Chinese Brands Dominate the Electric Vehicle Market in China

Six Out of Ten Global Electric Vehicles Are Consumed in China

Expanding Market Share in China Is Essential for Hyundai Motor’s Bid for Global No. 1

Hyundai Motor Completely Revamps Its China Strategy

First China-Specific Electric Vehicle to Launch in the Second Half of This Year

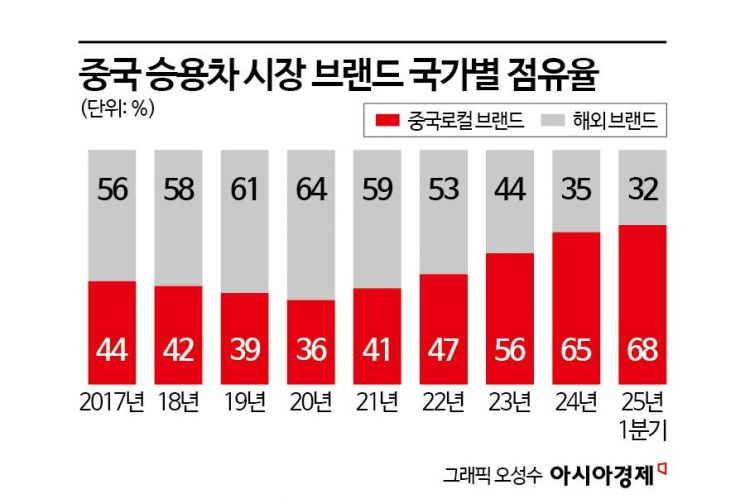

2023 was a landmark year for the Chinese passenger car market. For the first time ever, local brands in the world’s largest market surpassed foreign brands in market share. Let’s look at an analysis by consulting firm Automobility, based on data from the China Association of Automobile Manufacturers (CAAM). In 2023, Chinese local brands accounted for 56% of the Chinese passenger car market, surpassing half for the first time. In the first quarter of this year, their market share soared to 68%. This means that 7 out of every 10 new passenger cars sold in China are Chinese brands. The market share of foreign brands in China, which was overtaken by local brands at 44% in 2023, shrank further to 32% as of the first quarter of 2025.

2025 is expected to mark another turning point in the Chinese automotive market. Starting this year, new energy vehicles are projected to surpass internal combustion engine vehicles in new car sales. In the Chinese automotive market, which has an annual volume of 26 million vehicles, the penetration rate of new energy vehicles (the proportion of a specific technology or product within the total market) has been steadily increasing. The annual rate was 44% in 2024, 47% in the first quarter of 2025, and as of March 2025, the monthly rate reached 51%.

In China, the world’s largest automobile consumer market, new energy vehicles have long been mainstream. New energy vehicles refer to those that significantly reduce carbon emissions, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), extended-range electric vehicles (EREVs), and fuel cell electric vehicles (FCEVs). The Chinese automotive market peaked at 29 million units in 2017 and has since declined to 26 million units in 2024. While sales of internal combustion engine vehicles dropped by about 9%, new energy vehicle sales surged by an impressive 46%.

The conclusion that can be drawn from this analysis is striking. Chinese consumers, who account for one-third of global new car purchases, are no longer buying foreign-brand internal combustion engine vehicles. Among them, the perception that Chinese electric vehicles are superior?not only in price but also in driving performance, safety, design, and even brand image?is spreading rapidly.

What Is Behind the Rapid Rise of Chinese Local Companies?

Let’s examine the reasons why Chinese local companies have rapidly risen in their domestic automotive market. First, China has a massive domestic market. As of 2024, about 16 million electric vehicles (including PHEVs) were sold worldwide, with 66% (10.56 million units) consumed in China. This means that 6 out of every 10 electric vehicles sold globally last year were on Chinese roads. The existence of such a huge consumer market is advantageous for Chinese manufacturers. By leveraging the purchasing power of domestic consumers, they can achieve economies of scale and reduce costs. They can also quickly incorporate consumer feedback into product development, enhance brand recognition as a domestic brand, and exercise tighter control over distribution networks.

How were Chinese local companies able to take the lead in electrification? The answer can be divided into technological and policy factors. From a technological perspective, China remained a latecomer in internal combustion engine technology. Internal combustion engines represent the pinnacle of precision mechanical engineering, requiring flawless coordination of the engine and transmission, as well as complex systems for fuel injection, ignition, and exhaust. Germany has over a century of tradition and expertise in this field, while Japan has established a unique position in optimizing fuel efficiency for internal combustion engines. South Korea was essentially the last country to develop its own proprietary engine technology.

Until the 2010s, China also devoted itself to developing internal combustion engines but failed to close the gap with the leading group. However, with the paradigm shift to electric vehicles, the technological complexity of the powertrain was significantly reduced. Electric vehicles require expertise in high-voltage systems and motors, without the need for engines or transmissions. Of course, controlling batteries, motors, and reducers is not easy, but compared to internal combustion engines or hybrids, the mechanical complexity is much lower, according to industry consensus. Instead, higher standards are required for software-based electrical and electronic technologies. In software technology utilizing artificial intelligence (AI), China is among the most advanced.

Chinese local companies, once laggards in the era of internal combustion engines, are now leading the way in the electric vehicle era. With the starting line reset, the Chinese government poured massive support into the sector. According to the Center for Strategic and International Studies (CSIS), the Chinese government’s support for the electric vehicle industry from 2009 to 2023 is estimated at $230.9 billion (about 322 trillion won). The government fostered the industry through various means, including subsidies for electric vehicle purchases, exemptions from sales tax, subsidies for charging infrastructure, R&D support for manufacturers, and government purchases of electric vehicles. The industry also acknowledges the significant impact of indirect support, such as low-interest loans, cheap land and electricity, and local government assistance, in addition to direct subsidies.

Another formidable aspect of China’s electric vehicle rise is its rich ecosystem. When the government released large-scale subsidies, hundreds of electric vehicle manufacturers sprang up across China. In 2018, there were more than 500 registered electric vehicle manufacturers in China, but as subsidies decreased, this number dropped to about 100 by 2025. By 2030, only around 50 companies are expected to survive. At first glance, one might think that China’s electric vehicle industry has been artificially sustained by government subsidies.

But consider the opposite. The wealth of talent and development experience gained from participating in a new industry remains in China. Moreover, any electric vehicle manufacturer that survives a 10% survival rate as the number of companies shrinks from 500 to 50 is likely to have tremendous global competitiveness. The government provided a platform for failure and challenge, and it is worth reflecting on the value of the technological know-how accumulated in this process.

Finally, the key competitive advantages of Chinese companies are price and technological innovation. Above all, no one can match China on price. The 2025 model of BYD’s compact SUV ‘Seagull’ starts at 56,800 yuan (about 10.96 million won) for the base trim in China. This electric vehicle, which can travel 300 km on a single charge (based on Chinese certification), is being sold for just over 10 million won. In Korea, Hyundai’s compact electric car Casper starts at around 28 million won, and even with government subsidies, it can only be purchased for just over 20 million won (based on Seoul city).

BYD reduced costs by vertically integrating its supply chain, directly producing more than 75% of all components, from batteries to semiconductors and motors. In particular, BYD developed its own LFP (lithium iron phosphate) ‘Blade Battery,’ significantly lowering the battery cost, which accounts for most of an electric vehicle’s cost. Chinese companies are also innovating in vehicle development and manufacturing processes. By actively utilizing simulation software, they have shortened development times, and by deploying industrial robots in manufacturing, they have reduced production costs.

What About Hyundai Motor’s ‘De-China’ Strategy? A Masterstroke

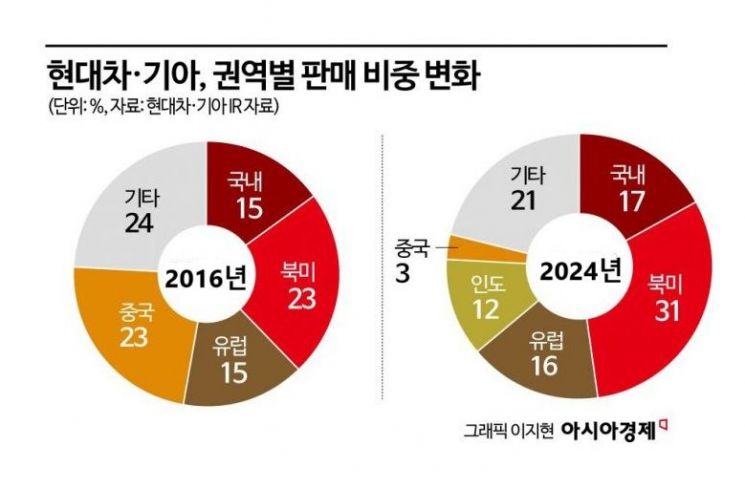

Given the current situation in the Chinese market, Hyundai Motor Group’s ‘de-China’ strategy was a masterstroke. There is debate over whether reducing the share of China in its portfolio was a nimble response to external conditions or a result of weakened competitiveness. However, in hindsight, Hyundai Motor and Kia’s strategy of lowering China’s share in global sales to 3% and filling the gap with India and the United States proved to be spot on.

In the Chinese market, the share of foreign brands was halved within five years after the COVID-19 pandemic, and companies highly dependent on China, such as Volkswagen Group and General Motors (GM), faced crises. Volkswagen, which had maintained the top spot in the Chinese market for 15 years since the 2008 global financial crisis, was finally overtaken by emerging local player BYD in 2023. GM, which once sold 4 million cars a year in China, saw its sales plummet to 1.8 million units in 2024. Last year, GM’s Chinese subsidiary recorded losses of over $5 billion (about 7 trillion won). Despite drastic measures such as restructuring, plant closures, and lineup optimization, it is uncertain whether GM can recover in the Chinese market.

On the other hand, Hyundai Motor Group, which reduced its dependence on China early on, is now focusing on expanding its market share in the United States and India. In India, now the world’s most populous country, the group is securing profitability with internal combustion engine vehicles, while in the advanced U.S. market, it is maximizing profits by increasing sales of eco-friendly vehicles. The industry highly values the fact that Hyundai Motor Group achieved the milestone of becoming the world’s third-largest automaker after 2022, even while excluding China, the world’s largest market. Currently, Hyundai Motor Group’s only remaining competitors are Toyota Group (1st) and Volkswagen Group (2nd).

However, for Hyundai Motor Group to truly become the world’s number one automaker, future growth in China appears essential. While the group is performing well in the United States and India and maintaining steady results in Europe, expanding its market share in China, which drives explosive growth, is more important than anything else. An executive at Hyundai Motor said, “There’s no doubt that China is a challenging market, but we cannot simply walk away from the world’s largest market. We must keep revising our strategies and keep knocking on the door until we succeed.”

Hyundai Motor’s Master Plan to Re-Enter China

To regain competitiveness, Hyundai Motor Group has completely revamped its China strategy. At the end of 2024, Hyundai Motor made a large-scale paid-in capital increase of 784 billion won in its Chinese subsidiary, Beijing Hyundai. Through this investment, Hyundai Motor expressed its intention to develop electric vehicles tailored to China and to turn its Chinese plants into global export hubs.

In the second half of 2025, Hyundai Motor will launch its first electric vehicle dedicated to China, Elexio. Hyundai Motor plans to export the locally produced compact electric SUV Elexio not only to China but also to emerging markets such as Southeast Asia, the Middle East, and Africa. Starting with this model, Hyundai Motor aims to build a lineup of six new energy vehicles by 2027. Kia also plans to overcome sluggish domestic sales by exporting models produced in China, including at the Yenching plant, to overseas markets. As export volumes increased, Kia’s Chinese subsidiary returned to profitability in 2024 for the first time in eight years.

The key difference in Hyundai Motor’s current China strategy is its active partnerships with local suppliers. The status of Chinese parts suppliers, especially for key electric vehicle components such as batteries, has changed dramatically from the internal combustion engine era. At last year’s Beijing Motor Show, Beijing Hyundai announced a strategic partnership with Chinese battery company CATL. The two companies will not only collaborate on joint electric vehicle projects in China but also plan to launch more than 10 electric vehicle models equipped with CATL batteries in China by 2027.

Beijing Hyundai's first dedicated electric vehicle model for China, Elexio, unveiled last April. Provided by Hyundai Motor Company

Beijing Hyundai's first dedicated electric vehicle model for China, Elexio, unveiled last April. Provided by Hyundai Motor Company

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.