An Increase of 356.8 Billion Won Compared to March

Impact of Reciprocal Tariff Measures Announced Early Last Month

Financial Support of About 26 Trillion Won from the Five Major Financial Groups

Loan Interest Rates Also Declined

Banks to Launch New Financial Products for Small Business Owners in July

Support Expected to Continue for the Time Being

However, Lending May Slow Due to Rising Delinquency Rates

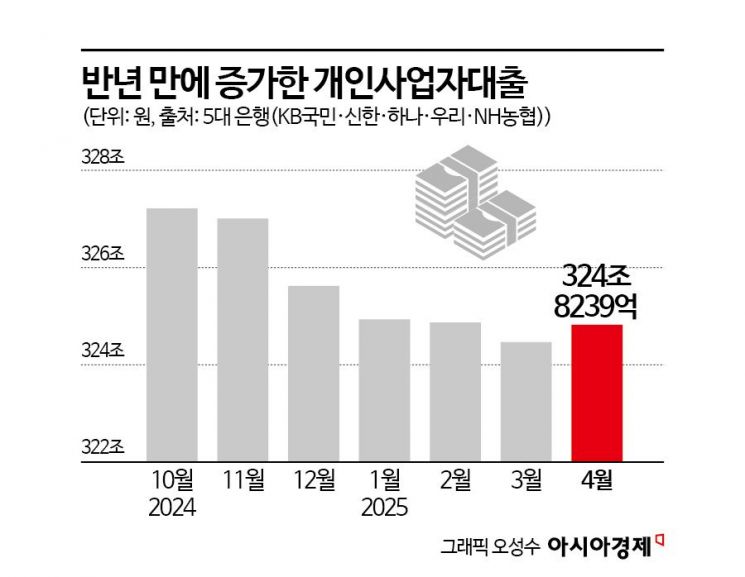

The total volume of SOHO (Small Office/Home Office) loans at major banks increased for the first time in six months. It appears that the measures for small business owners announced by the banking sector last month in response to reciprocal tariffs had an impact. As additional financial support measures are expected to be introduced during the first half of the year, it is anticipated that the financial burden on small business owners will be alleviated. However, as delinquency rates among these borrowers remain concerning, there is a possibility that banks may tighten their credit screening processes.

According to the financial sector on May 8, the total amount of SOHO loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH NongHyup) last month was 324.8239 trillion won. This figure represents an increase of 356.8 billion won compared to March (324.4671 trillion won), marking the first rise in six months after a period of decline that began in November last year. Looking at the broader timeline, the volume of SOHO loans had been increasing for eight consecutive months from February to October last year before shifting to a downward trend in November.

The increase in SOHO loans can be attributed to the small business support measures introduced by the banking sector last month. The five major financial holding companies (KB, Shinhan, Hana, Woori, and NongHyup) announced financial support measures totaling 26 trillion won for SMEs and small business owners, with banks taking the lead. These measures are primarily aimed at overcoming domestic demand stagnation and difficulties caused by the United States' reciprocal tariff actions, focusing on preferential interest rates and new loans. KB Kookmin Bank expanded its branch manager approval preferential interest rate program from 1.5 trillion won to 3 trillion won. Shinhan Bank is providing 6.4 trillion won through a similar program and has contributed a special fund of 500 billion won to the Credit Guarantee Foundation to support new loans. Hana Bank is supporting new funds totaling 300 billion won with preferential interest rates of up to 1.9%, and is facilitating guaranteed loans by making additional contributions to regional credit guarantee foundations. Woori Bank is providing 200 billion won in specialized guarantee-backed loans for small business owners in cooperation with regional guarantee foundations, while NongHyup Bank plans to provide financial support totaling 1.3 trillion won through special contributions to 17 regional credit guarantee foundations nationwide.

The decline in SOHO loan interest rates also played a role. According to disclosures by the Korea Federation of Banks, the average interest rate for newly issued guaranteed SOHO loans at the five major banks last month ranged from 4.02% to 4.5%. This is lower than the 4.23% to 4.85% range in March. From November last year to February this year, when the volume of SOHO loans was on the decline, the increase in interest rates was significant. The average interest rate, which was 4.39% to 4.67% in October, rose to 4.4% to 4.73% in November and further to 4.6% to 5.25% in February, with both the lower and upper bounds increasing. During this period, the Bank of Korea lowered its base rate twice (in October and November), but individual business owners did not benefit from the rate cuts.

As many self-employed individuals are on the front lines of the economic downturn, financial support is expected to continue for the time being. According to Statistics Korea, the number of self-employed persons in the first quarter of this year was 5,523,000, the lowest since the first quarter of 2019 (5,520,000). The number of corporate bankruptcy filings in the first quarter was 453, the highest since 2014. In response, the banking sector launched three products for small business owners (Small Business Owner 119 Plus, Business Closure Support, and Sunshine Loan 119) by April, and plans to launch the 'Small Business Owner Growth UP' product in July. This product will provide up to 50 million won in new funds to small business owners who can demonstrate competitiveness improvement plans. Corporations can receive up to 100 million won, and the loans will be guaranteed by regional credit guarantee foundations. Funding will be provided by the banking sector, with 100 billion won contributed annually for three years, totaling 300 billion won.

However, as the delinquency rate among small business owners rose in the first quarter, banks may reduce the volume of SOHO loans, except for the planned support, to manage asset quality. The average SOHO loan delinquency rate at Shinhan, Hana, and Woori Bank, where such data is available, was 0.51% in the first quarter of this year, higher than 0.47% in the third quarter and 0.43% in the fourth quarter of last year. In fact, among the five major banks, some banks that saw an increase in delinquency rates were the only ones to record a decrease in SOHO loan volume last month, continuing the downward trend. It is presumed that these banks have maintained higher SOHO loan interest rates to manage asset quality.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.