Assets Up by 1.4 Trillion Won Through Acquisition of Foodist and Others

Fair Trade Commission Regulation and Third-Generation Leadership Put to the Test

Sajo Group, which has grown as a company centered on the fisheries industry, has entered the ranks of major conglomerates for the first time this year. By acquiring seven food manufacturing and distribution companies last year, its total assets surpassed 5 trillion won, and it was ranked 88th among business groups according to the Fair Trade Commission's announcement.

According to the Fair Trade Commission and other sources on May 7, Sajo Group recorded a total fair asset value of 5.257 trillion won across 40 affiliates as of the end of last year. The Fair Trade Commission designates companies with total assets of 5 trillion won or more as publicly notified business groups (large business groups) each year, subjecting them to disclosure obligations for internal transactions and regulations on private interests of controlling shareholders and their families.

Acquisition of Food Distribution Affiliates... Transformation into a Comprehensive Food Group

Sajo Group owns 33 food and distribution affiliates, including Sajo Industries, Sajo Daerim, Sajo Oyang, and Sajo Seafood, five financial affiliates including Pureun Mutual Savings Bank, and two leisure assets such as Castlelex Golf Course. The group began with Sajo Industries (then Sijeonsa), founded in 1971 by the late Chairman Joo Inyong. After entering the distant-water fishing industry in 1973, it is regarded as a company that led the domestic tuna fishing industry alongside Dongwon Industries. Sajo Group expanded its business into food processing, distribution, and livestock, taking its listing on the stock market in 1989 as an opportunity.

Last year, Sajo Group acquired seven food manufacturing and distribution companies in succession, including the food material distributor Foodist, the starch syrup manufacturer Sajo CPK, and the Winplus Mart group, increasing its assets by about 1.4 trillion won. As a result, the group’s total sales last year reached 5.443 trillion won, with a net profit of 119 billion won. Through these acquisitions, Sajo Group established a vertically integrated food business system, spanning from seafood harvesting and slaughtering (Sajo Industries) to processing (Sajo Daerim and Sajo Oyang) and distribution/catering (Foodist), laying the foundation for its leap from a "fisheries-centered company" to a "comprehensive food group."

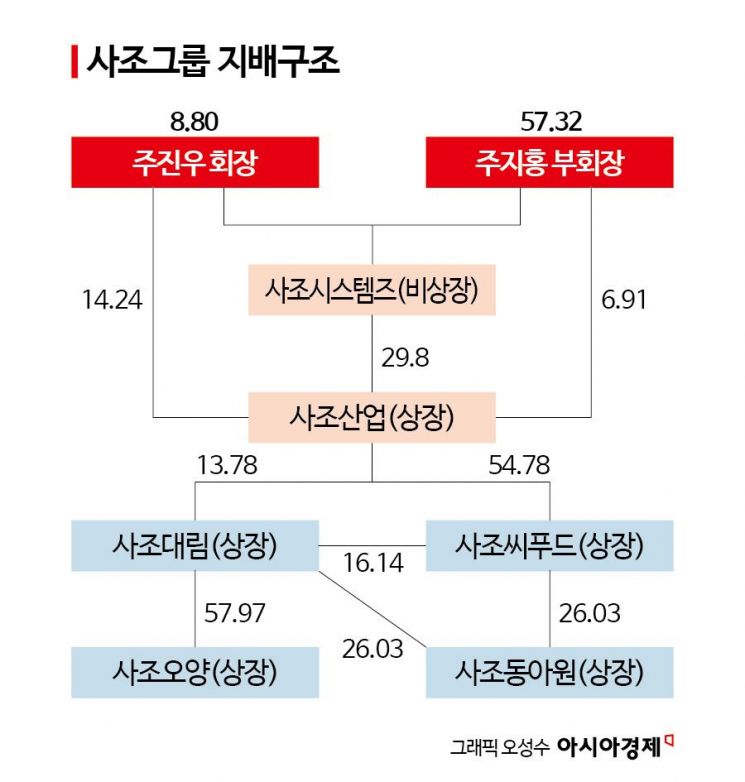

Along with external growth, the governance structure is transitioning to a "third-generation system." Joo Jihong, the eldest son of Chairman Joo Jinwoo and Vice Chairman of the group, is the largest shareholder of Sajo Systems, the group's de facto holding company, with a 57.3% stake. The unlisted Sajo Systems holds a 29.8% stake in the listed Sajo Industries. Sajo Industries serves as the parent company of major affiliates such as Sajo Seafood, Sajo Daerim, and Sajo Oyang. This structure is a classic pyramid-type vertical governance system, following the sequence: owner family → unlisted holding company → intermediate holding company → operating company.

Foodist and Sajo CPK, which were acquired last year, were also integrated into the group through Sajo Oyang and Sajo Daerim, respectively, and were naturally absorbed into the governance structure. Foodist operates catering and B2B distribution channels, while Sajo CPK produces starch syrup, a key ingredient in food processing, serving as a core supply chain within the group.

Pyramid-Type Governance Structure Raises Possibility of Fair Trade Commission Regulation

However, there are concerns that such a structure could pose potential risks, as the controlling family's influence is excessively concentrated. Sajo Seafood, Sajo Daerim, Sajo Oyang, and Foodist engage in internal transactions for raw material supply, contract processing, and distribution, and ultimately, the profit structure is linked to the unlisted Sajo Systems, in which the owner family holds shares.

Some observers have pointed out, "A structure in which the owner family holds controlling power and concentrates profits through internal transactions could lead to concerns about unfair business allocation."

If the Fair Trade Commission designates either Chairman Joo or Vice Chairman Joo as the same person (controlling shareholder), transactions between companies where the owner family holds more than 20% of the shares, such as Sajo Systems and its affiliates, will be subject to regulations on private interest appropriation, including prior disclosure, external board approval, and sanctions. The Fair Trade Commission has demanded that companies with similar structures reduce the proportion of internal transactions, expand disclosure of information on unlisted holding companies, and prevent private interests of controlling families.

Verification of the third-generation management’s performance and leadership remains a challenge. Vice Chairman Joo has increased his stake in Sajo Systems from 50.01% to 57.32% and has also raised his stake in Sajo Daerim to 3.6% through open-market purchases, thereby expanding his influence. However, the main affiliate, Sajo Industries, has posted operating losses for two consecutive years, recording an operating loss of 9.3 billion won last year. Sales have also remained stagnant, at 660 billion won in 2022, 632.4 billion won in 2023, and 635.2 billion won last year.

For this reason, Chairman Joo Jinwoo, who had stepped back from frontline management, returned this year as CEO of Sajo Industries. Industry sources analyzed, "With market confidence in Vice Chairman Joo's leadership remaining unstable, it is interpreted that Chairman Joo has directly stepped in to stabilize management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)