Declining Excess Liquidity and Increasing Demand Uncertainty

A Recent Structural Shift Requires Flexible Responses

Monetary Stabilization Bonds for Long-Term Management, RP Transactions for Situation-Based Response

Regular RP Purchases Enhance Predictability, Resolve Supply-Demand Imbalances and Stigma Effects

The Bank of Korea is working to institutionalize regular repurchase agreement (RP) purchases within this year. While excess liquidity in the market that needs to be absorbed through open market operations has recently decreased, the uncertainty surrounding demand fluctuations has actually increased. This has heightened the need for a more flexible response, prompting the central bank to regularize RP purchases alongside existing RP sales. Previously, RP sales were conducted regularly every Thursday, but RP purchases were carried out irregularly and only when deemed necessary.

Balancing Supply and Demand and Reducing Stigma Effects Through Regular RP Purchases

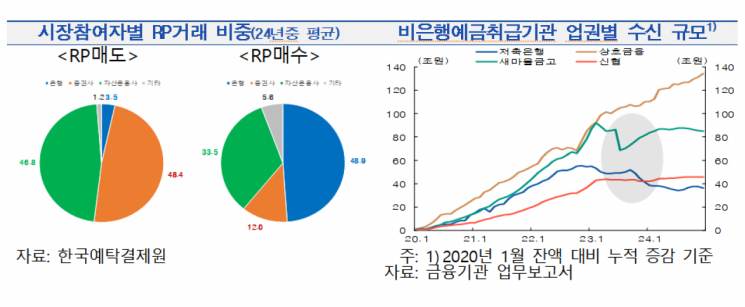

Kong Daehee, Director of the Open Market Operations Department at the Bank of Korea's Financial Markets Bureau, announced this at the policy symposium "Bank of Korea Open Market Operations: Past and Future," held on April 30 at the Bank of Korea annex in Jung-gu, Seoul. Kong stated, "Recently, the scale of excess liquidity in the market (base money, which is the sum of cash in circulation and required reserves) has decreased. At the same time, the expansion of the non-bank sector's share in the financial market has increased demand uncertainty, raising the likelihood of temporary imbalances in liquidity supply and demand." He emphasized, "The Bank of Korea's open market operations also need to shift from a sole focus on liquidity absorption to a balanced approach that combines both absorption and supply."

He explained that the majority of excess liquidity should be absorbed through Monetary Stabilization Bonds, which have longer maturities and thus longer-lasting policy effects, while RP transactions using short-term instruments can be used to swiftly absorb or supply liquidity depending on market conditions. To achieve this, regular RP purchases are needed to enhance predictability and allow for planned management of the required amounts. Kong said, "For example, if previously, out of an excess liquidity of 100, 80 was absorbed through Monetary Stabilization Bonds and 20 through RP sales, then in a situation where excess liquidity has decreased to 70, after absorbing 80 through Monetary Stabilization Bonds, it would be necessary to supply 10 in liquidity to the market via RP purchases." He added, "With the scale of Monetary Stabilization Bonds already reduced as much as possible, it is time to seek structural changes."

He explained that by conducting open market operations that combine RP purchases and sales?supplying liquidity to sectors facing shortages and absorbing it from sectors with surpluses?the smooth circulation of funds can be achieved, and supply-demand imbalances between sectors can be resolved. Regularizing liquidity supply through RP purchases is also expected to reduce the negative perception, or stigma effect, associated with obtaining funds from the central bank.

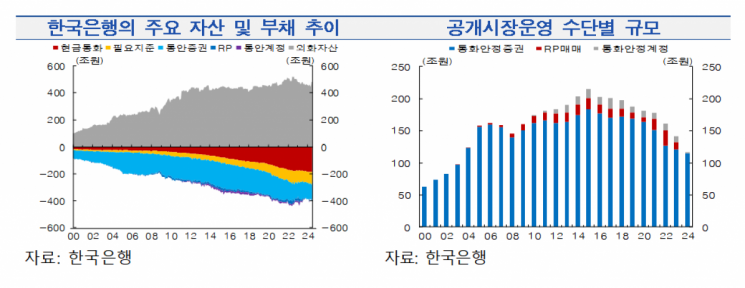

The most fundamental role of open market operations is to ensure that ultra-short-term market interest rates do not deviate significantly from the policy rate. The Bank of Korea employs a "corridor system" for monetary policy operations, establishing upper and lower bounds around the policy rate to guide short-term market rates within this range. When accumulating foreign reserves and stabilizing exchange rate volatility, excess liquidity can be created in the process. The Bank of Korea absorbs this excess using Monetary Stabilization Bonds, RP transactions, and Monetary Stabilization Accounts.

Kong dismissed concerns that injecting liquidity into the market could fuel inflation or drive up exchange rates. He explained, "As the number of players such as non-banks increases, imbalances occur when liquidity does not flow to where it is needed. The Bank of Korea aims to play a priming role by conducting regular operations only at the necessary level to maintain balance." He added, "When liquidity is released in one area, it is absorbed elsewhere to maintain balance; this is not about increasing the overall supply. While there may be some psychological effects, there is no technical mechanism by which this would stimulate inflation."

Various options are being considered for the maturities of regular RP purchases. Kong explained, "For purchases with maturities up to six days, the base rate will be applied as a fixed rate, while for maturities of seven days or longer, the base rate will serve as the minimum rate, with awards going to the highest rates first."

Declining Excess Liquidity and Rising Demand Uncertainty... Structural Changes Require New Responses

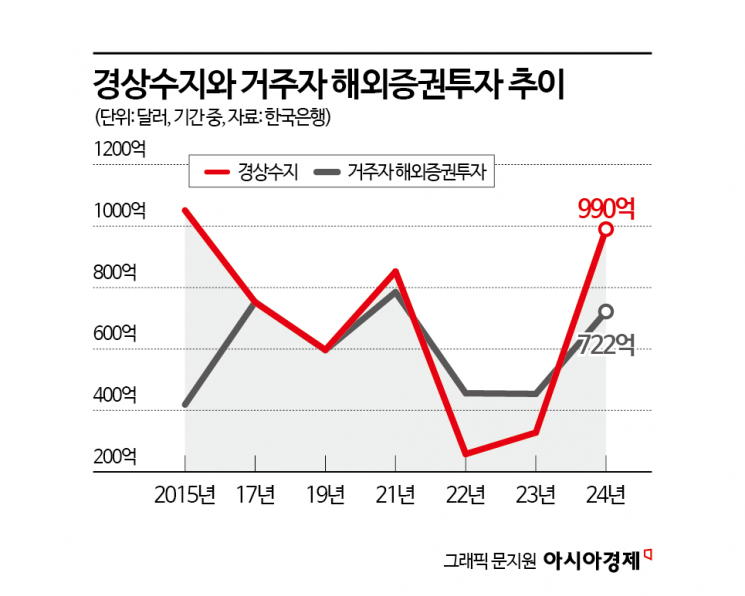

The reduction in excess liquidity in the market is attributed to several factors: a structural decrease in the current account surplus, a sharp increase in overseas securities investment by residents, and a decline in liquidity supply from abroad. In addition, foreign exchange swaps between the Bank of Korea and the National Pension Service, conducted to stabilize the foreign exchange market, have further reduced the supply of required reserves. Due to these structural changes, the outstanding balance of Monetary Stabilization Bonds?a key tool for absorbing liquidity?plummeted from 180.9 trillion won at the end of 2015 to 115.7 trillion won at the end of last year. The steady increase in base money demand, driven by economic growth and rising private sector demand for cash, has also contributed to the reduction in excess liquidity. The balance of cash held by the private sector, which stood at around 20 trillion won in the early 2000s, surged to 193 trillion won by the end of last year.

The growing share of non-bank deposit-taking institutions such as NongHyup and Saemaeul Geumgo, as well as insurance companies and securities firms, in the domestic financial market has increased the potential risks facing the financial system. Since 2010, total assets in the non-bank sector have grown by an average of 8.5% per year, accounting for 59.5% of the financial sector's total assets as of the end of 2023. As the influence of non-bank financial institutions on market liquidity and ultra-short-term rates increases, the potential for greater volatility in call rates has also risen. The expansion of deposits at non-bank deposit-taking institutions means that, in the event of large-scale withdrawals, the risk of a crisis spreading throughout the financial market has also grown.

The emergence of new payment methods and the advancement of digital finance have also heightened uncertainty in base money demand. New payment solutions such as credit cards and various "Pay" services, which replace cash, have increased the volatility of private sector money demand, making it more difficult to forecast required reserve demand. The establishment of internet-only banks and the spread of mobile-based, non-face-to-face financial transactions have also increased the risk of digital bank runs, where large-scale withdrawals could occur in a short period if confidence in financial institutions is undermined.

Meanwhile, Kong also noted the need to reassess the role and function of Monetary Stabilization Bonds, the main instrument for absorbing liquidity and the Bank of Korea's primary security-type liability. He explained that, in preparation for a possible continued increase in required reserve demand, it is necessary to proactively consider expanding additional liquidity supply tools. Kong said, "If we are faced with a situation where ongoing supply of required reserves is necessary, we could consider introducing a system similar to long-term RP purchases used by central banks in advanced economies." However, he added, "We are not currently reviewing the timing or details of such an introduction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.