KOSPI Falls Below 2600 During Trading on the 19th...

U.S. Credit Rating Downgrade Triggers Market Correction

Accumulated Fatigue After Prolonged Gains...

Short-Term Cooling-Off Period Expected

Focus on Defensive Stocks Such as Cosmetics, Non-Ferrous Metals, and Defense Industry

The KOSPI 2600 level is once again under threat. This is because Moody's, an international credit rating agency, downgraded the United States' credit rating, providing a trigger for a short-term market correction after a period of sustained stock market gains. The market is expected to undergo a short-term cooling-off period and absorb selling pressure for the time being.

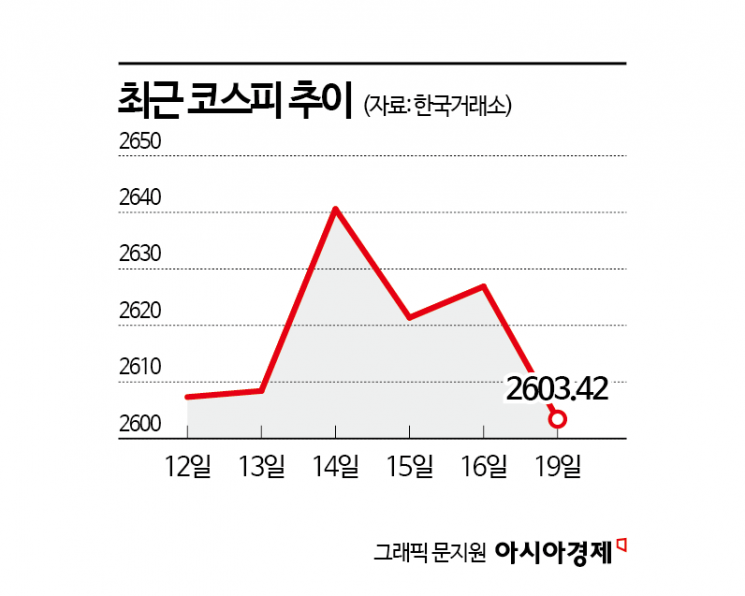

According to the Korea Exchange on May 20, the KOSPI closed at 2,603.42 on the previous trading day, down 0.89% from the previous session. During intraday trading, the index fell by more than 1% and briefly dipped below the 2600 mark, but pared losses toward the end of the session to finish above 2600. This was the first time in five days that the KOSPI fell below 2600 during trading hours.

The downgrade of the U.S. credit rating acted as a bearish factor for the stock market. Foreign investors, who had led the KOSPI above the 2600 mark with eight consecutive days of net buying, switched to net selling on this day.

Although the downgrade of the U.S. credit rating is expected to trigger a short-term correction in global stock markets, including Korea, which had been on an upward trend, some analysts believe the market impact will be limited. Lee Kyungmin, a researcher at Daishin Securities, explained, "This was the last of the three major credit rating agencies to downgrade the rating, and the downgrade had already been signaled through previous changes in the credit outlook."

Kim Daejun, a researcher at Korea Investment & Securities, said, "The Moody's announcement is largely a reiteration of previous outlooks, so its impact appears limited. The market will assess how this issue will play out, and may take a brief pause in the process." He added, "The KOSPI has been trading above the 2600 level since breaking out from its early April lows, and as of May 16, the 12-month forward price-to-earnings ratio (PER) stood at 8.96 times, just below the short-term resistance level of 9 times. As the market was attempting to break through this resistance, the negative news from the U.S. emerged, making it difficult to avoid downward pressure. Because the market was in an overbought state, it could react even more sensitively."

The stock market is expected to undergo a short-term cooling-off period. Lee said, "The KOSPI, which had been burdened by short-term overheating and accumulated upward fatigue, is likely to enter a phase of short-term cooling and absorption of selling pressure, triggered by the U.S. credit rating downgrade. The first support level is at 2500, and fluctuations in the low to mid-2500s could provide an opportunity to increase holdings. After the short-term cooling and absorption of selling pressure, the KOSPI is expected to resume its upward trend toward the 2700 level."

During the short-term correction period, it is advisable to focus on defensive stocks with low market sensitivity (beta). Kim said, "The key concern will be whether returns can be protected during a market correction. The recommended strategy is to select sectors that may show a different trajectory from the index, and among these, sectors with low beta are more likely to deliver positive returns even if the KOSPI declines." He added, "In particular, it may be wise to select sectors where profit forecasts are rising this year. Continued attention should be paid to cosmetics, non-ferrous metals, and the defense industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.