Outstanding SME Loans at Five Major Banks Reach 665 Trillion Won in April

Slight Monthly Increase, but January-April Growth Plunges 80% Year-on-Year

With Lower Delinquency Rates, Banks Reduce Unsecured Loans and Raise Collateralized Loan Share

"Focus on Asset Quality Management... Lending Will Remain Conservative for Now"

The lending threshold for small and medium-sized enterprises (SMEs) at major commercial banks is steadily rising. The year-on-year increase in outstanding SME loans has shrunk by about 80%, and the proportion of collateralized loans?a more conservative lending approach?is steadily growing. This is because banks have tightened their lending practices as delinquency rates have reached their highest levels in seven to eight years. With asset quality management emerging as the top priority for banks, analysts predict that this conservative lending trend will only intensify going forward.

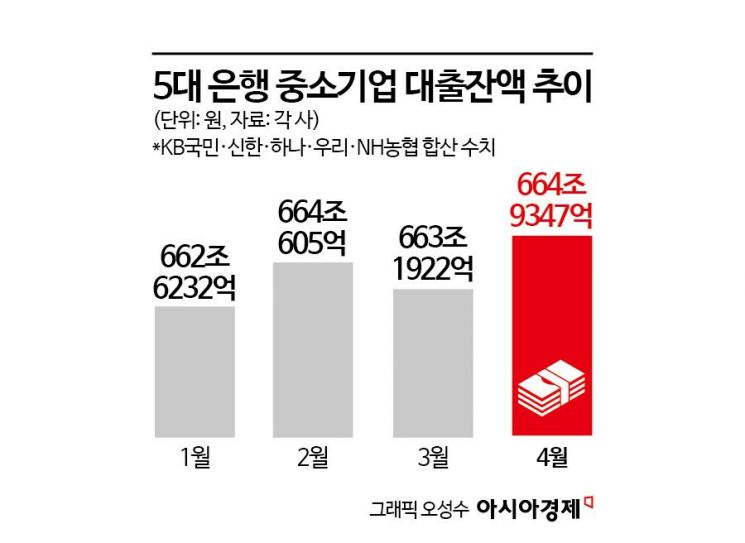

According to the financial sector on May 7, the outstanding balance of SME loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 664.9347 trillion won at the end of last month, up 0.26% from the previous month.

Although the figure rebounded to growth in April after declining in March, the cumulative increase from January to April this year was the smallest in the past four years. The outstanding balance rose by only 2.7057 trillion won from 662.2290 trillion won at the end of last year. Compared to the same period last year (13.9380 trillion won), this represents a drop of more than 80%. The increase is also minimal compared to 2022 (19.4460 trillion won) and 2023 (7.1941 trillion won).

Typically, both household and corporate loans tend to grow at the beginning of the year, as repayments are lower than at year-end and companies’ demand for funds increases. In fact, from 2022 to 2024, the average monthly increase during this period was about 3 to 4 trillion won. However, this year, the increase in January was only 394.2 billion won, and in March, the balance actually decreased by 868.2 billion won.

The reduced growth is due to a decline in new loan issuance. Banks have tightened lending standards, citing capital soundness and rising delinquency rates. The banking sector also explains that as the business environment has deteriorated, fewer companies are borrowing to actively invest in business expansion.

In fact, SME loan delinquency rates at banks have reached alarming levels. As of the end of March this year, the delinquency rate at the five major banks was 0.59%, about 1.7 times higher than a year earlier (0.34%). By bank, KB Kookmin Bank recorded 0.5%, the highest since the end of June 2016. The figures for the others were: Shinhan Bank 0.49% (previous peak June 2017), Hana Bank 0.49% (March 2021), Woori Bank 0.5% (March 2018), and Nonghyup Bank 0.96% (end of 2012). All of these represent the highest delinquency rates in four to thirteen years.

Given these circumstances, banks have been handling SME loans more conservatively, increasing the proportion of collateralized loans. According to performance data disclosed by Shinhan, Hana, and Woori Financial Groups, the average proportion of collateralized SME loans at these three banks stood at 86.3% as of March this year. This is an increase of 4.1 percentage points in five years, compared to 82.2% in March 2021.

At Shinhan Bank, collateralized loans?including real estate (69%) and guarantee-backed loans (11%)?accounted for 85% of SME lending, up 8 percentage points over the same period. In particular, the proportion of real estate-backed loans rose from 59% to 69%. Hana Bank also saw the proportion of collateralized loans, mainly real estate (68.5%), rise to 84.2% of its total SME loans. At Woori Bank, the collateralized loan ratio increased from 87.3% five years ago to 89.7%.

It is highly likely that banks will further tighten SME lending going forward. If the effects of the US-led tariff war intensify, banks are expected to raise the threshold for corporate loans?especially SME loans?in order to manage risk-weighted assets (RWA) and delinquency rates. With banks maintaining a conservative lending stance, financially vulnerable borrowers could face even more severe funding difficulties. A commercial bank official commented, "Although the exchange rate has stabilized somewhat, market uncertainty remains high and delinquency rates are increasing, particularly among vulnerable borrowers. This is a time when we need to reduce bad loans and focus on asset quality management. Lending will inevitably remain conservative for the time being."

However, amid these trends, the government and political circles are calling for expanded financial support due to concerns about corporate funding shortages, putting banks in a dilemma where they must support vulnerable companies while also managing asset quality. Another commercial bank official said, "We cannot simply cut off financial support for struggling SMEs. We are now faced with the difficult task of finding the right balance between expanding lending and maintaining asset quality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.