A Choice for Survival, Not Market Share Expansion

"Easier to Secure Loans and Attract Investment, Exploring Solutions"

"An Opportunity to Establish Spaces Differentiated from OTT"

Financial Vulnerability... Challenges Expected in Debt Repayment

In 2016, AMC Entertainment acquired Carmike Cinemas for $1.1 billion (1.559 trillion won). By increasing the number of screens from 5,425 to 8,379, AMC surpassed Regal Entertainment to become the largest movie theater chain in North America. At the time, CEO Adam Aron stated, "We will invest millions of dollars to improve Carmike Cinemas and introduce loyalty programs, among other initiatives."

Megabox and Lotte Cinema aim to revitalize the stagnant Korean film industry through their merger. Yonhap News

Megabox and Lotte Cinema aim to revitalize the stagnant Korean film industry through their merger. Yonhap News

This aggressive merger strategy only produced temporary results. Revenue, which reached $5.02 billion (7.1148 trillion won) in 2019, plummeted to $1.07 billion (1.5165 trillion won) in 2020. Many locations were forced to close due to the COVID-19 pandemic and the expansion of online video services (OTT).

AMC weathered the crisis by raising $3.5 billion (4.9605 trillion won) through stock issuance, but the aftereffects persist. The company has not been able to resolve its $4.5 billion debt, due to the expansion of OTT platforms and the Hollywood labor union strikes. AMC managed to extend the maturity of $2.4 billion (3.4015 trillion won) in debt from 2026 to 2029, providing some breathing room.

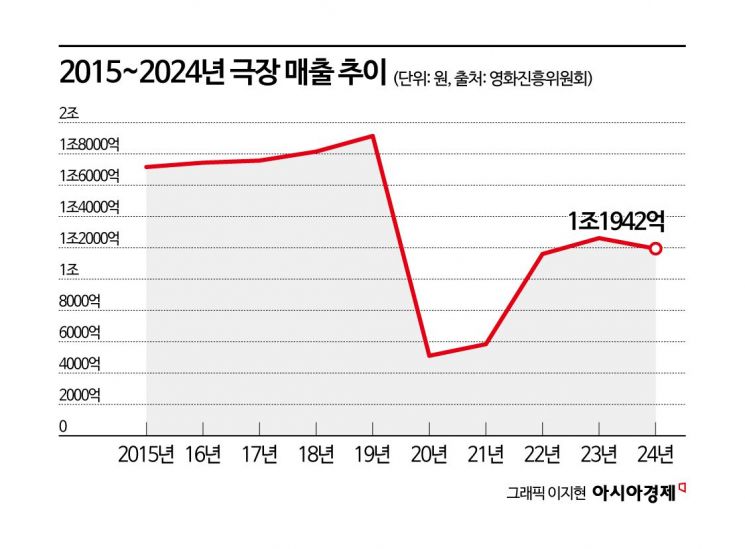

The situation for domestic theater chains is even more severe. Audience numbers are recovering slowly, while debt continues to rise. From 2013 to 2019, domestic movie theaters attracted over 200 million viewers annually for seven consecutive years, but after the COVID-19 pandemic, attendance has remained at about half that level. Although a few films, such as "12·12: The Day" and "Exhuma," drew over 10 million viewers, they failed to turn around the overall market atmosphere.

As this vicious cycle continued, Lotte Cultureworks, the second-largest domestic theater chain, and Megabox Joongang, the third-largest, signed a memorandum of understanding for a merger on May 8. Unlike AMC, this move is not aimed at expanding market share, but is an unavoidable choice for survival. The goal is to pursue sustainable growth amid a rapidly changing content industry environment and to strengthen customer-centered services.

Contentree Joongang of Joongang Group holds a 95.98% stake in Megabox Joongang, while Lotte Shopping of Lotte Group holds an 86.37% stake in Lotte Cultureworks. The two companies explained, "We aim to revitalize the domestic film industry, which has stagnated since COVID-19, by strengthening the competitiveness of our existing theater and film businesses and expanding into new ventures." They also stated, "We expect to maximize synergy through the merger by improving profitability, attracting new investment to ensure financial stability, and easing competition to strengthen our own competitiveness in advertising sales and theater operations."

It is difficult to expect significant synergy in theater operations, as the two companies have run their locations in similar ways. However, the landscape of the theater industry could change dramatically after the merger. According to the Korean Film Council, as of the end of last year, CGV operated 192 locations, Lotte Cinema 133, and Megabox 115. If the merger is completed, Lotte Cinema and Megabox will become the largest operator with a combined 248 locations.

An industry insider, referred to as A, said, "With a larger business scale, it becomes easier to secure loans and attract investment, enabling us to explore various solutions." Another insider, B, commented, "This could be interpreted as a positive signal for market recovery," adding, "In particular, it could be an opportunity to establish spaces that are differentiated from OTT platforms."

In fact, since 2023, AMC has been pursuing an 'upgraded movie viewing experience.' The company has expanded IMAX and Dolby Cinema, as well as 4DX theaters (multi-sensory experience screens) and ScreenX theaters (which utilize three screens), offering a variety of viewing cultures. AMC has also developed and operates its own 'XL at AMC' theaters, which project 4K laser images onto approximately 12 square meter screens. In addition, AMC has enhanced amenities by developing food and beverage options tailored to audience preferences and expanding the use of recliner seats.

AMC Entertainment is leading the transformation of movie theater chains worldwide. Photo by AP Yonhap News

AMC Entertainment is leading the transformation of movie theater chains worldwide. Photo by AP Yonhap News

These strategies are showing gradual results. In the first quarter, AMC recorded a net loss of $202 million. Although the number of moviegoers decreased by 10% year-on-year, ticket revenue per attendee reached an all-time high. Food and beverage sales have also remained stable. While the frequency of theater visits has declined, there is a growing preference for high-quality services and premium environments.

Lotte Cinema and Megabox have also made various efforts to differentiate their services. Lotte Cinema operates Colorium and MX4D, while Megabox offers Dolby Cinema and Dolby Atmos, and since last year, all seats at major locations have been converted to recliners.

The main challenge is risk management, which even AMC struggles with. Lotte Cultureworks and Megabox Joongang are in financially vulnerable positions. Lotte Cultureworks emerged from capital impairment last year, but its total equity is only 67.3 billion won, and it recorded a net loss of 51.1 billion won. Megabox Joongang's debt ratio has surged, with total liabilities reaching 922.2 billion won. Furthermore, 606.9 billion won of its debt is due within one year. Long-term profitability remains uncertain, making it likely that both companies will face difficulties in meeting their financial obligations.

The two companies have not yet engaged in concrete discussions, nor do they have plans regarding shareholding structures or a new brand name. Insider A stated, "The early announcement reflects the intention to quickly attract new investment and expedite the Fair Trade Commission's review of the merger," emphasizing, "It is important to strike a balance between audience recovery and managing financial limitations." Insider B argued, "If we become the number one operator in the domestic market, we will be able to operate more aggressively, so beyond just synergy from the merger, we need to seriously consider how to lead the theater industry going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.