Trump to Announce Pharmaceutical Tariffs Within Two Weeks

Hints at High Tariffs, Citing "Unfair" and "Exploitation"

Tension is rising in the global pharmaceutical and biotech industry after U.S. President Donald Trump announced plans to impose tariffs on pharmaceuticals within two weeks. As companies with high dependence on the U.S. market, particularly in the biotech sector, are expected to be most affected, experts are advising the need for long-term strategic planning.

On May 7, Lee Seungkyu, Vice President of the Korea Biotechnology Industry Organization, said in a phone interview with reporters, "Since Korea's export ratio of active pharmaceutical ingredients (APIs) is not high, the impact of tariffs will be limited." However, he added, "There is a high possibility that companies exporting finished products such as biosimilars, and contract development and manufacturing organizations (CDMOs) without manufacturing facilities in the U.S., will be affected."

Lee also noted that since the tariffs are primarily targeting countries like China and India, which have emerged as powerhouses in API production, this could present an opportunity for Korean pharmaceutical and biotech companies, especially in light of the U.S. policy direction toward lowering drug prices. He stated, "Korea is in a position to potentially replace China in fields such as biosimilars and CDMOs, so this could be a long-term opportunity. The government and industry should develop long-term strategies and respond diplomatically and commercially."

Previously, on May 5 (local time), President Trump signed an executive order at the White House to promote pharmaceutical manufacturing, stating, "We will make a major announcement next week regarding drug prices," and added, "Compared to other countries around the world, we are being treated extremely unfairly and exploited." The use of such strong language by President Trump has raised concerns that high tariff rates may be imposed.

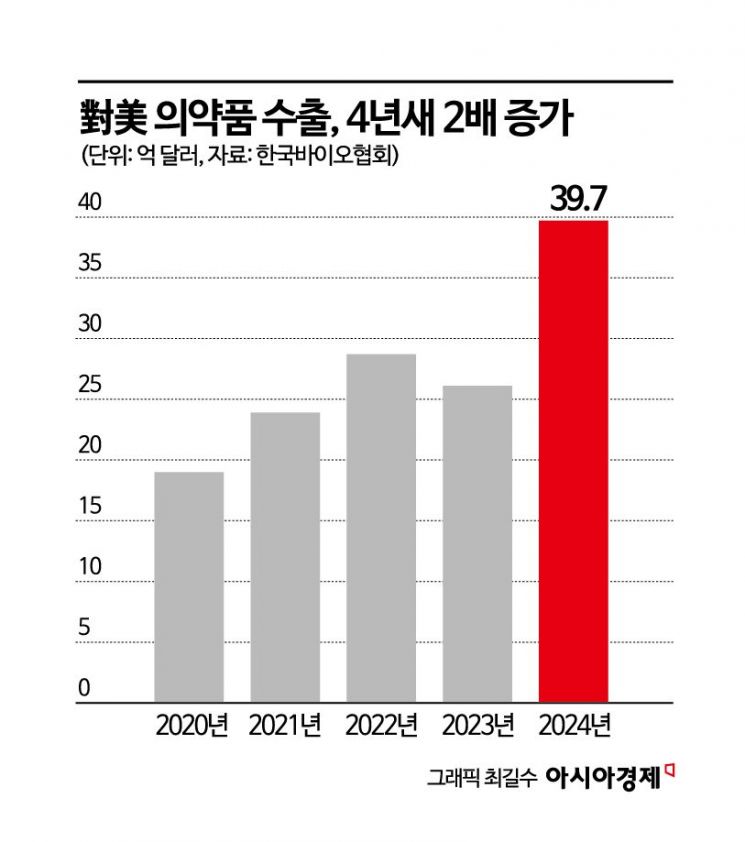

The impact on the biosimilar sector, which has a high export ratio to the U.S., appears inevitable. According to the Korea Biotechnology Industry Organization, as of last year, the U.S. imported $3.97 billion (about 5.4865 trillion won) worth of pharmaceuticals from Korea, with biopharmaceuticals accounting for $3.74 billion (about 5.1686 trillion won), or 94.2% of the total. Some observers have raised the need to build production bases within the U.S. as a result of the tariffs.

There is also a strong opinion that the impact of pharmaceutical tariffs will be limited. Hwang Juri, Head of International Cooperation at the Korea Biotechnology Industry Organization, said, "If tariffs are imposed, large companies such as Samsung Biologics and Celltrion will be mainly affected, but the overall impact will be less significant compared to sectors like semiconductors or automobiles."

Hwang also noted, "There is considerable resistance within the U.S. itself to imposing pharmaceutical tariffs. Multinational pharmaceutical companies value not only the U.S. market but also other markets such as China, so it will be difficult for tariff measures to be sustained over the long term." She further explained, "Although the U.S. is promoting domestic manufacturing, it is unlikely that Korean companies will immediately establish manufacturing facilities in the U.S., as it takes more than five years to build a plant. This would coincide with the end of the Trump administration's term."

The Korean pharmaceutical and biotech industry mainly produces active pharmaceutical ingredients (DS) domestically and then packages and sells finished pharmaceutical products (DP) at overseas destinations. The price difference between DS and DP is five to ten times. For example, if the price of a finished pharmaceutical product is 100 won, the export price of the API produced in Korea is about 10 to 20 won. Even if a 25% tariff is applied, the impact would be limited to about 2.5 to 5 won out of the total 100 won.

Lee Hyunwoo, Head of Global Affairs at the Korea Pharmaceutical and Bio-Pharma Manufacturers Association, also commented, "The imposition of tariffs is likely a pressure tactic to encourage 'reshoring' (the return of manufacturing to the U.S.) by American pharmaceutical companies, but expanding pharmaceutical production within the U.S. cannot happen in the short term." Jung Yuntaek, President of the Pharmaceutical Industry Strategy Research Institute, also remarked on the tariff issue, stating, "Since Korea runs about a 10% deficit in the pharmaceutical sector, it does not make logical sense for the U.S. to demand tariffs from us. The U.S. keeps raising the tariff issue mainly as a means to address drug pricing, rather than because of tariffs themselves."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.