Hanssem Tops Q1 Sales; Hyundai Livart Leads in Operating Profit

B2B Business Slows Amid Construction Slump, Lowest Apartment Move-ins in 11 Years Expected

Both Companies Strengthen B2C Strategies, Seeking Survival Solutions

Hanssem Pursues Market Leadership; Livart Counters with "THE ROOM"

Hanssem maintained its position as the top furniture company in terms of sales for the first quarter of this year, following its annual performance lead last year. In the first quarter of last year, Hanssem ceded the top spot to Hyundai Livart, but this year, it established an early lead, solidifying its dominance in the market. However, due to the overall downturn in the furniture industry caused by the slump in the construction sector, the focus has shifted from improving results to defending performance. As a result, the competition between the two companies is expected to become a fierce battle for survival rather than a simple contest for first place.

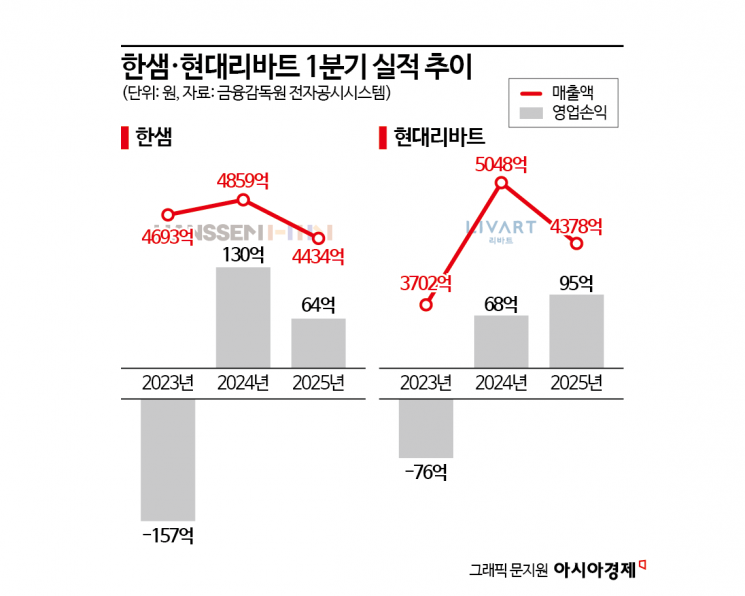

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Hanssem recorded consolidated sales of 443.4 billion won and an operating profit of 6.4 billion won in the first quarter of this year. Compared to the same period last year, sales decreased by 8.7% and operating profit dropped by 50.4%. Hyundai Livart posted sales of 437.8 billion won and an operating profit of 9.5 billion won. While sales declined by 13.3%, operating profit increased by 39.9%.

The simultaneous downturn in the construction market and sluggish domestic demand have been identified as the main causes of poor performance. Both companies experienced significant declines in business-to-business (B2B) sales. Hanssem's B2B sales were 110.9 billion won, while Hyundai Livart's were 157.1 billion won, representing decreases of 22.4% and 17.2%, respectively, compared to the same period last year. A Hanssem representative stated, "We were affected by weakened consumer sentiment due to domestic and international economic uncertainties, a decrease in large-scale move-ins, delayed recovery in the real estate market, and rising exchange rates." A Hyundai Livart representative also explained, "The supply of built-in furniture decreased due to the slump in the construction market, leading to a drop in sales."

Despite the weak performance, Hanssem led first-quarter sales by a margin of 5.6 billion won. This is a reversal from the first quarter of last year, when Hyundai Livart posted sales of 504.8 billion won, 18.9 billion won more than Hanssem's 485.9 billion won. Hyundai Livart continued to outperform Hanssem through the third quarter, but Hanssem posted strong results in the fourth quarter, ultimately reclaiming the top spot in annual sales. Last year's annual sales were 1.9084 trillion won for Hanssem and 1.8706 trillion won for Hyundai Livart, with the gap being less than 40 billion won.

The main variable affecting the two companies' performance is business-to-consumer (B2C) sales. Hanssem generates more than half of its total sales from B2C operations, making it relatively less affected by the construction market. In B2C, where consumers purchase furniture directly, steady demand for moving and remodeling ensures stable revenue. In the first quarter of this year, Hanssem's B2C businesses?Rehaus and home furnishing?accounted for 52.2% of total sales. This is significantly higher than Hyundai Livart's B2C share of 20.1%.

The furniture industry does not expect the business environment to recover this year. The Korea Institute of Construction Policy predicted that the construction market will remain sluggish due to weak leading indicators, including construction orders, and that construction investment will decrease by 1.2% year-on-year, falling below 300 trillion won. Therefore, strengthening the B2C market and reducing dependence on B2B have become even more important.

Meanwhile, the industry is increasingly alarmed as the nationwide supply of new apartments is expected to drop significantly this year. According to real estate information provider Real Estate R114, the number of new apartment move-ins nationwide is projected to be 263,330 units this year, more than 100,000 fewer than last year (364,058 units). This is the lowest level in 11 years since 2014 (274,943 units). The volume of new apartment move-ins is directly linked to furniture industry sales. As the decrease in new move-in demand has a direct impact on sales, both companies are working hard to develop response strategies.

Hanssem plans to further strengthen its B2C business to solidify its position as the industry leader. In the Rehaus division, the company will enhance its nationwide sales, logistics, and construction systems, and focus its portfolio on mid- to high-priced products to increase average transaction value and profitability. In the home furnishing business, Hanssem will enhance product competitiveness by focusing on core categories such as built-in wardrobes, hotel beds, student rooms, and Saem Kids. In particular, Hanssem will promote its signature storage products through intensive campaigns in the second quarter to boost sales.

Hyundai Livart is also strengthening its B2C strategy by targeting the market with its customized space solution, "THE ROOM," tailored to customer preferences. A Hyundai Livart representative said, "Our operating profit increased significantly in the first quarter due to portfolio improvements, including a higher proportion of B2C furniture sales," adding, "We will enhance our brand value by offering differentiated products and spaces that embody Hyundai Livart's unique design philosophy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)