Foreign Investors Record Six Consecutive Days of Net Buying in KOSPI

Attention on Whether Net Selling Streak Will End

Buying Driven by Eased Tariff Risks, Strong Earnings, and Stable Exchange Rates

Further Buying Expected in Export Stocks Benefiting from Tariff Relief

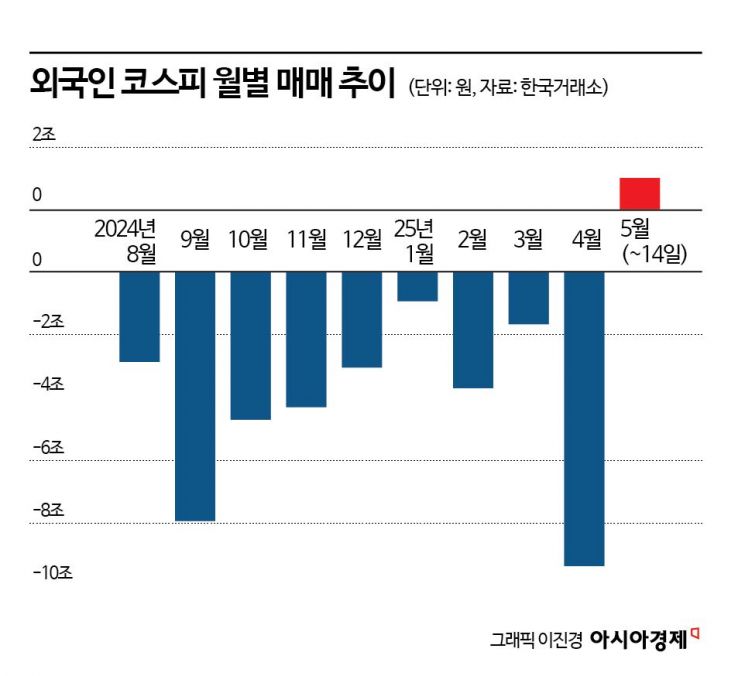

Foreign investors, who had maintained a net selling streak for nine consecutive months through last month, are showing signs of change. Recently, they have recorded net purchases for six consecutive trading days, raising attention as to whether this could mark the end of their nine-month-long net selling trend.

According to the Korea Exchange on May 15, foreign investors have made net purchases totaling 1.0287 trillion won in the KOSPI market so far this month. With net buying recorded for six consecutive trading days, there has been only one day of net selling this month. As foreign investors shifted to net buying, the KOSPI recently recovered the 2,600-point level.

Previously, foreign investors had continued net selling for nine consecutive months since August last year. In particular, they sold off as much as 9.3552 trillion won last month alone.

Lee Kyungmin, a researcher at Daishin Securities, analyzed, "The KOSPI has gained fundamental momentum thanks to robust export momentum and first-quarter results that exceeded expectations," adding, "The Korean won, which had been on a one-sided weakening trend, has also reversed to a stronger position. As a result, foreign investors have shifted to net buying in the spot market, which is seen as a change that is supporting the upward trend of the KOSPI."

With concerns over tariffs easing, buying is expected to flow into export-oriented stocks. Kwon Soonho, a researcher at IBK Investment & Securities, said, "On May 12, optimism over the US-China trade negotiations was reflected in the market, leading to a slight reversal in supply and demand for sectors that had previously seen net selling. If risk appetite continues to recover, we expect to see additional short-term net buying, particularly in export stocks that had previously experienced significant selling."

The possibility of South Korea being included on the Morgan Stanley Capital International (MSCI) Developed Markets Index watch list is also fueling expectations for increased foreign buying. Every June, MSCI evaluates each country's stock market and classifies them as developed, emerging, or frontier markets. Last year, MSCI did not include South Korea on the watch list for the Developed Markets Index, with the failure to lift the short-selling ban cited as a reason. Na Jeonghwan, a researcher at NH Investment & Securities, explained, "With the resumption of short selling at the end of March this year, the possibility of South Korea being included on the MSCI Developed Markets Index watch list in June is rising. Currently, the foreign ownership ratio in the KOSPI market is near a historical low, and foreign investors have recorded weekly cumulative net buying in the KOSPI for the past two weeks. If South Korea is designated as a watch list country, expectations for inclusion in the MSCI Developed Markets Index will grow, increasing the likelihood of foreign capital inflows."

This month, foreign investors have been actively buying shipbuilding stocks. Purchases included 110.5 billion won in HD Hyundai Mipo, 98.5 billion won in HD Hyundai Heavy Industries, and 75.6 billion won in HD Korea Shipbuilding & Offshore Engineering. As tariff concerns eased, they also bought automobile stocks, with net purchases of 76.8 billion won in Kia and 44.1 billion won in Hyundai Motor.

Among semiconductor stocks, foreign investors continue to favor SK Hynix. This month, they made net purchases of 1.1377 trillion won in SK Hynix, making it the most heavily bought stock. In contrast, they sold off 662.7 billion won of Samsung Electronics, making it the most heavily sold stock.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)