First Pre-sale in Eight Months... 'Application Tsunami'

"Demand Still Lags, Supply is Overflowing"

Following Pyeongtaek and Icheon, Yongin, a major semiconductor industry hub in southern Gyeonggi Province, is now at risk of being designated as a region with unsold housing inventory. Despite the positive factor of being a so-called "Banse-gwon" (areas adjacent to semiconductor industrial complexes), recent new housing developments in Yongin have seen a series of undersubscribed pre-sale applications. With unsold units now piling up even in Yongin, which had previously held up relatively well, analysts say the Banse-gwon effect has all but disappeared.

First Pre-sale in Eight Months... 'Application Tsunami'

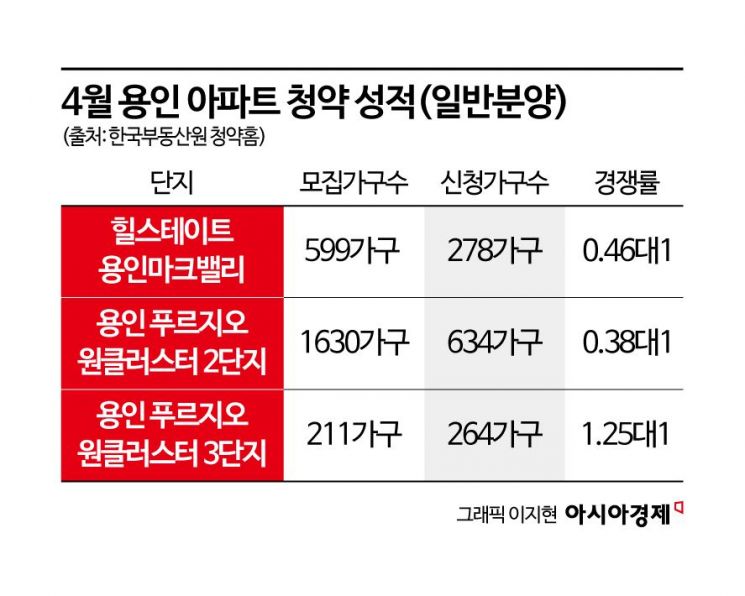

According to Korea Real Estate Board's Cheongyak Home on May 8, the second phase of 'Yongin Prugio One Cluster' recorded the worst performance among 30 nationwide developments that accepted applications last month, based on the number of unsold units. Out of 1,630 units offered, only 634 applications were received, resulting in an average competition rate of 0.38 to 1. This means that there was a large-scale undersubscription, with nearly 1,000 units remaining unsold. The third phase of 'Yongin Prugio One Cluster,' which accepted applications during the same period, saw 264 applications for 211 units, posting a competition rate of 1.25 to 1. 'Hillstate Yongin Mark Valley,' also offered for sale in the same month, failed to attract enough applicants for most unit sizes, resulting in an average competition rate of just 0.46 to 1 (278 applications for 599 units).

The three developments supplied in Yongin last month are all located in Cheoin-gu, Yongin. This area has been designated as a national industrial complex for advanced system semiconductors. The semiconductor cluster is a large-scale project expected to house six major fabs (semiconductor manufacturing plants), three power plants, and more than 60 partner companies specializing in materials, parts, and equipment, on a site spanning 7.28 million square meters. Operations are expected to begin as early as 2030.

Notably, these developments were the first new apartments to be supplied in eight months, since 'Yongin Dunjun Station Epitte' in August last year. At that time, 'Yongin Dunjun Station Epitte' received 1,637 applications for 1,009 units, recording a competition rate of 1.62 to 1. The market downturn, which was already noticeable during the Epitte application period, has now become much more pronounced.

"Demand Still Lags, Supply is Overflowing"

The downturn in Yongin mirrors the trends seen in Pyeongtaek and Icheon, other key Banse-gwon areas in southern Gyeonggi. As of March, Pyeongtaek had 5,281 unsold units and Icheon had 1,610, ranking first and third among Gyeonggi Province cities and counties, respectively. In contrast, Yongin had just 474 unsold units as of March, making it the most resilient among Banse-gwon areas. However, with last month's large-scale undersubscription of over 1,000 units, Yongin now faces the risk of being designated as a "region with unsold housing inventory," following Icheon in August last year and Pyeongtaek in March this year. The Housing and Urban Guarantee Corporation (HUG) considers designating a region as such if a city, county, or district maintains more than 1,000 unsold units for over three months and the number of unsold units exceeds 2% of the total multi-family housing stock.

Housing prices are also clearly declining. According to the Korea Real Estate Board, as of the fourth week of last month, the cumulative price change for apartments this year was -2.52% in Pyeongtaek and -1.72% in Icheon. Even in Cheoin-gu, Yongin, which is part of the Banse-gwon area, prices fell by 0.51%. Delays in the development of semiconductor industrial complexes for various reasons are weakening the appeal of Banse-gwon areas. Due to the downturn in the semiconductor industry, construction of Samsung Electronics' Pyeongtaek Campus Plant 5 (P5) has been halted. The Yongin Semiconductor Cluster project is also being delayed due to conflicts between local governments and delays in permits and approvals. There is even talk that the current target of starting operations in 2030 may not be met.

Oversupply is also fueling the downturn in Banse-gwon areas. According to real estate big data platform Asil, the appropriate number of new housing units for Cheoin-gu, Yongin last year was 1,398, but the actual number supplied reached 9,309?more than six times the appropriate level. Pyeongtaek and Icheon also saw two to three times more new units supplied than appropriate demand. The 'supply bomb' in Banse-gwon areas is expected to continue for several years. In particular, Pyeongtaek is expected to see about 27,000 new units supplied over the next three years. Including Icheon and Yongin, the total will approach 40,000 units. From next year through 2027, these three regions will account for 25.9% of the total expected new housing supply in Gyeonggi Province (156,828 units).

Park Wongap, Senior Real Estate Expert at KB Kookmin Bank, stated, "The perception that the semiconductor industry is no longer as strong as it once was is weakening the positive effect of the Banse-gwon, shrinking demand and widening the gap with supply. Ultimately, the downturn is likely to continue until demand for actual occupancy begins to materialize in earnest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.