What about Hanwha and Shinsegae, where ownership changes were anticipated?

KFTC: "Kim Seungyun and Lee Myunghee retain effective control." Park Samkoo of Kumho Asiana excluded from head designation.

The 5 trillion won asset threshold unchanged for 16 years...

Number of regulated conglomerates doubles

Five newly designated groups...

Business expansion driven by external uncertainties such as Middle East conflicts and the US presidential election

This year, 92 conglomerates with total assets exceeding 5 trillion won have been designated. Defense, virtual assets, and shipping companies, which rapidly expanded their business due to intensifying geopolitical conflicts and rising exchange rates, newly entered the list of large business groups or rose in the rankings. Kim Seungyun maintained his status as the head (owner) of Hanwha Group, while Park Samkoo, chairman of Kumho Asiana, was excluded from the list of heads after selling Asiana Airlines amid management difficulties and being reclassified as a mid-sized company.

What about Hanwha and Shinsegae, where a change in ownership was expected? KFTC: "Kim Seungyun and Lee Myunghee retain effective control." Park Samkoo of Kumho Asiana excluded from head designation.

On May 1, the Korea Fair Trade Commission (KFTC) announced the "2025 Designation Status of Publicly Announced Business Groups and Heads (Owners)," which includes this information. The head (owner) is the person (or company) who has effective control and influence over a business group. The KFTC designates the head to regulate matters such as the controlling family's shareholdings in affiliates and potential private benefit transactions.

Dongkwan Kim, CEO of Hanwha Group, is attending the 'Economic Community New Year Meeting' held at the Korea Federation of Small and Medium Business in Yeouido, Seoul on the 2nd. Photo by Jinhyung Kang aymsdream@

Dongkwan Kim, CEO of Hanwha Group, is attending the 'Economic Community New Year Meeting' held at the Korea Federation of Small and Medium Business in Yeouido, Seoul on the 2nd. Photo by Jinhyung Kang aymsdream@

Except for newly designated business groups, the heads of existing groups remained unchanged in this year's announcement. Although some groups, such as Hanwha and Shinsegae, are undergoing processes that may transfer group control, the KFTC determined that the effective control of the current heads is still being maintained. Hanwha, which recently completed its succession process, did not apply for a change of head.

Um Jandi, director of the KFTC’s Business Group Management Division, explained, "Although Dongkwan Kim, vice chairman of Hanwha Group and eldest son, secured the largest shareholding and completed the succession process, we determined that Kim Seungyun still holds the highest internal and external position, so we did not designate a new head ex officio."

In the case of Shinsegae, the shares of Emart and Shinsegae are still mixed, and the separation of affiliates has not been completed, so the requirements were not fully met. Um said, "For some affiliates such as SSG.com, the shares are still mixed between the two groups, and Lee Myunghee continues to be active as the group chairperson, so we do not believe it is time to change the head designation yet."

Park Samkoo, chairman of Kumho Asiana, was excluded from the head designation after Kumho Asiana was removed from the list of large business groups in February due to a decrease in total assets. Bom Suk Kim, chairman of Coupang, has also been excluded from the head designation for five consecutive years. The KFTC explained that Coupang and Dunamu met all exception criteria, so there were no concerns about private benefit transactions, and both companies were designated as the heads of their respective business groups, as was the case last year.

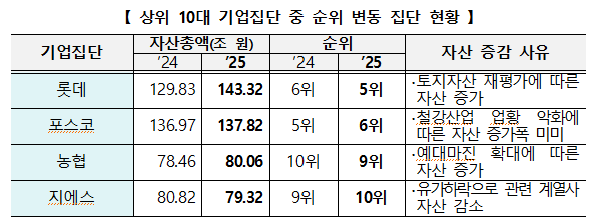

This year's announcement also brought changes to the business group rankings. Among the top 10 conglomerates, POSCO and Lotte swapped places. POSCO, which ranked fifth last year, dropped to sixth due to a downturn in the steel industry, while Lotte rose from sixth to fifth after an increase in assets resulting from a revaluation of land assets. GS fell from ninth to tenth place due to a downturn in the petrochemical industry, swapping places with Nonghyup (which rose from tenth to ninth) after Nonghyup's assets increased due to a widened loan-deposit margin.

Major mergers and acquisitions (M&A) also influenced ranking changes and new group designations. Hanjin Group saw its assets increase by 19.1 trillion won after Korean Air completed its merger with Asiana Airlines, bringing eight companies including Asiana Airlines into the group as affiliates. Korea & Company Group was upgraded to a mutual investment restriction group after Korea Tire & Technology acquired three auto parts manufacturers, including Hanon Systems, increasing its assets by 11.1 trillion won.

Sajo was newly designated as a publicly announced business group after Sajo Daerim and others acquired seven companies, including food manufacturer and distributor Sajo CPK and Foodist, increasing its assets by 1.4 trillion won.

The 5 trillion won asset criterion remains unchanged for 16 years... Number of regulated conglomerates doubles. Five newly designated groups... Business expansion driven by external uncertainties such as Middle East conflicts and the US presidential election

The number of conglomerates with assets of 5 trillion won or more (publicly announced business groups) increased by four to 92 compared to last year. Five groups?LIG, Daekwang, Sajo, Bithumb, and EUKOR Car Carriers?were newly designated. Since the regulatory threshold for conglomerates was fixed at 5 trillion won in 2009, the number of regulated groups has nearly doubled from 48 to 92 this year.

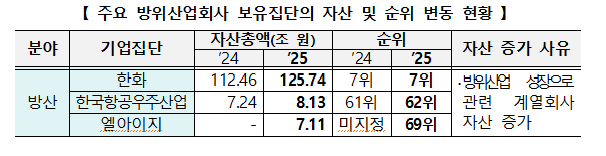

Amid growing external uncertainties, the defense, virtual asset, and shipping industries have grown rapidly, increasing both the number of business groups and total assets. Defense companies, such as Hanwha, Korea Aerospace Industries, and LIG, all saw asset growth due to intensified geopolitical conflicts and increased military spending worldwide. In particular, LIG’s assets increased by more than 2 trillion won, leading to its new designation as a publicly announced business group. As of the end of last year, Hanwha’s total assets stood at 125.741 trillion won, up 13.278 trillion won from 112.463 trillion won a year earlier.

At the end of last year, ahead of the US presidential election, increased trading of virtual assets led to a rise in customer deposits at exchanges, boosting the assets and rankings of virtual asset-focused groups Dunamu and Bithumb. Dunamu was upgraded to a mutual investment restriction group for the first time, while Bithumb was newly designated as a publicly announced business group.

HMM (rising from 19th to 17th) and Janggeum Merchant Marine (from 38th to 32nd) saw increased operating profits due to higher freight rates caused by Middle East conflicts, as well as asset gains from currency translation effects following a sharp rise in exchange rates, resulting in higher rankings. EUKOR Car Carriers, a group specializing in automobile transport, was newly designated as a publicly announced business group.

Due to the Financial Supervisory Service's reduction of the insurance liability discount rate, insurance contract liabilities increased (reducing capital), leading to a decrease in assets and a drop of more than five places in the rankings for insurance-focused groups DB, Kyobo Life Insurance, and Hyundai Marine & Fire Insurance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.