Samsung Electronics Q1 Final Results

Smartphone Market Enters Off-Season

Improved 12-Layer HBM3E Products

Full-Scale Launch Expected from Q2

Attention on Nvidia Quality Validation

Turning Point Needed for Foundry Business

Interest in US Tariff Response Strategy

Record-High 9 Trillion Won R&D Investment in Q1

The Device Solutions (DS) division, responsible for Samsung Electronics' semiconductor business, recorded 1.1 trillion won in operating profit in the first quarter of this year, returning to the 1 trillion won range on a quarterly basis. Compared to the same period last year, when operating profit reached around 1.9 trillion won, profit has been halved. Analysts attribute this to a decline in high-bandwidth memory (HBM) sales, as well as underperformance in the System LSI and Foundry divisions, which affected overall profitability.

In particular, for HBM, shipments were delayed as the quality certification schedule of a major client, Nvidia, was postponed, and the proportion of high-value-added products did not increase as rapidly as expected. System LSI was unable to accelerate its performance recovery due to limited flagship system-on-chip (SoC) supply, and the Foundry division reportedly remained in the red, affected by a combination of sluggish mobile demand, inventory adjustments by clients, and low utilization rates. Although there were expectations for a rebound in memory prices, the extent of the recovery was limited due to a continued conservative approach, including a shift to profitability-focused strategies and adjustments to shipment timing. Despite growing demand for AI servers, the market points to Samsung Electronics' lagging HBM supply as a primary reason for its lackluster performance. Delays in product validation and securing stable mass production capabilities are cited as key factors for a future turnaround in results.

Solid performance, but Q2 will be more challenging

While the DS division struggled, the Mobile eXperience (MX) and Network Business Division supported overall results with 4.3 trillion won in operating profit, thanks to strong sales of the Galaxy S25.

However, it remains uncertain whether this trend will continue in the second quarter. As smartphones enter the off-season and there is still time before the next-generation product launch, many point out that the semiconductor division will need to drive performance improvement once again.

The recovery strategy centered on high-value-added memory, such as HBM, remains valid. Starting in the second quarter, Samsung Electronics plans to launch improved 12-layer HBM3E products in earnest and expand its supply chain to meet initial demand. In particular, the results of the qualification test for Nvidia's 8-layer HBM3E product are expected to be released at this time, so the timing of Samsung’s response could significantly impact its performance.

The Foundry business also needs a turning point. It is estimated that losses have continued so far, and Samsung Electronics is seeking improvement by stabilizing 2-nanometer process mass production and securing automotive demand. There are also reports that discussions are underway with Qualcomm regarding mobile chip production and with global automotive companies regarding automotive semiconductors.

Alongside Samsung Electronics' results, the industry's attention is focused on its strategy for responding to US tariffs. With production bases in 74 countries worldwide, Samsung Electronics is the most widely exposed to US tariff policies. In particular, Mexico (home appliances), Vietnam (smartphones), and China (semiconductors) are among the key countries mentioned by the Donald Trump administration as potentially subject to tariffs. Depending on the as-yet-undefined direction of 'semiconductor tariffs,' the impact on Samsung Electronics' overall business could be significant.

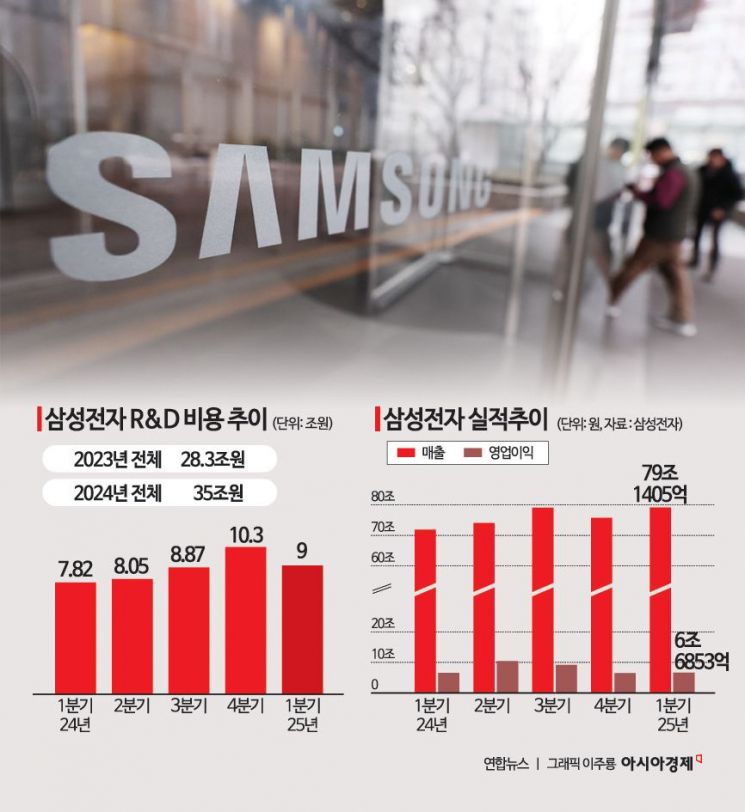

Relentless R&D investment... 9 trillion won in Q1 alone

Despite challenging external conditions, Samsung Electronics has not slowed its pace of research and development (R&D). In the first quarter of 2025 alone, the company invested 9 trillion won in R&D, marking the highest quarterly level ever. Except for the fourth quarter of last year (10.3 trillion won), this figure surpasses the usual quarterly investment range of 7 to 8 trillion won. There is also a strong possibility that annual R&D investment will once again reach a record high. Samsung Electronics' R&D investment has increased for eight consecutive years, reaching 28.3 trillion won in 2023 and 35 trillion won in 2024. This year, the company will also expand its R&D hubs, which serve as forward bases. The next-generation semiconductor R&D complex, completed in January at the Giheung Campus in Yongin, Gyeonggi Province, has begun full-scale operations. Industry observers expect that Samsung Electronics will seek to attract a joint research EUV (extreme ultraviolet) equipment development center with global semiconductor equipment company ASML.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)