First Quarter: -0.246% Negative Growth, Last Place Among 19 Countries

"Korea Unlikely to Achieve 1% Growth This Year"

Domestic and International Institutions Sharply Lower Forecasts

Major Investment Banks Average 0.8%... Down 0.6 Percentage Points in One Month

Bank of Korea Also Expected to Significantly Lower Economic Outlook This Month

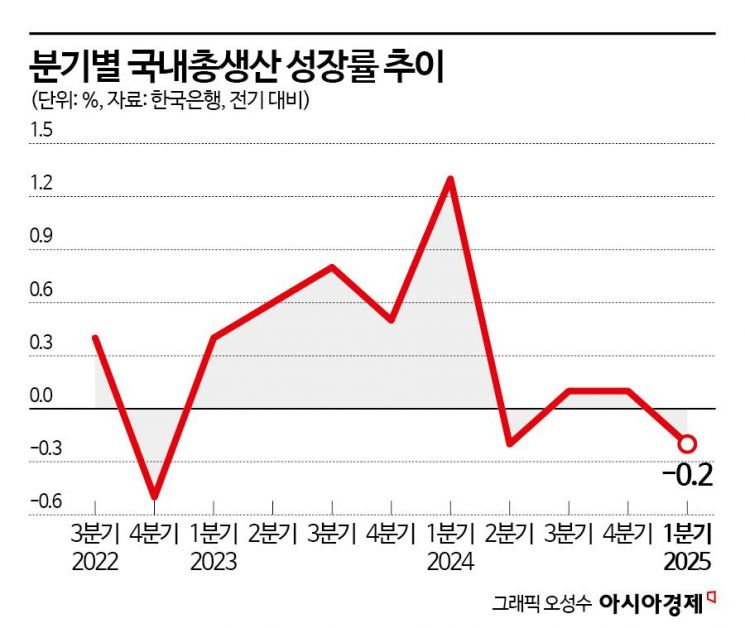

South Korea's "negative growth report card" for the first quarter of this year has been found to be the most severe among major global economies. Both domestic and international institutions are forecasting that even achieving 1% growth for the Korean economy this year will be difficult, with projections being revised downward at an unprecedentedly rapid pace. This is due to a contraction in domestic demand caused by sluggish consumption and investment, as well as external shocks such as the impact of U.S. tariff hikes. As a result, a turnaround is not expected next year either.

First Quarter: -0.246% Negative Growth, Last Place Among 19 Countries

According to the Bank of Korea on May 11, South Korea's real gross domestic product (GDP) growth rate for the first quarter of this year (compared to the previous quarter) was -0.246%. Among the 19 countries that have announced their first-quarter growth rates so far, this is the lowest. Of these 19 countries, 18 are members of the Organisation for Economic Co-operation and Development (OECD), and the only non-OECD country is China. Ireland ranked first with a first-quarter growth rate of 3.219%, followed by China at 1.2% and Indonesia at 1.124%. Spain, which has a similar GDP size to South Korea, also ranked fourth with a growth rate of 0.568%.

Major economies with larger GDPs than South Korea, such as Canada (0.4%), Italy (0.26%), Germany (0.211%), and France (0.127%), also recorded positive growth rates. Even the United States, the world's largest economy and a country directly affected by its own tariff policies, experienced only a minor negative growth of -0.069%, which is much less severe than South Korea's. Japan and the United Kingdom, whose official first-quarter growth rates have not yet been released, are also unlikely to have performed worse than South Korea. According to the country-by-country growth consensus (estimates) surveyed by Bloomberg, Japan and the United Kingdom are projected to have first-quarter growth rates of -0.1% and 0.6%, respectively.

South Korea has been receiving a report card in the bottom ranks of global growth for four consecutive quarters. After plunging to 32nd place in the second quarter of last year (-0.228%), the country remained at 26th place in the third quarter (0.1%). With consumption and construction investment failing to recover, and the December martial law crisis and impeachment political turmoil continuing, the country managed only 0.066% growth in the fourth quarter of last year, falling to 29th place. For the first quarter of this year, although the growth rates for all 37 countries surveyed by the Bank of Korea have not yet been released, it is expected that South Korea will remain among the lowest ranks.

Market analysts have pointed to the contraction in domestic demand, caused by sluggish private consumption and corporate investment including construction, as a structural weakness of the Korean economy. With household debt and the absolute price level remaining high, there are no signs of recovery in depressed consumption. Construction is also struggling due to a downturn in the real estate market and high interest rates. On top of this, exports?a major pillar of the Korean economy?are now inevitably being hit by the shock of U.S. tariffs, leaving the country facing both internal and external crises.

"Korea Unlikely to Achieve 1% Growth This Year"...Major Investment Banks Sharply Lower Forecasts by 0.6 Percentage Points in a Month

As South Korea posted one of the worst performances among major global economies in the first quarter, both domestic and international institutions are rapidly revising their growth forecasts downward. According to the International Finance Center, as of the end of April, the average economic growth forecast for South Korea this year among eight major global investment banks (IBs) was only 0.8%. This is a sharp downward revision of 0.6 percentage points from the average of 1.4% at the end of March.

Nomura and UBS each forecast 1.0%, Barclays 0.9%, Bank of America (BOA) 0.8%, Goldman Sachs and HSBC each 0.7%, Citi 0.6%, and JP Morgan 0.5%. Goldman Sachs presented a new figure less than half of its previous forecast of 1.5%. Citi and HSBC also halved their forecasts at once. Six out of the eight institutions are now predicting growth below 1%. Analysts attribute this to ongoing political uncertainty, as well as a leadership vacuum that has disrupted trade negotiations with the U.S. government, thereby amplifying concerns over low growth. The outlook for next year has also worsened. The average economic growth forecast for South Korea in 2026 among the eight major investment banks dropped from 1.8% at the end of March to 1.6% at the end of April, a downward revision of 0.2 percentage points.

The same sentiment prevails when looking at a broader range of domestic and international institutions. According to Bloomberg, as of May 2, the average economic growth forecast for South Korea among 42 domestic and international institutions was 1.31%. This is 0.1 percentage points lower than the 1.41% recorded in the survey on April 10. The number of institutions forecasting growth in the 0% range increased from seven to nine over the past month. In addition to major investment banks such as Citi and JP Morgan, Bloomberg Economics (0.7%), Hi Investment & Securities (0.8%), iM Securities (0.8%), ING Group (0.8%), and Capital Economics (0.9%) also projected growth in the 0% range.

The Bank of Korea is also expected to sharply lower its growth forecast for this year in its revised economic outlook to be announced on May 29. At a press conference held in Milan, Italy, on May 5 (local time), Bank of Korea Governor Rhee Changyong stated, "Not only the effect of negative growth in the first quarter, but also various current indicators suggest that we need to lower our growth forecast," adding, "Depending on the growth outlook, situations such as the final interest rate will change significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)