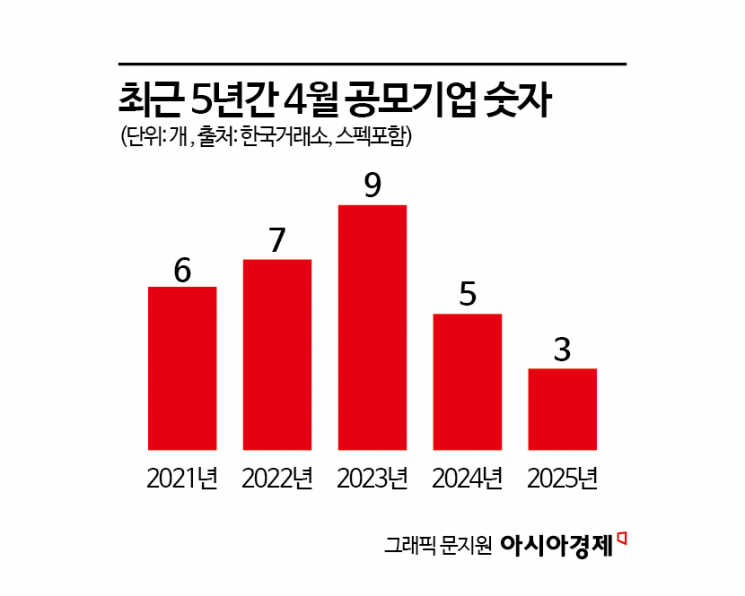

Only Three Companies Listed in April, Half the Five-Year Average of Six

Wait-and-See Sentiment Persists This Month... Aftermath of Large-Cap IPO Withdrawals

The sluggish initial public offering (IPO) market has yet to show signs of recovery. This appears to be due to a series of withdrawals by large-cap companies as well as domestic and international uncertainties.

According to the Korea Exchange on May 12, only six companies have gone public from April to May 9 this year, and in April alone, just three companies?AU Brands, Korea PIM, and Sec?were listed.

The number of companies that went public last month was the lowest in the past five years. Over the past five years, an average of six companies have been listed in April. The amount raised through public offerings was also low. Last month, the total amount raised was 64.6 billion won, which is below the five-year average of 109 billion won.

Park Jongseon, a researcher at Eugene Investment & Securities, explained, "The reason the public offering amount was significantly lower than the average is that the three listed companies were small and medium-sized enterprises with relatively low offering amounts and market capitalizations." He added, "Among the three companies, AU Brands had the largest offering amount, but it was only 32 billion won."

The competition rate for the listed companies was high. This was because there were relatively few companies going public and the market environment was favorable. In April, the KOSPI rose by 3.04% and the KOSDAQ by 6.60%. Yoon Cheolhwan, a researcher at Korea Investment & Securities, said, "The average subscription competition rate for companies listed in April was 1,096 to 1, which was an improvement compared to 952 to 1 in March." He added, "The market was favorable for IPO subscriptions, and since the number of listings was lower than the first-quarter average of 7.3, demand was concentrated on newly listed stocks."

However, post-listing stock performance was poor. Only one out of the three companies closed above its offering price. AU Brands had an offering price of 16,000 won, but its closing price on May 9 was 12,660 won. Sec also fell from 15,000 won to 14,720 won. Only Korea PIM managed to close at 17,550 won on May 9, surpassing its offering price of 11,200 won.

The IPO market is expected to remain challenging this month as well. So far, three companies have gone public, but all are small- to mid-cap stocks, with no large-cap listings. This is because all the large-cap companies withdrew their IPOs. Recently, DN Solutions and Lotte Global Logistics submitted withdrawal reports after poor results in demand forecasting among institutional investors. Before their withdrawal, DN Solutions was expected to be valued at around 5 trillion won, and Lotte Global Logistics at around 500 billion won.

The securities industry expects a wait-and-see approach to prevail in the IPO market for some time. Park Jongseon said, "Large-cap IPOs that were scheduled to proceed are expected to remain on hold for the time being," and added, "The total public offering amount is expected to be in the range of 190 billion to 240 billion won, as only small and medium-sized companies are pursuing listings after the withdrawal of large-cap companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)