Increase in Non-Performing Loans at Financial Holding Companies Due to Economic Downturn

Profitability Improves, but Calls Grow for Stronger Asset Quality Management

As the economic downturn persists, financial institutions are seeing an increase in the amount of money loaned to borrowers that is not being repaid on time. With asset quality indicators deteriorating, there are growing calls for financial companies to strengthen their asset quality management.

Increase in Non-Performing Loans at Financial Holding Companies Due to Economic Downturn

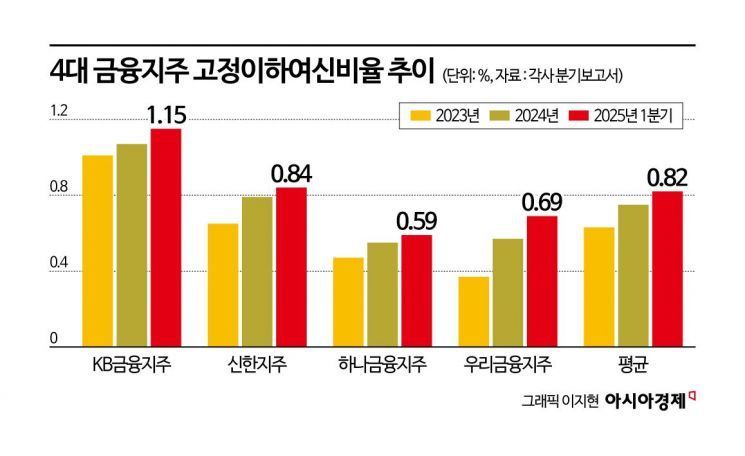

According to the quarterly reports disclosed by the four major financial holding companies on May 19, their average ratio of substandard or lower loans in the first quarter of this year was 0.82%. This ratio for the four major financial holding companies rose from 0.63% at the end of 2023 to 0.75% at the end of last year, and increased again in the first quarter of this year.

The ratio of substandard or lower loans is an indicator that shows the proportion of loans made by banks or financial companies that are unlikely to be recovered. An increase in this ratio also means that the amount of non-performing loans (NPL) at financial companies has grown.

By company, KB Financial Group had the highest ratio of substandard or lower loans at 1.15%. Although its core subsidiary KB Kookmin Bank maintained a low ratio at 0.40%, the high non-performing loan ratios at some subsidiaries?such as KB Real Estate Trust (64.7%) and KB Savings Bank (9.50%)?are seen as major contributing factors.

Shinhan Financial Group recorded the second highest ratio at 0.84%. Similarly, Shinhan Bank's ratio was only 0.31%, but the high ratios at other subsidiaries?including Shinhan Asset Trust (76.4%), Shinhan Investment Corp. (15.9%), and Shinhan Savings Bank (7.8%)?had a significant impact. Woori Financial Group and Hana Financial Group maintained lower ratios compared to others, at 0.69% and 0.59%, respectively.

The ratio of non-accrual loans, which are considered to be in even worse condition than substandard or lower loans, is also on the rise. While substandard or lower loans are non-performing loans with low recovery potential, non-accrual loans are even more serious, as they do not generate any interest income at all. In the first quarter of this year, KB Kookmin Bank's non-accrual loan ratio rose significantly to 0.34%, compared to 0.23% at the end of last year. During the same period, Shinhan Bank's ratio increased from 0.18% to 0.25%, and Woori Bank's from 0.19% to 0.24%. In contrast, Hana Bank's ratio decreased from 0.28% to 0.25%.

Need for Financial Companies to Strengthen Asset Quality Management

The increase in non-performing loans at domestic financial institutions is largely attributed to the prolonged economic slowdown. In the first quarter, the Korean economy contracted by 0.2% compared to the previous quarter, mainly due to weak domestic demand and sluggish investment. As the economic situation worsens, there are more cases of borrowers failing to repay their loans.

According to a report on the non-performing loan market trends published last month by Samjong KPMG, the volume of non-performing loans at domestic banks (excluding credit card business) reached KRW 14.5 trillion as of the end of the third quarter last year, and has been steadily increasing since KRW 10.1 trillion at the end of 2022. A representative from Samjong KPMG stated, "The rise of protectionism in the United States and intensifying trade conflicts are contributing to a global economic slowdown, which in turn is driving up delinquency rates. This trend is likely to persist for the time being."

Even when the scope is expanded from the four major financial holding companies to the top ten?including NH, iM, BNK, JB, Korea Investment, and Meritz Financial Group?the downward trend in asset quality among financial companies remains clear. According to the Financial Supervisory Service, the average ratio of substandard or lower loans at the top ten domestic financial holding companies was 0.90% at the end of last year, up 0.18 percentage points from 0.72% at the end of 2023.

The loan loss reserve ratio, an indicator of the ability to absorb credit losses, also dropped to 122.7%, down 27.9 percentage points from 150.6% at the end of the previous year. A representative from the Financial Supervisory Service explained, "Key management indicators for financial companies, such as profitability and capital adequacy, remain sound and are not yet a cause for concern. However, given the rising ratio of substandard or lower loans, there is a need to strengthen asset quality management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.