Operating Profit Down 56% in Q1

Cocoa Price Surge Continues to Impact Earnings

Five Securities Firms Lower Target Prices... Investment Ratings Downgraded to 'Hold'

Price Hike Effects Expected from Q2

Growth of Overseas Subsidiaries Anticipated in Second Half

The profitability of Lotte Wellfood, the core food affiliate of Lotte Group, has come under pressure. This is due to the prolonged domestic market slump and rising cost burdens. Although the company has entered the peak summer season, the high volatility in cocoa prices, a key raw material for chocolate, is expected to slow down the recovery of its earnings. Lotte Wellfood plans to boost its low overseas sales ratio and seek a rebound through the growth of major overseas subsidiaries in India and Russia in the second half of the year, as well as price increases.

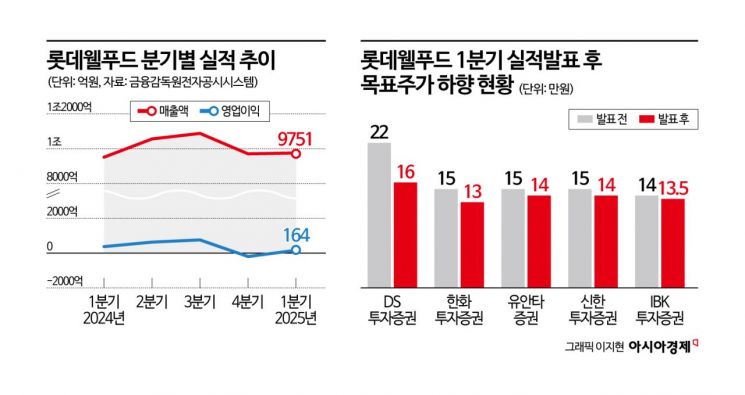

According to industry sources on May 12, Lotte Wellfood’s operating profit for the first quarter of this year was KRW 16.4 billion, a sharp decrease of 56.1% compared to the same period last year. This figure fell more than 30% short of the market consensus for operating profit, which ranged from KRW 20 billion to KRW 24 billion.

Operating profit from domestic operations plummeted by 63% year-on-year, while overseas operations saw a 37% decrease. Although selling and administrative expenses were reduced, profitability deteriorated both domestically and internationally due to the direct impact of rising cocoa prices. In fact, the international price of cocoa soared from $4,466 per ton at the end of 2023 to $12,477 in mid-December last year, before adjusting to $8,616 per ton as of the end of April. This represents a 29% drop from last year's peak and an 18% decrease from the beginning of the year, but it still remains nearly twice as high as the average input cost from last year.

The main reason for the rise in cocoa prices is attributed to a reduction in cultivation area caused by abnormal weather conditions. As a result, price stabilization is progressing slowly, and considering Lotte Wellfood’s inventory levels, high input costs are expected to persist through the second quarter.

Since February, Lotte Wellfood has raised the average prices of major products such as Ghana Chocolate and Pepero by 9.5%. Although the effects of these price hikes and the start of peak summer ice cream sales from the second quarter may improve earnings, the company is still expected to face ongoing profit pressure. During a conference call following the first-quarter earnings announcement, Lotte Wellfood stated, “(Cocoa) production has declined due to climate conditions in West Africa, and the volatility is so high that it is difficult to predict prices. We expect raw material cost pressures to intensify in the first half of the year, and to be about 60-70% of that level in the second half.”

For these reasons, securities firms have simultaneously lowered their target prices for Lotte Wellfood. DS Investment & Securities reduced its target price from KRW 220,000 to KRW 160,000, Hanwha Investment & Securities lowered its target from KRW 150,000 to KRW 130,000 and downgraded its investment opinion from “Buy” to “Hold.” Yuanta Securities and Shinhan Investment & Securities both cut their target prices from KRW 150,000 to KRW 140,000, while IBK Investment & Securities lowered its target from KRW 140,000 to KRW 135,000.

The company intends to recover profitability by increasing its overseas sales ratio, which currently stands at around 20%, lower than industry peers. Lotte Wellfood plans to merge its Indian confectionery subsidiary (Lotte India) and Indian ice cream subsidiary (India Havmor) within the first half of the year to enhance synergy. The sugar-free brand ‘ZERO’ is also preparing for overseas expansion. The company has also selected K-pop group Stray Kids as global ambassadors for Pepero. Lotte Wellfood aims to raise its overseas sales ratio to 35% by 2028.

Kang Eunji, a researcher at Korea Investment & Securities, stated, “Lotte Wellfood is considering further price increases at its overseas subsidiaries. The Indian confectionery and ice cream subsidiaries are continuing to grow through capacity expansion, and the overseas expansion of the ZERO brand is accelerating. If cocoa prices remain below $10,000 per ton, the effects of price increases are expected to become more apparent in the second half, leading to improved profitability.”

Shim Eunju, a researcher at Hana Securities, also forecast, “With the first quarter marking the bottom, both domestic and overseas profitability are expected to recover gradually. We estimate that in the second half, operating profit will increase year-on-year, with consolidated earnings projected at -18.6% in the second quarter, 5.1% in the third quarter, and a return to profit in the fourth quarter.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)