Down 2.23% on the 7th, Extending Three Days of Losses

Lowest Closing Price Since Last November's IPO

CEO Baek Jongwon's Apology and Franchisee Support Fail to Halt Decline

Overhang Concerns Add Pressure, Making Recovery Unlikely

Theborn Korea continues to experience a steep and seemingly bottomless decline. Since its listing, Theborn Korea has been on a downward trajectory, and even CEO Baek Jongwon's announcement to suspend his broadcasting activities has failed to halt the persistent weakness in its stock price. Concerns about an overhang are further weighing on the stock, making a recovery appear unlikely.

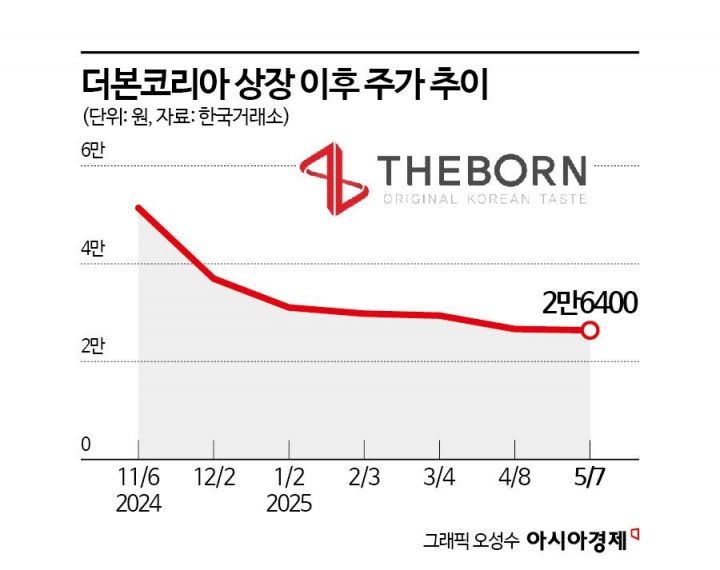

According to the Korea Exchange on May 8, Theborn Korea closed at 26,400 won on the previous day, down 2.04%. The stock has fallen for three consecutive days, hitting its lowest closing price since its listing in November last year.

Theborn Korea's stock price peaked at 64,500 won on its first day of listing on November 6, 2024, but has been on a continuous decline since then. On April 9, 2025, it dropped to an intraday low of 26,100 won, setting a new record low, and on this day, it again fell to 26,100 won during trading. The current price is 22.35% below the IPO price of 34,000 won. Since the beginning of this year, the stock has not once recovered to its IPO price.

Since its listing, Theborn Korea has been plagued by a series of controversies that have negatively impacted its stock price. These include product quality issues, errors in country-of-origin labeling, hygiene problems at festival sites, and allegations of neglecting ingredients. Most recently, the Gangnam Police Station in Seoul received a complaint alleging that the company used Vietnamese shrimp in its 'Deopjuk' product while advertising it as "domestic" and "wild-caught," which constitutes false information. As a result, CEO Baek and Theborn Korea have been booked and are under investigation for violating the Food Labeling and Advertising Act. In addition, police are investigating allegations that 'Paikdabang' misled consumers about the origin of ingredients in its new 'Chewy Sweet Potato Bread,' and that Theborn Korea used industrial metal cookware at regional festivals, misleading consumers into believing it was made from food-grade metal.

In response, CEO Baek issued an apology on May 6, 2025. This marks his third apology, following previous statements on March 13 and March 19 regarding false origin labeling and issues with the pork content in ham products. In his most recent apology, delivered via a YouTube video, Baek stated, "Except for programs that are currently being filmed, I will suspend all broadcasting activities," and added, "From now on, I will focus all my efforts on Theborn Korea's growth as a businessperson, not as a broadcaster." Earlier, on May 2, Theborn Korea also announced a support package for franchisees worth 5 billion won, including a three-month royalty exemption.

However, Baek's announcement to suspend broadcasting activities and the support package have not been enough to stop the stock's decline. The continued weakness is also being driven by concerns over an overhang (potential shares for sale). According to the Korea Securities Depository, the six-month lock-up period for Theborn Korea shares, which began with its listing in November 2024, has now expired. As a result, 4,865,835 shares (about 33.02%), including those held by Baek Jongwon and co-CEO Kang Seokwon, are now free to be sold. In addition, 282,600 shares that were subject to a six-month lock-up by institutional investors became eligible for sale starting from May 7, 2025.

The mandatory holding period for stock options granted to employees before the listing in 2022 has also ended. According to Theborn Korea's business report, there are currently 854,860 unexercised stock options, which account for 5.8% of the total 14,737,260 shares issued.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)