Operating Profit of 1.76 Billion Won in Q1

Up 1.95 Billion Won Year-on-Year

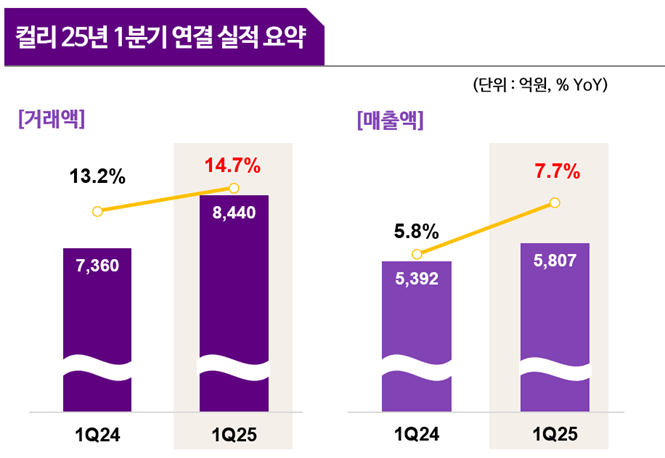

Revenue and Total GMV Also Increase

Retail tech company Kurly achieved its first-ever consolidated quarterly profit in the first quarter of this year, driven by strong performance in its core businesses such as food and beauty.

On May 13, Kurly announced that its consolidated operating profit for the first quarter reached 1.761 billion won, turning from an operating loss of approximately 190 million won in the same period last year?a turnaround of 1.949 billion won. Previously, Kurly had recorded an operating profit of 525.7 million won on a separate basis in the first quarter of last year, but this is the first time the company has posted a profit on a consolidated basis since its founding 10 years ago.

During the same period, revenue increased by 8% to 580.7 billion won, and total gross merchandise value (GMV) rose by 15% to 844.3 billion won. This figure is nearly six times higher than the domestic online shopping growth rate (2.6% by transaction value) for the first quarter of this year recently announced by Statistics Korea.

Kurly explained that the achievement of its first consolidated operating profit was primarily due to the stable growth of its core businesses such as food and beauty, as well as revenue diversification through the expansion of new businesses. In fact, the food category saw a 16% year-over-year increase in GMV in the first quarter. Beauty Kurly also maintained steady growth, driven by strong sales of luxury, premium, and indie brands.

Seller-shipped products (3P), fulfillment services (FBK), and logistics outsourcing?initiatives promoted as part of business diversification?also contributed to the increase in total GMV. The GMV for 3P in the first quarter grew by 72% compared to the same period last year, leading overall growth. FBK expanded its share within the home and kitchen category and increased the number of new partner companies, thereby scaling up its business. Kurly plans to further diversify the categories for both 3P and FBK going forward.

Alongside its operating profit, Kurly also achieved a positive adjusted EBITDA. The EBITDA for the first quarter of this year was 6.7 billion won, an improvement of 2.3% compared to the same period last year. Cash and cash equivalents stood at 220 billion won during the same period, maintaining stable cash generation.

A Kurly representative stated, "In the first quarter of this year, which marks the 10th anniversary of our service launch, we were able to achieve solid results through balanced growth across all business areas and diversification efforts. From the second quarter onward, we plan to increase investment in marketing and customer initiatives, and focus on achieving growth that exceeds the market average through aggressive IMC (Integrated Marketing Communication) campaigns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)