Difficult to Begin Design Phase After Requirements Definition by End of June

"First Half Measures" Target by Financial Services Commission Likely Delayed

"Urgent Need to Identify Vulnerable Groups Left in the Blind Spot"

The development of an advanced standard Credit Scoring System (CSS), which is essential for increasing loans from savings banks to vulnerable groups in local areas, is progressing more slowly than expected. The Financial Services Commission and the Korea Federation of Savings Banks had aimed to begin the design and model development in the first half of the year (by the end of June), but this now appears unlikely.

According to the Korea Federation of Savings Banks on May 13, the federation is currently gathering opinions on the CSS project from the savings bank industry, credit bureaus (CBs), fintech companies, and the Korea Credit Information Services. No companies have yet received a formal request for proposal (RFP) from the federation.

The CSS project is being carried out in the following order: opinion gathering, business requirements definition, design, and model development. The opinion gathering stage is the most time-consuming and critical, which is causing delays. At this pace, the 'first half of the year (by June 30)' deadline announced by the Financial Services Commission in March appears difficult to meet.

This is because there needs to be a certain level of standardization among institutions in evaluating both financial information (such as payment history of mid- and low-credit borrowers) and non-financial information (such as telecom usage data). In addition, unified criteria regarding household credit loan customers?such as asset and income levels, age groups, and loan history?must be established for the CSS system, which is expected to further lengthen the opinion gathering process.

A federation official stated, "We plan to complete the opinion gathering process within the first half of the year, define business requirements, and begin detailed design work no later than the beginning of the second half of the year. Our goal is to finish gathering opinions by next month (June)."

The federation has not disclosed which companies are currently participating in the opinion gathering process. Industry sources mention NICE Information Service, Korea Credit Bureau (KCB, both CBs), Naver Financial, Toss (both fintech firms), and PFCT (a P2P company) as participants. The federation plans to announce the companies that will be part of the permanent CSS joint management organization when the design phase begins.

Currently, the federation and these companies are sharing opinions on issues such as the scope of customer data application, frameworks for sharing business information, and sampling of key customer data such as creditworthiness. In the next stage, business requirements definition, there will be focused discussions on the extent to which customer data should be applied to the standard CSS. They will decide whether to apply data from all savings bank customers or only from mid- and low-credit borrowers and small business owners.

Additionally, they will determine how to target household credit loan customers and decide how many years prior to the introduction of the standard CSS to include customers who have taken out loans as data collection subjects.

There is a growing consensus in the financial sector that upgrading the CSS for savings banks is urgent. Large savings banks with well-established CSS frameworks are smoothly conducting personal credit loan businesses, but small and medium-sized savings banks in local areas are unable to even enter the personal credit loan market. According to the Financial Services Commission, as of the end of last year, the proportion of household credit loans among all loans at savings banks with assets of over 2 trillion won was 34.4%, while for smaller banks with less than 300 billion won in assets, it was only 3.6%. The remaining over 90% consists of unstable real estate project financing (PF) and corporate loans.

The data show that the smaller the asset size of a savings bank, the more unstable its business portfolio is, making it more difficult to manage soundness indicators such as delinquency rates and the ratio of substandard and below loans. According to the federation, as of the end of last year, none of the 17 savings banks with assets under 300 billion won were located in Seoul, while 14 out of 18 savings banks with assets over 2 trillion won (77.7%) were concentrated in Seoul.

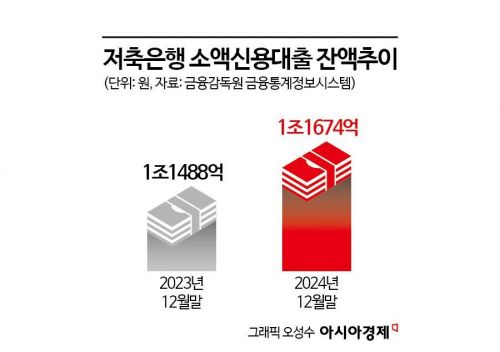

The overall performance of personal credit loans at savings banks has also stagnated. According to the Financial Supervisory Service, as of the end of December last year, the outstanding balance of small-amount credit loans at 79 savings banks was 1.1674 trillion won, a 1.6% increase from 1.1488 trillion won at the end of December 2023.

The financial sector emphasizes that the CSS for savings banks must be upgraded as soon as possible to identify as many "thin filers" (individuals with limited financial history) as possible, who are currently excluded from financial services. Only then can both the industry and the government achieve their goals: strengthening the soundness of local and small savings banks (industry) and supporting low-income individuals through increased financial supply (government).

An official from the savings bank industry stressed, "To increase the proportion of household credit loans at small and medium-sized savings banks, which is currently only in the 3% range, we must accelerate the development of the advanced CSS."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)