Transaction Volume Drops 67.5% from Previous Quarter

March Vacancy Rate Hits 3.16%, Highest Since March 2022

In the first quarter of this year, the volume of office building transactions in Seoul decreased by 50% compared to the same period last year.

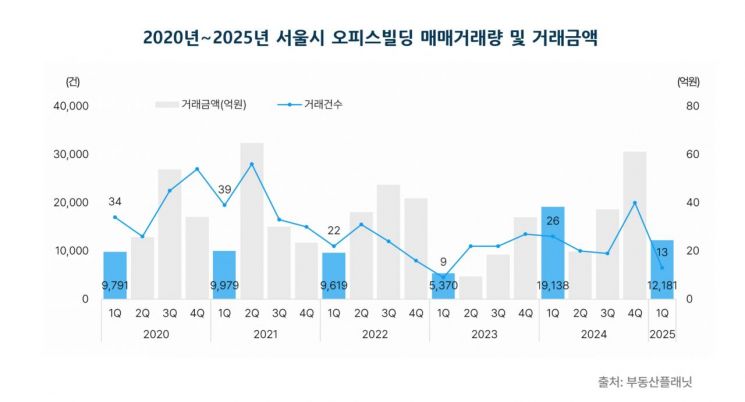

On May 13, Real Estate Planet announced in its 2025 Q1 Seoul Office Sales and Leasing Market Report that the total number of office building transactions was 13, with a total transaction amount of 1.2181 trillion won. Compared to the previous quarter (40 transactions, 3.0577 trillion won), the transaction volume dropped by 67.5%, and the transaction amount decreased by 60.2%. Compared to the same period last year (26 transactions, 1.9138 trillion won), the figures fell by 50% and 36.4%, respectively.

By region, both transaction volume and amount declined in the three major districts. In the first quarter, the number of office building transactions in the Gangnam Business District (GBD) was three, down 87.0% from the previous quarter. In the Central Business District (CBD) and Yeouido Business District (YBD), there were two transactions each, a decrease of 60.0%.

In terms of transaction amount, GBD recorded 167.4 billion won, a 78.3% decrease from the previous quarter; CBD recorded 793.6 billion won, down 47.2%; and YBD recorded 49 billion won, a 93.1% drop. In other areas, there were six transactions, a 14.3% decrease from the previous quarter, but the transaction amount increased by 185.5% to 208.2 billion won.

Among the 13 office building transactions in Seoul during the first quarter, 10 (76.9%) were purchased by corporations. Sellers were corporations and individuals in seven (53.8%) and three (23.1%) cases, respectively. This was followed by two transactions (15.4%) between individuals and one transaction (7.7%) between a corporation and an individual (in that order). Corporate-to-corporate transactions accounted for 1.0967 trillion won, or 90% of the total transaction amount.

Office Building Sales Volume and Transaction Amount in Seoul from 2020 to 2025. Provided by Real Estate Planet

Office Building Sales Volume and Transaction Amount in Seoul from 2020 to 2025. Provided by Real Estate Planet

The office building vacancy rate in Seoul rose for three consecutive months from January, reaching its highest level since March 2022 (3.23%). According to Real Estate Planet, which conducted phone and on-site surveys of office facilities and reviewed leasing notices from property management companies, the vacancy rate increased from 2.83% in January to 3.06% in February, and then to 3.16% in March.

By region, the vacancy rate in the CBD rose by 0.31 percentage points to 3.35% compared to the previous month (3.04%). In contrast, the GBD vacancy rate decreased by 0.06 percentage points from 3.40% to 3.34%, and the YBD vacancy rate declined by 0.07 percentage points from 2.41% to 2.34%.

In March, the net operating cost (NOC) per exclusive area for Seoul office buildings was 199,854 won. This represents a slight increase from January (199,492 won) and February (199,628 won). The month-on-month changes by major district were: CBD (196,204 won), up 266 won; GBD (209,371 won), up 263 won; and YBD (189,525 won), up 18 won.

Jung Sumin, CEO of Real Estate Planet, stated, "In the first quarter, the Seoul office market saw a general contraction in transactions, and the overall vacancy rate reached its highest level in three years due to the rise in the CBD vacancy rate. If the political uncertainty caused by the impeachment crisis at the end of 2024 is resolved in the first half of the year and an interest rate cut cycle begins, investment sentiment is expected to gradually recover. At the same time, with limited new office supply in the three major districts, the leasing market is likely to remain stable, and rents are expected to continue their slight upward trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.