Partial Sale of Major U.S. Financial Stocks

Expansion in Consumer Goods Holdings

Berkshire's Cash Reserves Reach All-Time High

Berkshire Hathaway, the American investment firm led by Warren Buffett, has drastically reduced its holdings in bank stocks and completely sold off its shares in Citigroup. Analysts suggest that during a period of stock market turmoil triggered by President Donald Trump's tariff war, Berkshire adopted a conservative strategy by selling financial stocks and accumulating cash reserves.

According to the "Form 13F" report submitted to the U.S. Securities and Exchange Commission (SEC) on May 15 (local time), Berkshire Hathaway sold all of its Citigroup shares?approximately 14 million shares held as of the end of 2024?during the first quarter of this year. Additionally, Berkshire sold about 48 million shares of Bank of America (BoA), which was previously its fourth-largest holding, reducing its stake from 11.19% at the end of last year to 10.19%.

Furthermore, Berkshire completely divested its stake in Nubank, a Brazilian digital bank, and partially sold shares in Capital One, a major U.S. credit card company. Considering the ongoing reduction in bank stock holdings since the fourth quarter of 2023, Nikkei reported that Chairman Buffett appears to be increasingly cautious and pessimistic about the financial sector.

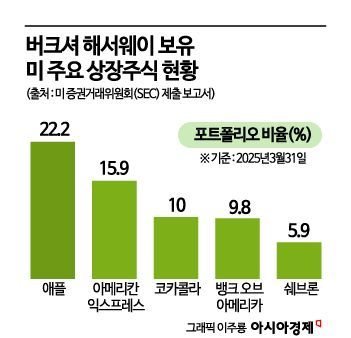

In contrast, Berkshire increased its investments in food, beverage, and consumer goods stocks. While there were no new additions to its portfolio this quarter, Berkshire purchased additional shares of Constellation Brands, a Mexican beer import and distribution company first acquired in the fourth quarter of last year. The company also increased its holdings in Domino's Pizza and Pool Corporation, a swimming pool equipment supplier, both of which were added to the portfolio in the third quarter of last year. The Wall Street Journal (WSJ) interpreted these moves as reflecting confidence in the consumer goods and essentials sector. As a result, there were changes in Berkshire's portfolio rankings: Bank of America, previously in third place, dropped to fourth, while Coca-Cola rose to third.

There were no changes in Berkshire's Apple holdings this quarter. Despite large-scale sales of Apple shares up to the third quarter of last year, the value of Berkshire's Apple holdings stood at $63.4 billion as of the end of March, making it still the company's largest holding. At the annual shareholders' meeting held on May 2, Buffett praised CEO Tim Cook's leadership.

As of the end of March this year, Berkshire held $347.7 billion (about 496 trillion won) in cash and cash equivalents, marking the highest level in its history. This amount surpassed the company's year-end cash and Treasury holdings of $334.2 billion.

This conservative cash retention strategy is seen as a reflection of caution toward market uncertainty and overvalued asset prices. Chairman Buffett has emphasized the legitimacy of holding large cash reserves, stating, "Opportunities do not always come."

Of particular note, Berkshire requested that some of its holdings remain confidential in the "Form 13F" report submitted to the SEC. Major institutional investors in the U.S. are required to disclose their holdings in U.S.-listed stocks to the SEC every quarter via Form 13F. However, this report focuses on U.S.-listed stocks, so Berkshire's holdings in Japanese trading companies, for example, are not included in the disclosure.

Regarding Berkshire's decision to keep some holdings confidential, the WSJ speculated that there may be newly acquired or strategically significant investments that are being kept hidden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)