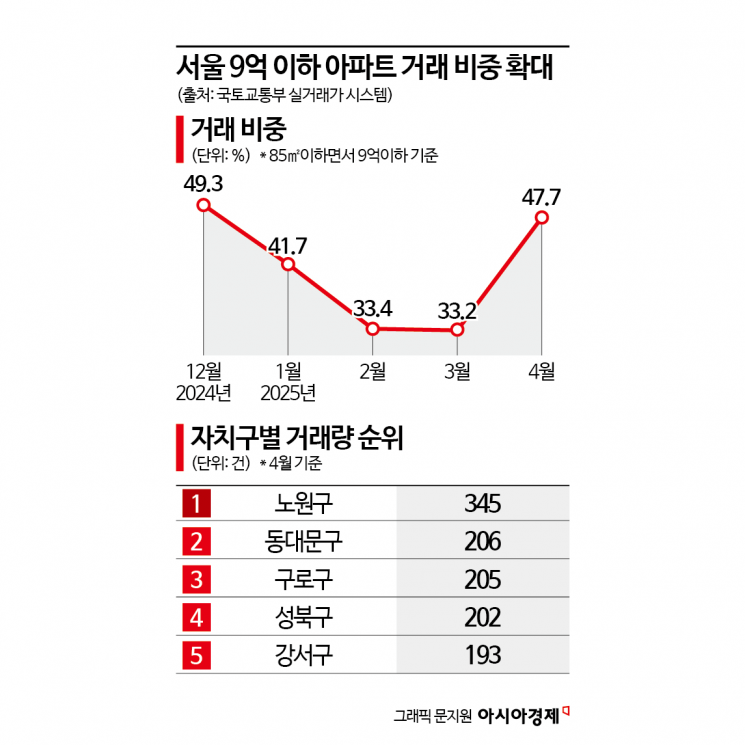

47.7% of April Transactions Were for Apartments Priced at 900 Million Won or Less, the Highest Since Last December

High-End Apartment Deals Plummet After New Regulations

Policy Support Sustains Demand for Units Under 900 Million Won

Active Mid- to Low-Priced Transactions in Nowon, Dongdaemun, Guro, and Seongbuk Districts

Last month, the proportion of transactions involving "mid- to low-priced apartments"-defined as units with an exclusive area of 85 square meters or less and priced at 900 million won or less-reached its highest level in four months in the Seoul apartment market. This increase is attributed to a decline in high-priced apartment transactions, which have been constrained by the expanded re-designation of Land Transaction Permission Zones (LTPZ), while demand for mid- to low-priced apartments remained robust.

According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system on May 20, apartment transactions in Seoul last month totaled 4,941, a decrease of more than half (50.6%) compared to 10,004 in March. However, among these, transactions involving apartments with an exclusive area of 85 square meters or less and priced at 900 million won or less amounted to 2,359, accounting for 47.7% of the total. This is the highest figure since December last year (49.3%). The share had declined earlier this year-41.7% in January, 33.4% in February, and 33.2% in March-before rebounding last month. This marks a sharp increase of 14.5 percentage points compared to March.

Of the four price segments-900 million won or less, over 900 million won up to 1.5 billion won, over 1.5 billion won up to 3 billion won, and over 3 billion won-only the 900 million won or less segment saw an increase in its proportion. In terms of transaction count, while the figure is lower than March's 3,326 cases, it is higher than in January (1,454 cases) and February (2,189 cases).

Since March 24, when Gangnam, Seocho, Songpa (the three Gangnam districts), and Yongsan District were newly designated as LTPZs, high-priced apartment transactions have stalled, resulting in a higher proportion of mid- to low-priced apartment deals. The combined transaction volume in these four districts last month was 243, a decrease of nearly 90% compared to March (2,473 cases). Major adjacent districts such as Mapo, Seongdong, Gangdong, and Gwangjin also saw transaction volumes drop by about half. Transactions for apartments priced over 1.5 billion won up to 3 billion won fell sharply to 775 last month, down about 70% from the previous month's 2,548, with their share dropping from 25.5% to 15.7%. For units priced over 3 billion won, the share dropped from 6.5% (651 cases) to 2.5% (122 cases), and for the 900 million won to 1.5 billion won segment, both the share and transaction count fell from 33.4% (3,337 cases) to 32.8% (1,619 cases).

As the trend of "smart single-home purchases" lost momentum, actual demand from those prioritizing home ownership became more prominent. Policy-based financial products such as the government's Special Bogeumjari Loan and special loans for newborns have been concentrated on properties priced at 900 million won or less, which appears to be driving a steady increase in buyers seeking homes within this price range.

By district, Nowon District recorded the highest number of transactions for apartments priced at 900 million won or less, with 345 cases. It was followed by Dongdaemun District (206 cases), Guro District (205 cases), Seongbuk District (202 cases), and Gangseo District (193 cases), indicating active trading in areas with high concentrations of actual demand. Nowon District has the largest number of apartment households among Seoul's districts (164,133 households as of 2023). Gangseo, Seongbuk, and Guro Districts also rank high in terms of the number of apartment households. Dongdaemun District has seen a surge in transactions due to the continued influx of thousands of new apartment units.

Nam Hyukwoo, a real estate researcher at Woori Bank's WM Business Strategy Department, stated, "In regulated areas such as the three Gangnam districts and Yongsan, transaction volumes have slowed due to policy effects, and areas like Mapo and Seongdong, which were expected to benefit as alternatives, are showing a similar trend." He added, "On the other hand, mid- to low-priced areas are performing relatively well, recording a lower rate of transaction decline compared to March." He further predicted, "As price burdens in popular Seoul districts and tighter lending regulations weaken purchasing power, actual buyers are likely to continue seeking alternative areas for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)