Kimchi Exports Expand Beyond Asia to Europe and South America

Global Kimchi Market Projected to Reach 15 Trillion Won by 2050

Daesang, CJ CheilJedang, and Others Establish Overseas Production Facilities

Domestic kimchi producers are now turning their attention beyond Asia to new markets such as Europe, Australia, and South America. This shift is driven by the changing perception of kimchi among foreigners, who once considered it an unfamiliar fermented food but now recognize it as a superfood. The rising demand for kimchi, facilitated by the lowered entry barriers thanks to Korean Wave content, is another factor prompting companies to explore new markets. Food companies are accelerating their efforts to target the global kimchi market by establishing local factories in Europe and Australia and developing customized strategies.

According to the food industry on May 9, Daesang is building a kimchi factory in Poland, aiming for completion next year. The factory, currently under construction in the Krakow region of Poland, covers 6,613 square meters (2,000 pyeong) and is set to become the first kimchi factory built in Europe. It will be capable of producing over 3,000 tons of kimchi annually and is expected to serve as the European base for Daesang’s kimchi brand, Jongga.

A Daesang representative stated, "We had planned to build the kimchi factory in Poland within this year, but due to overseas circumstances, it has been slightly delayed," adding, "Europe is considered a less developed market compared to the United States, but if we begin local production in Europe, we expect to succeed there as well, drawing on our experience in the U.S."

The establishment of Daesang’s European subsidiary is seen as a representative move reflecting the elevated status of kimchi. Until now, most Korean kimchi exports have been directed to Asia, including Japan, due to geographical and cultural proximity and long-standing familiarity, which reduced resistance to the product.

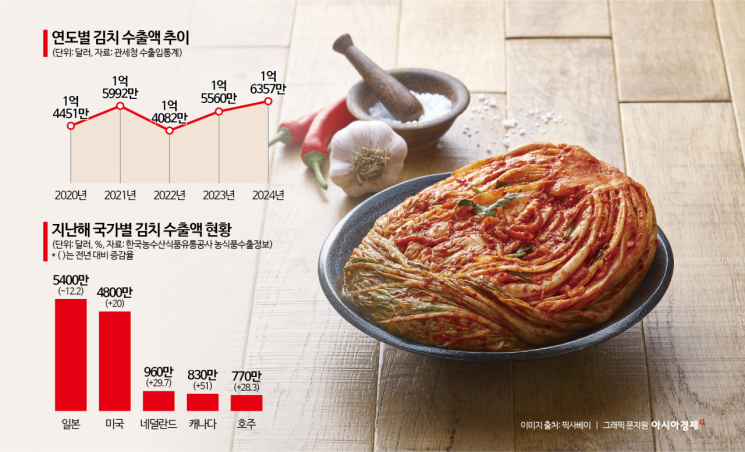

However, recently, growth has become noticeable even in regions where kimchi was previously unfamiliar. Reviewing last year’s kimchi export data, the Netherlands ranked as the third-largest importer after Japan and the United States. The year-on-year growth rate reached 29%. As the popularity of Korean restaurants rises and recipes incorporating kimchi into local cuisine spread, exports are increasing to countries such as the Netherlands, the United Kingdom, and France.

Kimchi is also gaining popularity as a convenient and healthy ingredient that can be added to sandwiches, hamburgers, and salads, beyond being a traditional side dish for rice. The global consumer trend toward healthy eating habits, such as vegan diets and low-carb high-fat (LCHF) diets, is further boosting demand. Additionally, research findings highlighting kimchi’s benefits for immunity are becoming widely known, leading to even greater interest in kimchi.

Kimchi export volumes continue to rise. Last year, Korea’s total kimchi exports reached $163 million, surpassing the previous record of $160 million set in 2021 after three years.

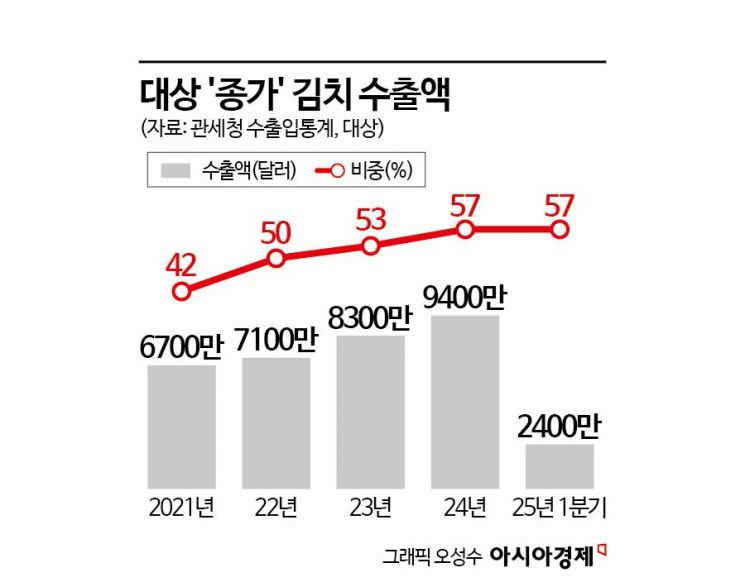

Daesang, which accounts for over half of Korea’s kimchi exports, has recently expanded its Jongga brand into markets such as the Middle East and South America. As of last year, Daesang was responsible for 58% of kimchi export value, followed by Nonghyup with 20?30%, and then CJ CheilJedang and Pulmuone.

This year, Daesang has further diversified its export markets to distant regions, successfully entering African countries such as C?te d'Ivoire and Kenya, as well as the Middle East (UAE, Kuwait) and Central and South America (Chile, Peru). Currently, Jongga kimchi is available in 95 countries worldwide, including the United States, the United Kingdom, Japan, and China.

CJ CheilJedang has also included kimchi among its seven global strategic products and is expanding exports of its Bibigo kimchi to new markets such as Europe. In particular, with the launch of 'Bibigo Shelf-Stable Kimchi,' the company is continuously expanding its presence in major European retail channels. Technology has been applied to ensure that kimchi made in Korea maintains optimal fermentation until it arrives in export markets.

In Australia, local production is underway through an Original Equipment Manufacturer (OEM) model. Currently, CJ CheilJedang exports kimchi to around 50 countries, including the United States, Japan, Europe, and the United Kingdom. A CJ CheilJedang representative stated, "We plan to continue diversifying our portfolio to expand our presence in major retail channels and broaden our experience by increasing brand awareness through collaboration with K-content."

Competition among domestic companies in the global kimchi market is expected to intensify further. Product lines reflecting local cultures, such as vegan kimchi, baek kimchi (white kimchi), beet kimchi, pickled radish, mat kimchi, and cabbage kimchi, are expected to expand. The industry forecasts that the global kimchi market could reach 15 trillion won by 2050.

An industry insider analyzed, "Until now, kimchi was mainly sold in markets serving Korean residents or Asian communities, but as kimchi’s reputation grows as a representative K-food and as a vegan and fermented food, sales are increasing," adding, "Companies will continue to invest steadily, developing a variety of related products such as kimchi spreads, kimchi powder, and kimchi snacks, in addition to napa cabbage kimchi."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)