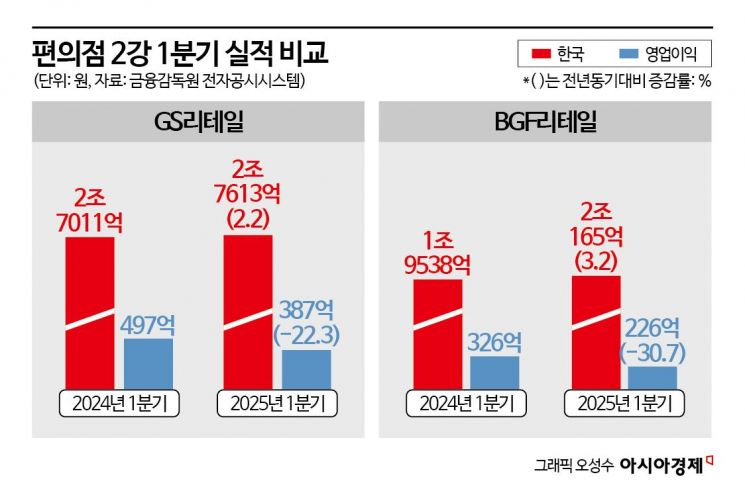

BGF Retail Reports Q1 Operating Profit of 22.6 Billion Won

Down 30.7% Year-on-Year

GS Retail Also Sees 22.3% Drop in Operating Profit

The two leading convenience store chains have reported disappointing business results for the first quarter of this year. This was largely due to a significant decline in consumer sentiment from the beginning of the year, caused by political instability following the 12·3 Martial Law Incident, as well as the lingering effects of disasters and calamities. Unfavorable weather conditions, such as severe cold, also contributed to the decline, as outdoor activities by consumers decreased, further impacting sales.

According to the Financial Supervisory Service's electronic disclosure system on May 9, BGF Retail, which operates the CU convenience store chain, announced the previous day that its consolidated operating profit for the first quarter of this year was provisionally tallied at 22.6 billion won, a decrease of 30.7% compared to the same period last year. Sales increased by 3.2% year-on-year to 2.0165 trillion won, but net profit fell by 42.7% to 13.4 billion won. BGF Retail explained, "Consumer sentiment was affected by unstable domestic and international conditions, as well as variables such as the severe cold, an airplane accident, and wildfires. In addition, compared to last year, which was a leap year, there was one less business day in the first quarter of this year. As a result, although sales saw a slight increase, this was not enough to offset costs, leading to a decrease in operating profit."

The growing trend of online consumption has also weakened the influence of convenience stores compared to the past. According to the Ministry of Trade, Industry and Energy, domestic convenience store sales in the first quarter of this year decreased by 0.4% compared to the same period last year. This is the first time since statistics began in 2013 that quarterly sales for convenience stores have recorded negative growth. In fact, in February, domestic convenience store sales dropped by 4.6% year-on-year, marking the first decline in about five years since 2020 (February to March). In March, sales increased by only 1.4% compared to the same period last year.

GS Retail, which also announced its first quarter results on the same day, reported an operating profit of 38.7 billion won, down 22.3% from the same period last year, reflecting a decline in profitability. Sales rose by 2.2% year-on-year to 2.7613 trillion won, but net profit plunged by 87.6% to 4.8 billion won.

Sales from its main convenience store business increased by 2.2% year-on-year to 2.0123 trillion won, but operating profit dropped by 34.6% to 17.2 billion won due to sluggish consumption and seasonal factors. Supermarket sales rose by 9.2% year-on-year to 416 billion won, but operating profit fell by 21.2% to 7.8 billion won. In addition, home shopping sales decreased by 6.7% to 257.8 billion won due to a decline in TV viewership and intensified competition from online shopping, while operating profit dropped by 31.7% to 22.4 billion won.

These companies plan to focus on improving their business structure by opening new stores in prime locations rather than indiscriminately expanding the number of convenience store outlets, and by increasing the proportion of medium and large-sized stores. They also intend to expand their lineups of ultra-low-priced products in line with consumer trends favoring private brand (PB) products and value for money amid high inflation.

A BGF Retail representative stated, "We expect that in the second quarter, when demand for outings increases, sales of seasonal categories such as ready-to-eat meals, desserts, beverages, and alcoholic drinks will rise. We plan to strengthen our competitiveness by expanding differentiated products related to these categories." GS Retail also commented, "We will focus on strengthening products and services that customers want and on enhancing substance rather than competing on scale, dedicating ourselves to sustainable business growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)