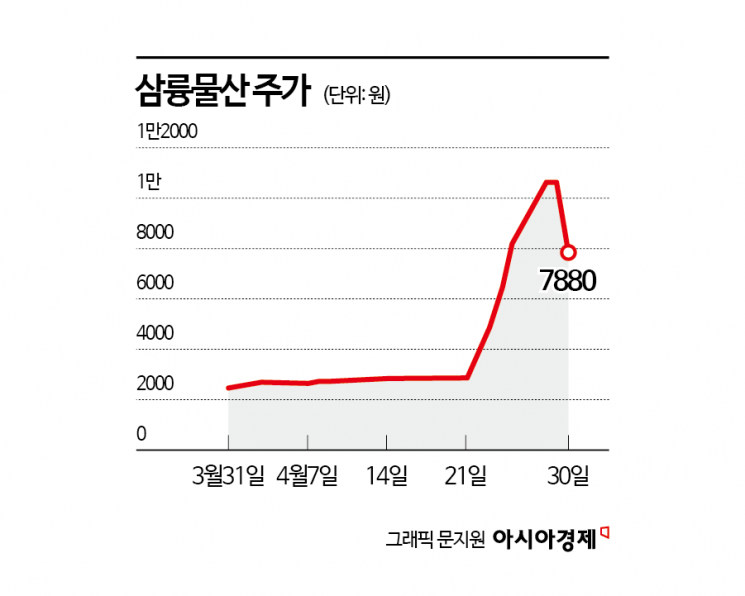

After the "Plastic Phase-Out Roadmap," five consecutive days of price ceiling

Share price soared vertically from 2,880 won to 10,660 won

On the 30th, share price surged to 13,590 won before plunging to 7,580 won

Samryungmulsan is facing the aftermath of a sharp surge after being labeled as a political theme stock.

According to the financial investment industry on May 2, the share price of Samryungmulsan soared to 13,590 won in early trading on April 30, before closing at 7,880 won. The intraday fluctuation between the high and low reached 44.3% in a single day.

Previously, on April 22, Lee Jaemyung, the presidential candidate of the Democratic Party of Korea, drew market attention to Samryungmulsan when he announced on 'Earth Day' that he would establish a national-level roadmap for phasing out plastic.

Samryungmulsan manufactures 'carton packs,' which are familiar as milk cartons. A carton pack refers to a paper-based container for liquid beverages. The carton pack market is closely linked to milk consumption. Its subsidiary, SR Technopack, produces plastic food containers such as aseptic rice containers and coffee drink cups, as well as functional films. SR Technopack independently developed and commercialized an oxygen barrier coating technology (GB-8). Products that use oxygen barrier coating film technology are easier to recycle. In the previous year, Samryungmulsan recorded consolidated sales of 9.4 billion won, operating profit of 5.8 billion won, and a net loss of 5.9 billion won.

As carton packs and oxygen barrier technology gained attention, Samryungmulsan's share price hit the upper price limit for five consecutive trading days from April 22 to April 28. The share price soared vertically by 270%, from 2,880 won to 10,660 won. The Korea Exchange suspended trading of Samryungmulsan shares for a day on April 29, citing a continued surge in the share price even after designating the stock as an investment warning issue. Trading resumed on April 30, and at one point in the morning, the share price climbed to 13,590 won, seemingly continuing its upward trend. However, at around 11:20 a.m., the share price reversed and plummeted to 7,570 won by 2:54 p.m. Trading volume that day reached 7.81 million shares. It appears that speculative funds seeking short-term gains drove up the share price early in the session, followed by a wave of sell orders for profit-taking, which led to the sharp decline. Individual investors were net buyers of 550 million won that day. The average unrealized loss rate for the day was -25.4%.

Before being mentioned as a political theme stock, Samryungmulsan's daily trading volume was mostly below 10,000 shares, indicating that trading was not active. Even during the upper limit rally, there was only one trading day with a volume exceeding 1 million shares. During the period when the market ignored the stock, Samryungmulsan's market capitalization remained in the 40 billion won range. Considering that the largest shareholder and related parties hold a 79.9% stake, the amount of shares in circulation is also low. When the stock first hit the upper price limit on April 22, the trading value was 2 billion won, equivalent to about 5% of the market capitalization.

An official from the financial investment industry explained, "It is not uncommon for listed companies with small market capitalization and low circulating shares to experience sharp rises after being associated with political themes," adding, "There is a concern that individual investors may incur losses if they engage in follow-up trading."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)