Applications for Dispute Mediation Against Non-Life Insurers Turn Downward for the First Time in Four Years

Court Precedents Accumulate for Non-Reimbursed Treatments Such as Cataract Surgery and Manual Therapy

Dispute Mediation Applications for Life Insurers Also Continue to Decline

Kim, a salaried worker in his 40s, experienced chest pain last year and underwent a coronary angiography at a specialized cardiovascular hospital. Afterwards, he filed a claim for surgical insurance benefits with his insurer but was denied. Feeling wronged, Kim considered applying for insurance dispute mediation but ultimately gave up after encountering numerous cases where coronary angiography was not deemed a "surgery"?defined as a procedure involving incision or excision of body tissue for disease treatment?and therefore not eligible for surgical insurance payouts.

In the first quarter of this year, the number of insurance dispute mediation applications filed against non-life insurance companies turned to a decrease for the first time in four years. This is attributed to increased consumer understanding regarding insurance payouts and the active campaigns conducted by the Financial Supervisory Service and insurance companies.

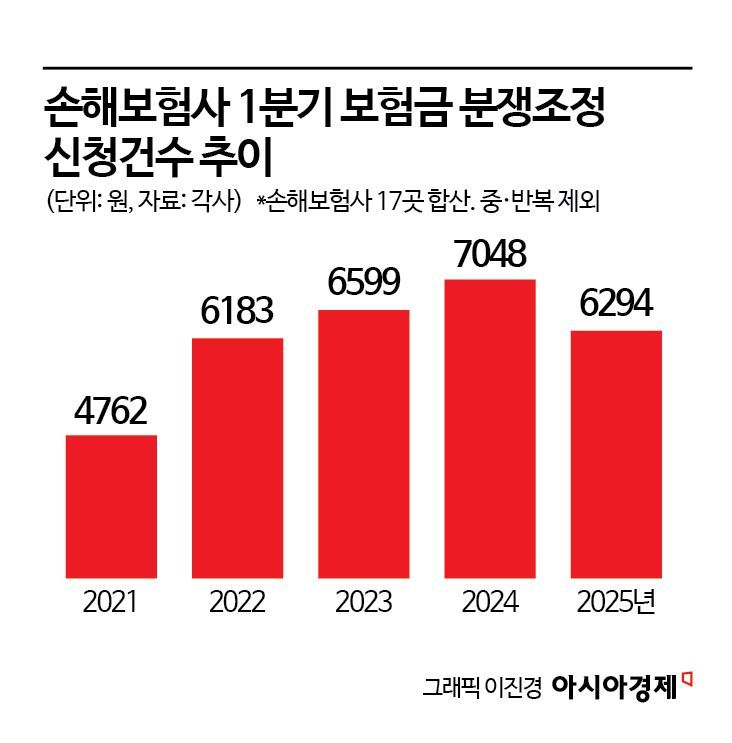

According to the insurance industry on May 20, the number of dispute mediation applications submitted to 17 non-life insurers in the first quarter of this year was 6,294 cases (excluding duplicates and repeated cases), a 10.7% decrease compared to the same period last year. The number of first-quarter applications had increased for three consecutive years?4,762 in 2021, 6,183 in 2022, 6,599 in 2023, and 7,048 in 2024?before turning to a decline this year. Dispute mediation is a process in which customers can have issues such as insurance payouts reviewed through the Financial Services Commission or the Korea Consumer Agency when a dispute arises with an insurer.

The company that saw the largest decrease in dispute mediation applications in the first quarter compared to the same period last year was Hana Insurance, with a 40.9% drop. A Hana Insurance representative explained, "Since last year, we have significantly improved our products and services to be more consumer-centric, resulting in a sharp decline in complaints." This was followed by Heungkuk Fire & Marine Insurance (-37%), Lotte Insurance (-20.8%), and NH NongHyup Property & Casualty Insurance (-20.1%), all showing clear downward trends.

Industry insiders in the non-life insurance sector cited the main reason for the decrease in dispute mediation applications as the accumulation of court rulings regarding treatments that frequently caused insurance payout disputes, such as cataract surgery, stem cell injections, and manual therapy. They explained that, based on these precedents, financial authorities and insurers have worked to improve consumer understanding regarding insurance payouts. A non-life insurance industry official stated, "Legal interpretations regarding problematic non-reimbursed treatments have accumulated, and as consumers have begun to share this information, the number of dispute mediation applications has decreased." The official also noted, "The announcement of reforms for indemnity health insurance and auto insurance this year, which highlighted issues such as overtreatment and moral hazard, likely had some impact as well."

The company with the largest increase in dispute mediation applications was SGI Seoul Guarantee Insurance, which saw a jump from 1 case in the first quarter of last year to 34 cases this year, a 3,300% increase. A representative from SGI Seoul Guarantee explained, "Due to the prolonged period of high interest rates, difficulties for small and medium-sized businesses and self-employed individuals have intensified, leading to an increase in insurance claims and payouts. As a result, dispute mediation applications have also risen, and we plan to make greater efforts to minimize disputes." Following SGI Seoul Guarantee, Shinhan EZ Insurance (1,025%), Lina Insurance (95%), and MG Insurance (23.2%) also showed significant increases. In terms of the number of cases in the first quarter, Meritz Fire & Marine Insurance had the most, with 1,057 cases.

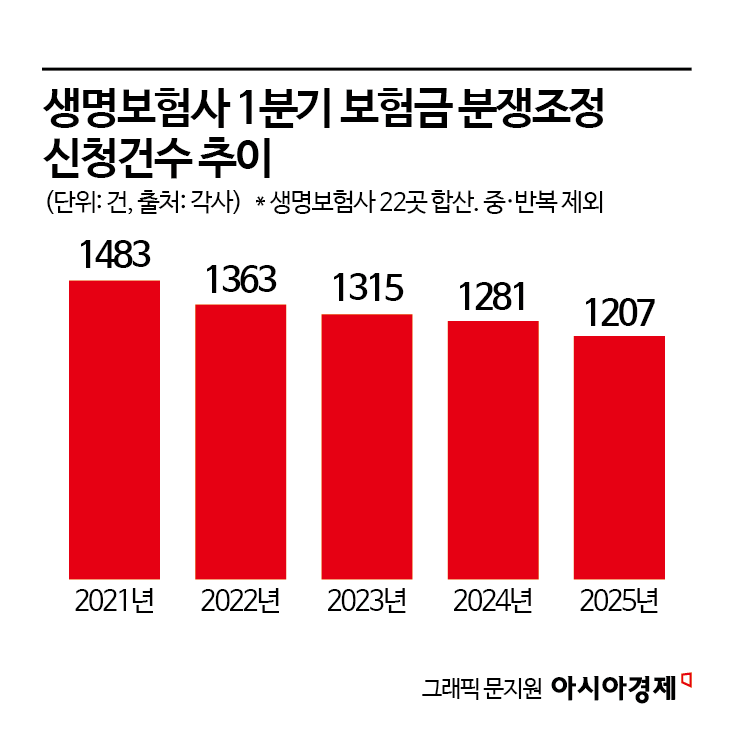

Dispute mediation applications at life insurance companies are also showing an overall downward trend. In the first quarter of this year, the 22 life insurers saw 1,207 dispute mediation applications, a 5.8% decrease compared to the same period last year. Life insurers have seen a decline in first-quarter dispute mediation applications for six consecutive years since 2020.

The number of dispute mediation applications for non-life insurance is more than five times higher than that for life insurance, due to the unique characteristics of non-life insurance. In life insurance, the beneficiary is usually the policyholder or a family member, so disputes are rare. In contrast, non-life insurance often involves cases?such as auto insurance?where the policyholder and the beneficiary are different, leading to frequent conflicts over fault ratios and the appropriateness of insurance payouts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.