APR, SND, and LIG Nex1 Hit Record Highs

Beauty, Food, and Defense Sectors Deliver "Surprise Earnings" While IT Lags Behind

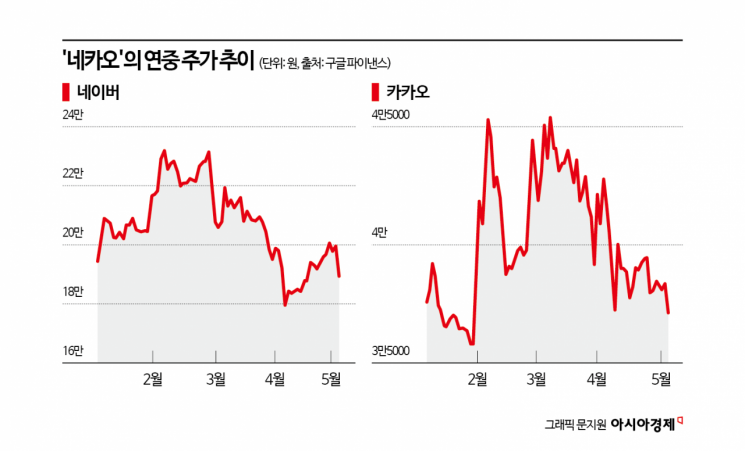

The outlook for Naver and Kakao, which together dominate the domestic IT platform market, is becoming increasingly uncertain. While beneficiaries of the US-led tariff shock continue to hit record highs with strong performances, leading IT stocks are failing to join the rally as concerns over poor earnings and industry conditions freeze investor sentiment.

According to the financial investment industry on May 9, Naver and Kakao closed the previous day down 5.22% and 3.52%, finishing at 188,700 won and 37,000 won, respectively. This contrasts with the sharp gains posted by tariff beneficiaries such as APR (beauty), SND (food), and LIG Nex1 (defense), which all ended higher on the same day. Kakao and Naver, which ranked among the top five net purchases by foreign investors during the first 100 days of Donald Trump's presidency, saw foreign investors sell more than 110 billion won combined, making them the top two net-sold stocks by foreigners that day.

Even among companies that are relatively unaffected by tariffs, stock prices are diverging significantly depending on earnings and guidance. APR, which has benefited from the "K-beauty" boom, surged 28.80% after reporting a consolidated operating profit of 54.568 billion won for the first quarter?nearly double the figure from a year earlier?setting a new 52-week high. SND, the maker of Buldak-bokkeum-myeon sauce, also joined the record-high parade after securities firms projected it could post its best-ever quarterly results in the first quarter. Defense company LIG Nex1, specializing in guided weapons, also hit an all-time high of 372,500 won on the back of a "surprise" first-quarter performance.

In contrast, leading IT stocks failed to shine. For Kakao, first-quarter consolidated revenue and operating profit came in at 1.8637 trillion won and 105.4 billion won, respectively, down 6% and 12% from the same period last year. In particular, a 16% drop in content segment revenue?mainly due to weakness in the music and gaming divisions?had a significant impact. Lim Heeseok, a researcher at Mirae Asset Securities, stated, "The downturn in the content segment is deepening, making a meaningful earnings rebound this year unlikely," and lowered his target price from 54,000 won to 50,000 won.

Even though Kakao CEO Chung Shina announced during the first-quarter conference call the previous day that the company had launched a closed beta test (CBT) for its B2C artificial intelligence (AI) service "Kanana" and had begun full-scale collaboration with OpenAI, the developer of ChatGPT, this failed to boost the stock price. Kakao Pay, despite achieving its first-ever consolidated operating profit since listing, saw its stock drop 5.71%, while affiliates such as Kakao Games (-3.34%) and Kakao Bank (-1.29%) also remained weak.

Naver, ahead of its first-quarter earnings release, saw its stock pressured by industry weakness and uncertainty over the earnings contribution of Plus Store. Previously, Hyundai Motor Securities lowered Naver's target price to 260,000 won on April 11, and Shinhan Investment reduced it to 210,000 won on April 24. Kang Seokoh, a senior researcher at Shinhan Investment, commented, "The recent decline in the stock price is due to industry weakness and uncertainty about Plus Store's growth contribution. Trading opportunities remain, but it will take time to meet the market's high expectations." He added that while collaboration with Kurly will strengthen Naver's previously weak fresh food segment and Plus Store will increase transaction volume starting with high-priced products and loyal users, the short-term earnings contribution is expected to be limited.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.