Cosmetics ETFs Post Over 20% Returns in the Past Month

K-Beauty Stocks Hit Consecutive Record Highs

Strong Exports and Earnings Drive Share Price Rally

Driven by the popularity of K-beauty, cosmetics-related exchange-traded funds (ETFs) are also experiencing strong returns. The robust overseas demand has translated into solid earnings, resulting in K-beauty stocks repeatedly hitting record highs and showing strong share price performance.

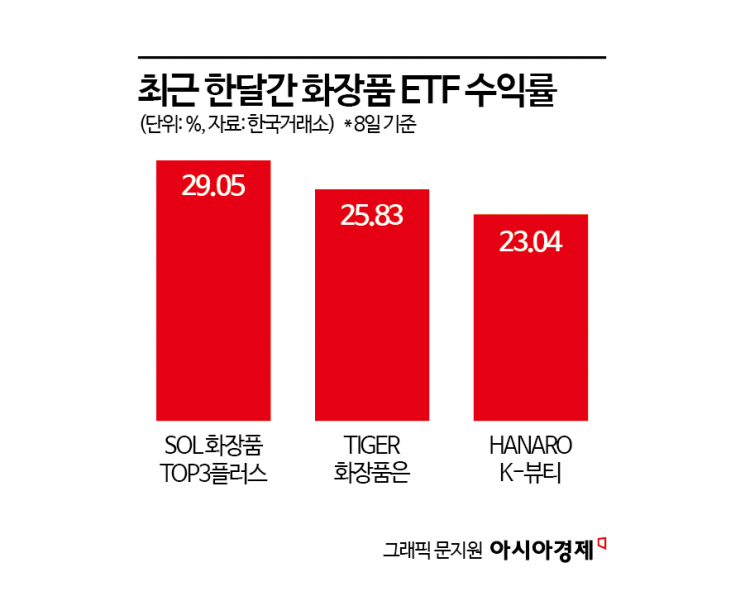

According to the Korea Exchange on May 9, over the past month, SOL Cosmetics TOP3 Plus rose by 29.05%. TIGER Cosmetics climbed by 25.83%, and HANARO K-Beauty increased by 23.04% during the same period.

On the previous trading day, K-beauty stocks successively set new 52-week highs. APR reached an intraday high of 99,300 won, marking a new 52-week record. APR closed at 98,400 won, up 28.80%. Korea Kolmar also set a new 52-week high, rising 5.43% intraday to 79,800 won. PharmaResearch hit an intraday 52-week high of 403,000 won, and Hugel also reached a new 52-week high, climbing to 375,000 won during trading.

The strong share price performance of K-beauty stocks has been underpinned by solid earnings. On the previous day, APR announced its first-quarter results for this year. In the first quarter, APR posted sales of 266 billion won and operating profit of 54.6 billion won, representing increases of 79% and 97%, respectively, compared to the same period last year. This is the first time quarterly sales have exceeded 250 billion won, and the company has recorded over 200 billion won in sales for two consecutive quarters. Notably, the cosmetics and beauty segment, fueled by the global popularity of K-beauty, achieved sales of 165 billion won, up 152% year-on-year. APR's overseas sales in the first quarter surged by 186% year-on-year to nearly 190 billion won, far surpassing last year's first-half overseas sales. The proportion of overseas sales also rose to 71%.

Amorepacific also delivered better-than-expected results in the first quarter. Sales reached 1.0675 trillion won and operating profit was 117.7 billion won, up 17% and 62% year-on-year, respectively. These figures exceeded market expectations of 1.233 trillion won in sales and 99.5 billion won in operating profit. Park Hyunjin, a researcher at Shinhan Investment & Securities, commented on Amorepacific, saying, "The strong performance was due to sales growth in North America, Europe, and Japan, as well as a rapid turnaround to profitability in China. The Chinese business is expected to remain profitable in the second quarter as well."

Robust exports are raising expectations for strong earnings among cosmetics companies. In April, cosmetics exports totaled $852 million, up 18.4% year-on-year. Park Jongdae, a researcher at Meritz Securities, noted, "It is significant that exports to the United States in April increased by 6% year-on-year despite tariffs. In terms of value, the figure reached $150 million, the second-largest ever. In addition, as tariff burdens on ultra-low-priced Chinese cosmetics have increased significantly, the price competitiveness of Korean cosmetics has improved." He added, "The importance of Europe is growing, with April exports to Europe surging by 42% and driving Korean cosmetics exports. Furthermore, exports to China have increased year-on-year for two consecutive months for the first time since November 2021, indicating a clearer recovery in the Chinese market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)