Significant Potential Demand:

"35.3% Intend to Use in the Future,

and the Rate Would Increase Further If Deterrents Are Removed"

Raising Reverse Mortgage Participation Rate Also Boosts GDP...

About 340,000 Seniors Escape Poverty

The Private Sector Is on the Verge of Disappearing...

For Market Expansion, Private Products Must Flourish

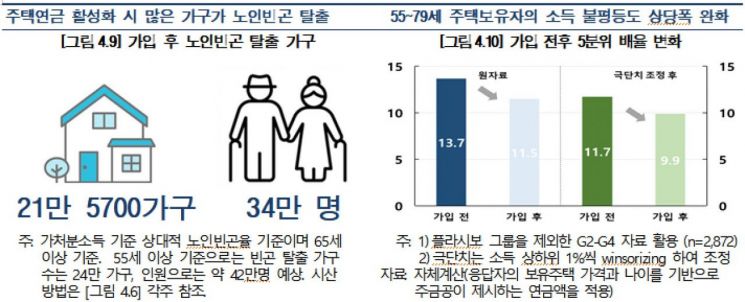

As South Korea enters a super-aged society, a recent study has found that reverse mortgages, which are gaining attention, could benefit the Korean economy in both production and distribution. If the current participation rate of 2% is raised to 40%, the country’s GDP could increase by up to 0.7%, and the elderly poverty rate could drop by 3.38 percentage points, allowing approximately 340,000 seniors to escape poverty. Experts point out that, in order to boost participation, product design should be improved to make reverse mortgages more attractive to consumers, and the private reverse mortgage market should be activated.

Significant Potential Demand: "35.3% Intend to Use in the Future, and the Rate Would Increase Further If Deterrents Are Removed"

On May 15, the Bank of Korea presented a report titled "Measures to Expand Consumption and Alleviate Elderly Poverty through Reverse Mortgages and Activation of Private Reverse Mortgages" at a symposium co-hosted with the Korea Development Institute (KDI). The research team included Hwang Indo, Head of the Financial and Monetary Research Department at the Bank of Korea Economic Research Institute; Kim Wooseok, Researcher; Han Jaekeun, Director of the Financial Markets Department; and Kim Deokgyu, Associate Professor at Yonsei University’s Department of Economics.

A reverse mortgage is a financial product that allows seniors to use their home as collateral to receive monthly cash payments, similar to a pension, while continuing to live in the property. Reverse mortgages are considered an alternative solution to elderly poverty. In South Korea, the proportion of real assets held by the elderly is high (85.1% as of 2021), but their liquid income is low, resulting in a high elderly poverty rate. As of 2023, the relative elderly poverty rate based on disposable income in South Korea was 39.8%, far exceeding the average of 15.1% among the 31 OECD member countries.

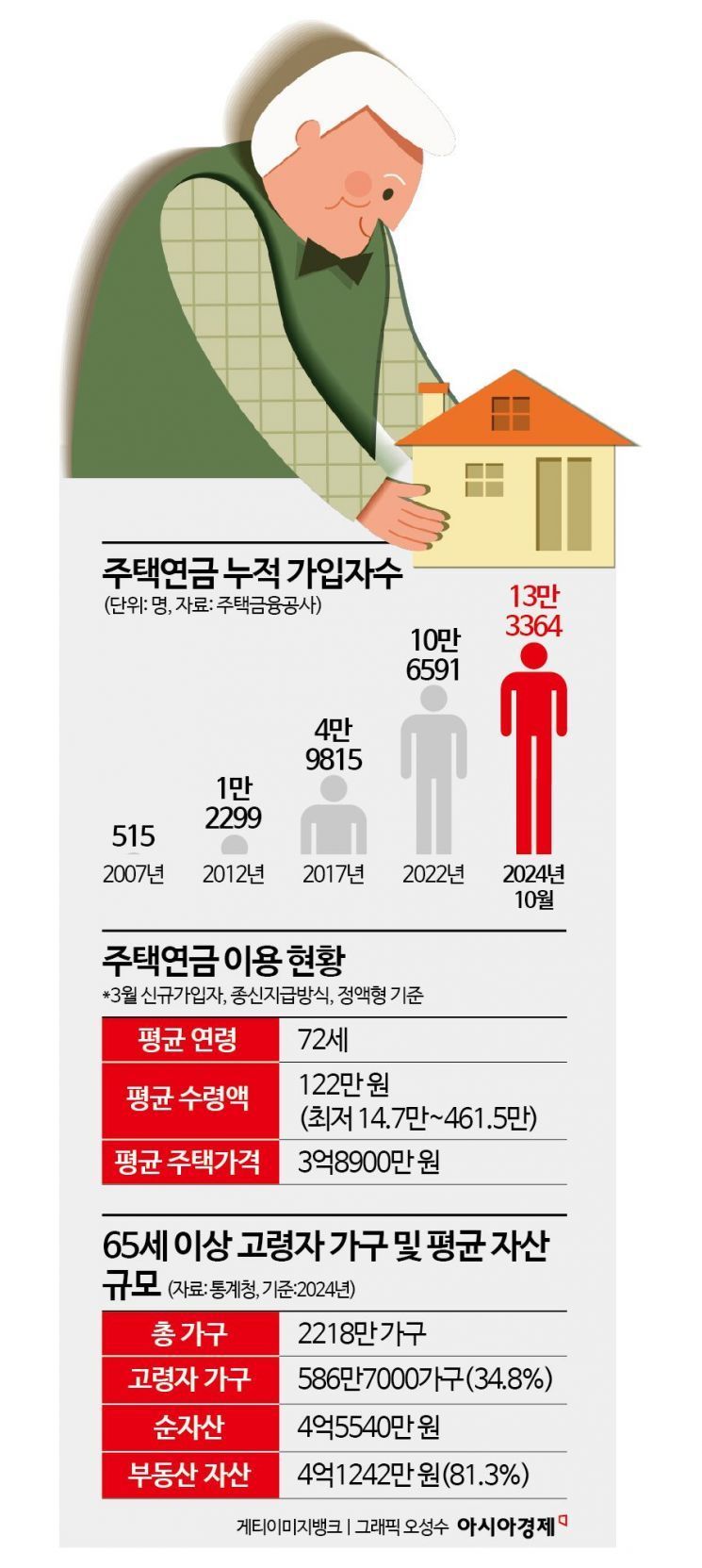

However, the actual utilization of reverse mortgages remains very low. Although the number of participants is steadily increasing, the level is still low. As of October last year, the total number of reverse mortgage subscribers was 133,364, accounting for only 1.89% of eligible households (those aged 55 or older, with a home official price of 1.2 billion KRW or less).

To identify the reasons for the low participation rate, the research team conducted a survey and found that potential demand is sufficient. According to a survey commissioned to Korea Research, conducted from August 26 to October 2, 2024, among 3,820 adults aged 55?79 nationwide who own a home (either themselves or their spouse) but have not enrolled in a reverse mortgage, 35.3% (1,348 people) said they intend to use the current reverse mortgage in the future.

Despite this high intention, the most common reason for reluctance to actually enroll was concern about potential losses if the total amount of pension received is less than the value of the home, cited by 18.2%. This was followed by 15.1% who wanted to leave the home entirely to their children, and another 15.1% who pointed out that changes in home prices are not reflected in pension payments. Other deterrents included the existence of penalties for early termination (10.2%) and the fact that pension payments are not indexed to inflation (9.8%).

If these deterrents were removed through improvements in product design, the intention to enroll increased to an average of 41.4%.

Specifically, 39.2% said they would enroll if changes in home prices were reflected in pension payments. If inheritance conditions were improved to make it easier to pass on the property, the intention rose to 41.9%. When respondents were informed that they would not incur a loss even if home prices increased after enrollment, 43.1% expressed willingness to participate.

Raising Reverse Mortgage Participation Rate Also Boosts GDP... About 340,000 Seniors Escape Poverty

The study found that increasing the number of reverse mortgage participants would stimulate consumption and reduce elderly poverty, thus benefiting the Korean economy in both growth and distribution.

Using marginal propensity to consume and a macroeconomic model, the analysis showed that if all respondents who expressed willingness to enroll after product redesign (41.4%) and who meet current eligibility criteria (home official price of 1.2 billion KRW or less) actually enrolled (participation rate of 39.7%, or about 2.76 million households), GDP would increase by 0.5?0.7%, and the elderly poverty rate would fall by 3.38 percentage points, allowing at least 340,000 seniors to escape poverty.

However, these positive effects vary depending on how much stated intention translates into actual enrollment. In a conservative scenario, assuming the low participation rate of 5.4% persists despite high intention, GDP would rise by only 0.02?0.03%, and the elderly poverty rate would drop by just 0.14 percentage points, which is only one-twentieth of the optimistic scenario.

In a compromise scenario, where about 37,000 new participants join each year, GDP would increase by about 0.1% and the elderly poverty rate would fall by 0.46 percentage points after 10 years. This scenario assumes new enrollments at the level of the UK, where the elderly own a high proportion of real estate and the reverse mortgage market is growing steadily.

Hwang Indo, Head of the Financial and Monetary Research Department at the Bank of Korea Economic Research Institute, stated, "The key is to ensure that high intentions to enroll actually lead to enrollment," adding, "To activate the reverse mortgage market, it is necessary to remove obstacles to enrollment and strengthen incentives."

Specifically, he suggested: introducing an additional "home price-linked product" that adjusts pension payments within a certain range (for example, ±20%) in response to significant home price fluctuations; easing inheritance requirements by extending the repayment period for loan principal and interest from the current 6 months to 3 years if children wish to inherit the property; expanding disclosure by the Korea Housing Finance Corporation to dispel the biggest concern deterring enrollment, which is the fear of incurring losses; and increasing tax benefits, which are currently lower than those for private pensions (property tax reduction of 25%).

The Private Sector Is on the Verge of Disappearing... For Market Expansion, Private Products Must Flourish

The research team emphasized the need to activate the private reverse mortgage market to broaden consumer choice and appropriately distribute the increased demand expected from a super-aged society.

Currently, private financial institutions also offer reverse mortgage products, but awareness is significantly lower compared to public products guaranteed by the Korea Housing Finance Corporation. Kookmin, Shinhan, and Hana Banks launched related products, but as of March last year, sales totaled only 14.7 billion KRW. As of October last year, public products accounted for 99.9% of the total outstanding loans. Monitoring results showed that in 2023, only two private reverse mortgage products were sold throughout the year.

Hwang pointed out that "private reverse mortgage products in Korea limit the pension payment period to a maximum of 30 years, and if the home price falls below the loan balance, the contract is terminated early, meaning housing is not guaranteed or the subscriber becomes liable for the excess amount. This structure shifts all risks to the subscriber," analyzing the cause of low participation.

Survey results showed that private reverse mortgage products are less competitive when sold under the same conditions as public products. When presented with identical conditions, 68% of respondents said they would choose the public product, while only 4% preferred the private product.

However, if private products are designed with more favorable options, such as pension payments linked to home prices or more flexible inheritance conditions compared to public products, the proportion of respondents willing to choose private products rises to 17.2%. Specifically, respondents said improvements are needed such as offering incentives like health insurance or tax reductions (19%), providing various conveniences like easy withdrawal options (18.7%), and extending the loan payment period to a lifetime (17.6%).

To revitalize the private reverse mortgage market, the research team stressed the need to: ease household debt regulations such as loan-to-value (LTV) and debt service ratio (DSR) to the level of public products; introduce lifetime and non-recourse products; encourage entry by life insurance companies; provide regulatory incentives and tax benefits for private product providers; and establish standard guidelines through a private provider-consumer council.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.