Top 5 Non-Life Insurers Post 2.0352 Trillion Won in Q1 Net Profit... Down 20% Year-on-Year

All But KB Insurance See Decline in Q1 Results Compared to Last Year

Rising Auto Insurance Loss Ratios and Major Wildfires Weigh on Performance

The five major non-life insurance companies in South Korea, which achieved record-high results last year, faced a downturn in the first quarter of this year. This was due to structural factors such as the worsening loss ratio in auto insurance, combined with unexpected negative events like large-scale wildfires.

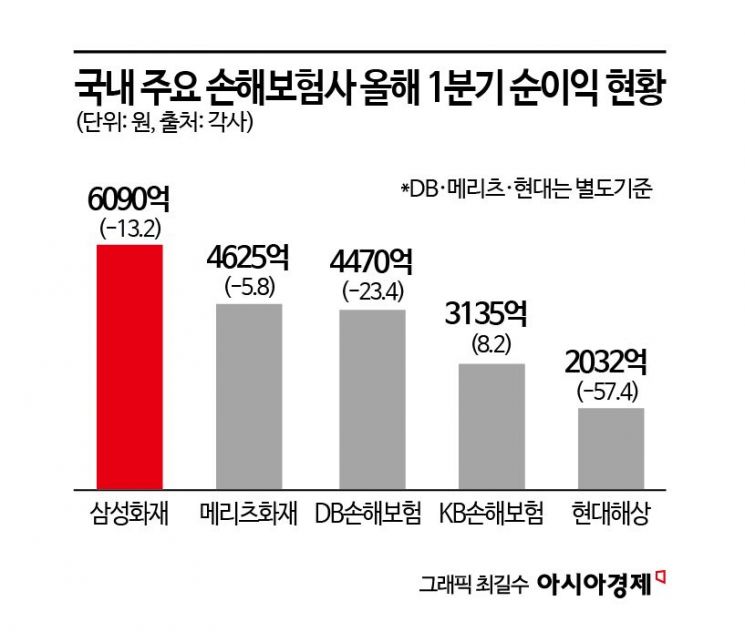

According to the financial sector on May 15, the combined net profit of the five leading non-life insurers?Samsung Fire & Marine Insurance, Meritz Fire & Marine Insurance, DB Insurance, KB Insurance, and Hyundai Marine & Fire Insurance?was 2.0352 trillion won in the first quarter of this year. This represents a 20% decrease compared to the same period last year (2.5434 trillion won). After achieving record-high results both in the first quarter and on an annual basis last year, these companies have shown signs of slowing down this year.

Samsung Fire & Marine Insurance reported a net profit of 609 billion won for the first quarter, down 13.2% from the same period last year. Its investment profit remained similar to last year’s first quarter at 739.7 billion won, but its core insurance profit fell by 6% to 419.4 billion won. A Samsung Fire & Marine Insurance representative explained, "The decline in performance was due to increased market volatility and the impact of major disasters." The Muan Airport disaster and wildfires that occurred across the country in the first quarter of this year were identified as factors that negatively affected the company’s results.

The company that saw the largest decline in first-quarter performance was Hyundai Marine & Fire Insurance. Its net profit for the first quarter (on a separate basis) was 203.2 billion won, a 57.4% decrease compared to the same period last year. Among the top five non-life insurers, it posted the lowest first-quarter results. Although Hyundai Marine & Fire Insurance achieved similar investment profits to last year, it underperformed in its core insurance business. In long-term insurance, losses from epidemic respiratory diseases such as the resurgence of influenza caused profits to plummet by 74.2% year-on-year to 114.3 billion won. For auto insurance, the cumulative reduction in premiums and increases in medical and repair costs led to a worsening loss ratio, resulting in a 63% year-on-year drop in profit to 15.7 billion won.

DB Insurance’s net profit for the first quarter (on a separate basis) was 447 billion won, down 23.4% from the same period last year. Profits declined across all major product lines: long-term, auto, and general insurance. Long-term insurance profits fell 12.1% year-on-year to 394 billion won. Auto insurance profits dropped 51.4% due to a higher loss ratio following premium reductions. General insurance posted a loss of 37 billion won, as the loss ratio rose by 10.1 percentage points year-on-year, impacted by events such as the LA wildfires. However, the company performed well in investments. Investment profit for the first quarter increased by 19.8% year-on-year to 244 billion won, driven by higher interest and dividend income from increased managed assets.

Meritz Fire & Marine Insurance’s net profit for the first quarter (on a separate basis) was 462.5 billion won, down 5.8% from the same period last year. While its core insurance business underperformed, investment profit increased by 29.3% year-on-year to 262.1 billion won, partially offsetting the decline. Meritz Fire & Marine Insurance ranked third in net profit among the top five last year, but moved up to second place this year due to DB Insurance’s weaker performance.

KB Insurance was the only one among the top five non-life insurers to achieve an increase in performance. Its net profit for the first quarter was 313.5 billion won, up 8.2% compared to the same period last year. A KB Insurance representative explained, "Although the loss ratio in auto insurance rose due to premium reductions as part of our mutual growth finance initiative and increased losses from heavy snowfall, we were able to maintain a stable loss ratio in long-term insurance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)