Individuals Net Purchased 5 Billion Won of Icecream Edu Shares Since Last Month

Stock Volatility Surges as Shares Tied to Former Prime Minister Han Ducksoo

Chairman Park Daemin Sold Part of His Holdings at the End of Last Month

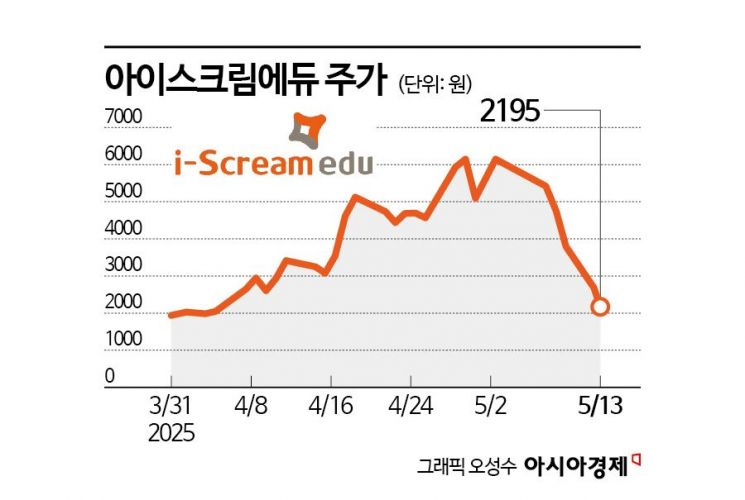

According to the financial investment industry on May 14, Icecream Edu fell by 42.2% over just two days, from May 12 to May 13. Previously, from April 1 to April 29, the stock had soared by 215.3% in about a month. The surge followed former Prime Minister Han's announcement of his presidential candidacy. The stock price, which was below 2,000 won at the end of March, briefly reached 6,660 won during trading on April 29. However, after news broke that Han would not be running, the rapidly rising stock reversed course and began to fall. Icecream Edu's share price has now returned to its late March levels.

From April 1 to May 13, individual investors made net purchases of Icecream Edu shares worth 4.65 billion won. The average purchase price was 5,142 won, and as of the previous day's closing price, the estimated loss rate stands at 57.3%.

A financial industry official commented, "This is a clear example of the risks involved in investing in political theme stocks," adding, "It is difficult to predict when the price will reverse, and once it starts to plunge, it becomes hard to exit."

In contrast to individual investors who suffered losses, Chairman Park sold 128,000 shares of his holdings at the end of April. The selling price was 5,940 won per share, about 11% lower than the year's high of 6,660 won. As a result, Park's stake decreased from 4.82% to 3.63%.

The sharp fluctuations in the share price over the past month also created winners and losers among holders of the company's first convertible bonds (CB). Investors who exercised their conversion rights on April 17 and 18 were able to realize gains, while those who exercised their rights on May 2 have not been able to respond as the share price has plunged.

The new shares issued from the April conversion were listed on May 7. The conversion price was 3,792 won, so those who sold between May 7 and May 9 likely made a profit. In contrast, the new shares from the May 2 conversion will be listed on May 19. As the share price has dropped to around 2,000 won, it now sits below the conversion price.

Previously, in April 2023, Icecream Edu issued its first round of CBs worth 16 billion won to domestic institutional investors. The coupon rate was 0%, and the initial conversion price was set at 5,417 won. The terms allowed the conversion price to be lowered to 3,792 won if the share price fell. At the time of issuance, the share price was above 5,000 won, but in two years, it has dropped below 2,000 won. In this situation, holding the CBs to maturity would have been more advantageous than exercising the conversion rights. However, as the stock became linked to political themes, the price surged, creating an opportunity for CB investors to realize gains. As a result, Icecream Edu was able to reduce its repayment burden.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)