Different Economic Conditions Between Korea and the US

"Growth Slowdown Is a Reality, Response Needed"

Rising Household Debt and Widening Korea-US Rate Gap Are Variables

Doubts About the Effectiveness of a Rate Cut

With the US Federal Reserve (Fed) having kept its benchmark interest rate (policy rate) unchanged for the third consecutive time this year, attention is now focused on the upcoming decision by the Bank of Korea’s Monetary Policy Committee at the end of this month. While the Fed’s cautious stance could increase the Bank of Korea’s concerns, the market still largely expects a rate cut in May.

Different Economic Conditions in Korea and the US: "Growth Slowdown Is a Reality, Response Needed"

Lee Changyong, Governor of the Bank of Korea, strikes the gavel to declare the opening of the Monetary Policy Committee plenary session held at the Bank of Korea headquarters in Jung-gu, Seoul on April 17, 2025. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, strikes the gavel to declare the opening of the Monetary Policy Committee plenary session held at the Bank of Korea headquarters in Jung-gu, Seoul on April 17, 2025. Photo by Joint Press Corps

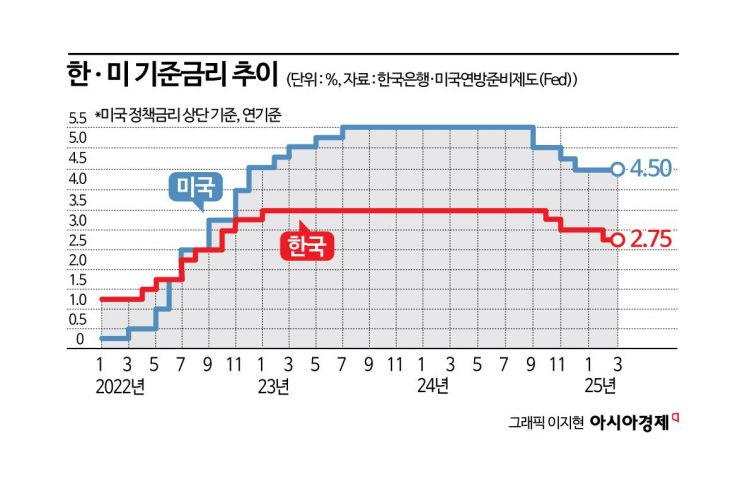

According to the financial sector on May 8, the Bank of Korea will hold a Monetary Policy Committee meeting on May 29 to decide the benchmark interest rate. After lowering the rate by 0.25 percentage points in February, the committee kept it unchanged at 2.75% per annum at the April meeting.

Following the April meeting, the market immediately anticipated a rate cut in May. All six members of the Monetary Policy Committee indicated the possibility of a rate cut within three months, raising expectations for a May cut. Governor Lee Changyong also emphasized that the committee was in a rate-cutting phase, and during a recent visit to Milan, Italy for the Asian Development Bank (ADB) annual meeting, he told reporters, "Do not doubt that we will lower the benchmark interest rate."

However, as the US Fed has kept rates unchanged for the third consecutive time this year and signaled that a cut is unlikely in the near future, the Bank of Korea’s committee members may face greater deliberation. Yoon Yeosam, a researcher at Meritz Securities, noted, "With a high probability that the Fed will maintain its freeze through June, the burden on domestic monetary policy to implement a rate cut in May has increased somewhat."

Nevertheless, the market still places significant weight on the possibility of a rate cut in May, citing the differences in economic conditions between the US and Korea. Huh Gunhyung and Ahn Jaegyun, researchers at Shinhan Investment Corp., stated in a report, "Unlike the US, Korea is experiencing a tangible slowdown in growth," and added, "Meanwhile, the risk of a resurgence in inflation is low, raising expectations for active monetary policy."

In fact, the Fed’s decision to keep rates unchanged was based on the judgment that, despite increased economic uncertainty due to tariffs and other factors, the US economy remains robust. Although sentiment indicators have deteriorated sharply, this has not been reflected in real economic indicators, so any rate cut would be considered a preemptive move.

In contrast, signs of an economic slump in Korea are clear. In the first quarter, GDP contracted by -0.2%. For four consecutive quarters?second quarter of last year (-0.2%), third quarter (0.1%), fourth quarter (0.1%), and first quarter of this year (-0.2%)?growth has failed to exceed 0.1% quarter-on-quarter, indicating a prolonged low-growth phase. The decision to lower the benchmark rate in February was also aimed at easing downward economic pressure, as growth was expected to decline significantly.

The high exchange rate, which could pose a burden to a rate cut, has also somewhat stabilized. Although volatility has increased due to US tariff policies and ongoing negotiations with trading partners, the won-dollar exchange rate, which approached 1,490 won last month, fell to 1,396.6 won as of this day. Researcher Yoon added, "After a cut in May, an additional cut is likely around August," and noted, "Some are even mentioning the possibility of a 'big cut' (0.5 percentage point cut) in May, followed by another cut in July, given the challenging domestic economic conditions."

Rising Household Debt and Widening Korea-US Rate Gap Are Variables... Doubts About the Effectiveness of a Rate Cut

The increase in household debt and the widening interest rate gap between Korea and the US are variables to watch. While the outstanding balance of household debt decreased in January this year, it rose again by 3.0931 trillion won in February, and the pace of increase accelerated to 1.7992 trillion won in March and 4.4337 trillion won in April. The increase in apartment transactions following the lifting of land transaction permit zones in the Gangnam area of Seoul is believed to have led, with a time lag, to an expansion in mortgage lending. However, with the re-designation of land transaction permit zones, apartment transactions have decreased again, suggesting that the growth in household debt could moderate somewhat in the second half of the year. In particular, under the financial authorities' strict management stance, banks are tightening lending standards and managing their total loan volume, which limits the impact of a benchmark rate cut.

The widening of the Korea-US rate gap due to a benchmark rate cut is also a concern. With the Fed’s latest rate freeze, the gap between Korea (2.75%) and the US (4.25?4.50%) remains at 1.75 percentage points (based on the upper bound). If the benchmark rate is lowered in May, the gap could widen to at least 2.00 percentage points. Typically, a wider Korea-US rate gap increases the incentive for foreign investors seeking higher yields to withdraw funds, which can weaken the won and push up the exchange rate. However, Governor Lee stated at a press conference after last month's committee meeting, "If the US delays its rate cut, we will also consider the impact on the exchange rate when lowering Korea’s rate, but we do not make decisions mechanically; we look at Korea’s economic conditions at the time."

There are also voices suggesting the need to carefully consider the effectiveness of a rate cut in boosting the economy. According to the minutes of the April committee meeting released by the Bank of Korea the previous day, one committee member who advocated for keeping rates unchanged questioned the effectiveness of a rate cut. He said, "Even if we further lower the benchmark rate, in the current environment of high uncertainty and subdued economic activity, it is more likely that funds will flow into the financial and real estate sectors rather than lead to increased consumption, investment, or employment by economic agents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)