been gradually declining, and the impact of regional mortgage loans on the recent increase in household debt has lessened. Therefore, the application of the third phase Stress DSR has been postponed for six months in regional areas." He added, "At the end of the year, we will comprehensively review the impact of regional mortgage loans on the regional economy and household debt, and reconsider the appropriate level for the stress interest rate."

Additionally, to encourage the expansion of pure fixed-rate loans, the proportion of stress interest rate applied to hybrid and step-up loans will be increased. For hybrid loans, where the interest rate is fixed for five years and then changes every six months, the application rate will rise from 60% to 80%. For step-up loans, it will increase from 30% to 40%. The longer the fixed-rate period, the lower the application rate; if a fixed rate is chosen for 21 years or more (based on a 30-year maturity), the stress interest rate will not be applied.

Once the third phase DSR is implemented, loan limits will decrease. For a borrower with an annual income of 100 million won, if they take out a variable-rate mortgage in the Seoul metropolitan area with a 30-year maturity and a 4.0% interest rate (with equal principal and interest repayment), the loan limit will be 587 million won. Under the second phase DSR conditions, the limit would have been 607 million won.

With the third phase DSR coming into effect in July, group loans for which a recruitment notice is issued by June 30 and standard mortgage loans for which a real estate sales contract is signed by that date will remain subject to the second phase DSR.

Kwon stated, "The Stress DSR serves as an 'automatic control device' that can limit borrowers' loan limits, especially during periods of declining interest rates. Therefore, the effectiveness of this system will become even greater in the future."

He added, "Since there are concerns that household debt may increase further in May, the financial authorities will closely monitor whether financial institutions comply with their monthly and quarterly management targets, and will take immediate action if necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.