Korea Institute of Finance Research Report

"One-Third of Global Cryptocurrency Owned by MZ Generation"

High Speculation Leads to Use of Credit Cards and Loans

Widening Asset Gap with Older Generations

Investing with Hopes of High Returns

"Traditional Banking Industry Will Be Threatened"

As the asset gap between the MZ Generation (Millennials and Generation Z) and older generations has become entrenched worldwide, younger people are increasingly investing in digital assets such as virtual assets, which offer the potential for high returns. Some experts argue that such investment trends could, in the long term, undermine bank profitability, highlighting the need for banks to enhance their competitiveness.

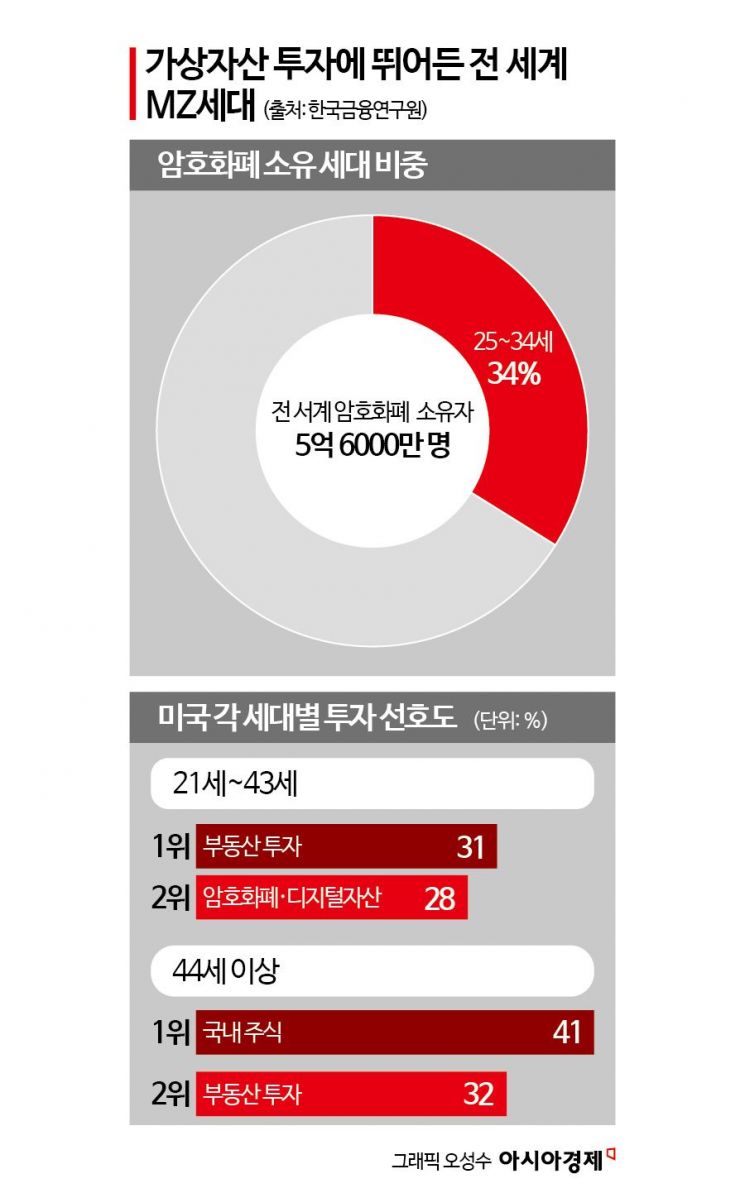

According to the financial sector on May 5, Sim Hyebin, a researcher at the Korea Institute of Finance, made these points in a recent report titled "Current Status of MZ Generation Digital Asset Investment and the Need for Banks to Develop Response Strategies." Sim noted that the preference for digital asset investment among younger generations is spreading not only in Korea but also in advanced countries such as the United States and the United Kingdom. In fact, a survey last year by TripleA, a global cryptocurrency payment gateway company, found that among 560 million cryptocurrency holders worldwide, those aged 25 to 34 accounted for the highest proportion at 34%. In a survey conducted by Bank of America of 1,007 Americans, real estate investment ranked first among those aged 21 to 43 at 31%, while digital assets such as cryptocurrencies ranked second at 28%. In Germany and France as well, the accessibility of digital assets among young people has increased, resulting in a high proportion of investment by this demographic.

As a result, concerns are being raised in various countries about inexperienced young investors putting money into highly speculative assets. Nikhil Rathi, Chief Executive of the UK's Financial Conduct Authority, stated at a recent meeting, "For millions of young people, their first investment product is not stocks or bonds, but very high-risk virtual assets where they could lose all their money."

There are also many cases where people use credit cards or unsecured loans to invest in digital assets. According to the US Federal Reserve, about 11% of virtual asset investors under the age of 30 last year had experience investing with credit cards or unsecured loans. Korea is no exception. According to data from the Korea Inclusive Finance Agency, 37.9% of young people have experienced or currently hold debt. Their average outstanding debt is 69.87 million won, with the third-largest category being debt related to stock and coin investments (18.55 million won). When asked about the reasons for taking out loans, stock and coin investment ranked sixth after housing costs, tuition, and living expenses, but in terms of outstanding debt, it ranked fourth. In other words, when young people use loans for coin investments, the amounts tend to be large. Sim observed that this trend could further exacerbate financial instability and deteriorate asset soundness among the MZ Generation.

Sim explained this investment culture by stating, "As low interest rates and high inflation have persisted, the asset gap with older generations has become structurally entrenched, prompting attention to digital assets that offer relatively high returns." The spread of consumption and investment cultures such as 'Yeonggeul' (leveraged investing) has also contributed, with the MZ Generation viewing digital assets not merely as an investment vehicle but as a means of social mobility.

Sim further noted that increased investment in virtual assets could lead to an outflow of deposit funds, weakening banks' deposit bases and worsening their income structure. She also predicted that the expansion of stablecoins and digital wallets could reduce the market share of traditional banks' payment and settlement systems and diminish the necessity of bank infrastructure. Accordingly, she stated, "It is necessary to develop response strategies to enhance competitiveness in the digital financial environment by fostering a sound investment culture among the MZ Generation, supporting asset management, and strengthening financial security." Specifically, she suggested that financial education to promote healthy investment habits, as well as the development of attractive asset management services or customized products, are needed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)