Bank of Korea Announces Preliminary March 2025 Balance of Payments

Semiconductor Exports Rebound... Goods Account Surplus Widens

End of Vacation Peak Season Narrows Travel Account Deficit

First Quarter Current Account Surplus Reaches $19.26 Billion, Up 16.9% Year-on-Year

U.S. Tariffs Expected to Gradually Impact After Second Quarter... First Quarter Gains to Offset

"Annual Current Account Surplus Forecast to Be Revised Down from $75 Billion This Year"

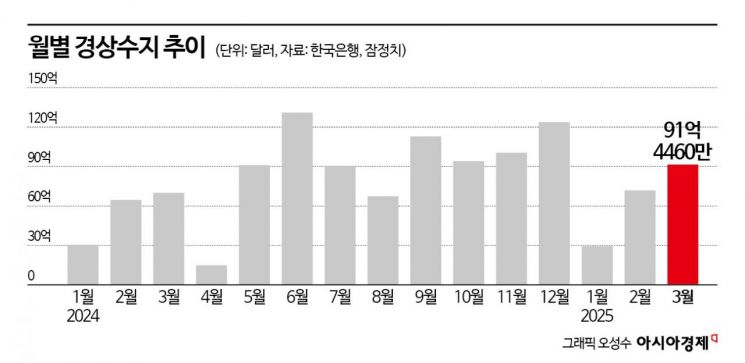

In March, South Korea’s current account recorded a surplus of $9.14 billion. This marks the 23rd consecutive month of surplus. The main drivers were a turnaround in semiconductor exports, which resumed growth after just one month, and a strong goods account. In addition, the end of the winter vacation peak season for overseas travel led to a reduction in the service account deficit, resulting in a larger surplus compared to both the previous month and the same period last year.

As a result, the current account surplus for the first quarter of this year (January to March) reached $19.26 billion, a 16.9% increase from the same period last year ($16.48 billion). This is the eighth consecutive quarter of surplus. While the size of the goods surplus and the service deficit were similar to last year, the expansion of primary income account surplus?driven by increased direct investment and securities investment by domestic residents?was a key factor behind these results.

Semiconductor Exports Rebound... Goods Account Surplus Widens

According to the “March 2025 Balance of Payments (Preliminary)” released by the Bank of Korea on the 9th, South Korea’s current account surplus in March was $9.14 billion. This marks 23 consecutive months of surplus since May 2023, making it the third-longest streak in the 2000s. The surplus widened compared to both the previous month ($7.18 billion) and the same month last year ($6.99 billion). For the month of March alone, this is the third-largest surplus on record after March 2016 and March 2015.

The goods account, which constitutes a large portion of the current account, expanded its surplus slightly compared to the previous month. In March, the goods account surplus was $8.49 billion, up from both the previous month ($8.18 billion) and the same month last year ($8.39 billion).

Exports reached $59.31 billion, up 2.2% from a year earlier. Semiconductor exports rebounded after just one month of decline, while strong computer exports further boosted IT item growth. Some non-IT items, such as automobiles and pharmaceuticals, also increased. In March, exports of information and communication devices, based on customs clearance, were $3.47 billion, a 21.0% increase. Semiconductor exports reached $13.2 billion, up 11.6%. This was due to a rise in general-purpose semiconductor prices from the previous month and increased demand for high-value-added semiconductors. Pharmaceuticals (17.6%), passenger cars (2.0%), and machinery and precision instruments (1.4%) also saw gains. However, petroleum products fell 28.2% to $3.36 billion.

Imports also rose, reaching $50.82 billion, a 2.3% increase. Although energy prices continued to fall, increased gas import volumes slowed the decline in raw material imports, while imports of capital and consumer goods rose, further increasing overall imports. In March, raw material imports, based on customs clearance, fell 7.5% to $23.85 billion. Coal (-34.6%), petroleum products (-15.1%), chemical products (-12.8%), and crude oil (-9.0%) all declined, while gas imports rose 10.9%. Capital goods imports increased 14.1% to $20.41 billion, mainly driven by semiconductor manufacturing equipment (85.1%) and semiconductors (10.6%). Imports of information and communication devices (-0.4%) and transportation equipment (-3.4%) decreased. Consumer goods imports also rose 7.1% to $9.04 billion, with passenger cars (8.8%), non-durable consumer goods (3.8%), and direct consumer goods (2.1%) increasing, while grain imports fell 17.3%.

End of Vacation Peak Season Narrows Travel Account Deficit... Dividend Income Surplus at $2.6 Billion

The service account, which includes the travel account, posted a deficit of $2.21 billion, narrowing from the previous month’s deficit of $3.21 billion. The travel account deficit shrank significantly to $720 million, down from $1.45 billion in the previous month. This was largely due to the end of the winter vacation overseas travel peak season and the start of the spring peak season for inbound foreign tourists. The intellectual property rights usage account deficit widened slightly to $630 million from $580 million in the previous month.

The primary income account posted a surplus of $3.23 billion, mainly due to dividend income. The dividend income account surplus was $2.6 billion, as direct investment dividend income increased, expanding the surplus.

Net assets in the financial account, calculated as assets minus liabilities, increased by $7.82 billion. Direct investment by domestic residents overseas rose by $4.75 billion, while foreign direct investment in South Korea increased by $760 million. In securities investment, overseas investment by domestic residents increased by $12.13 billion, mainly in stocks. Foreign investment in domestic securities rose by $4.5 billion, mainly in bonds. Derivative financial products increased by $2.04 billion. In other investments, assets decreased by $4.2 billion, mainly due to loans, while liabilities decreased by $940 million, mainly in other liabilities. Reserve assets decreased by $2.58 billion.

April Foreign Dividend Season to Narrow Surplus... U.S. Tariff Impact, Annual Outlook "Below $75 Billion"

The current account is expected to remain in surplus in April as well, but the size of the surplus is expected to decrease compared to March. Shin Seungcheol, Director General of Economic Statistics Department 1 at the Bank of Korea, stated, “April is typically the season when foreign dividend payments are concentrated, so the primary income account is likely to record a deficit.” He added, “However, considering that the trade balance for April, based on customs data, will likely show a large surplus similar to March, the current account surplus trend is expected to continue in April.”

It is also assessed that the annual current account surplus forecast, which was previously expected to reach $75 billion, will inevitably be revised downward. The impact of Trump tariffs is not expected to be fully reflected until after April, but is anticipated to gradually materialize. Shin noted, “The U.S. tariff policy is expected to be stronger and more comprehensive than previously anticipated, so the annual current account outlook will be lower than the February forecast (surplus of $75 billion).” He explained, “However, given that first quarter results this year are better than the first quarter last year, some offsetting effect is expected.”

However, Shin also noted that uncertainty remains as tariff negotiations with individual countries, including South Korea, are still ongoing. He said, “The outcome will depend not only on the details of negotiations with South Korea, but also on negotiations with other major countries such as China.” He added, “If there is progress in tariff negotiations between the U.S. and China, the outlook will be adjusted to reflect that.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.