Profitability Rebounds with Improved Cost Ratio

New Orders Reach KRW 1.5 Trillion... Major Urban Renewal Projects Lead

Debt Ratio at 102.8% and Net Cash at KRW 1 Trillion... Financial Stability Remains Solid

Despite the downturn in the real estate market and sluggish construction industry conditions, DL E&C succeeded in improving profitability and recovering its performance in the first quarter of this year.

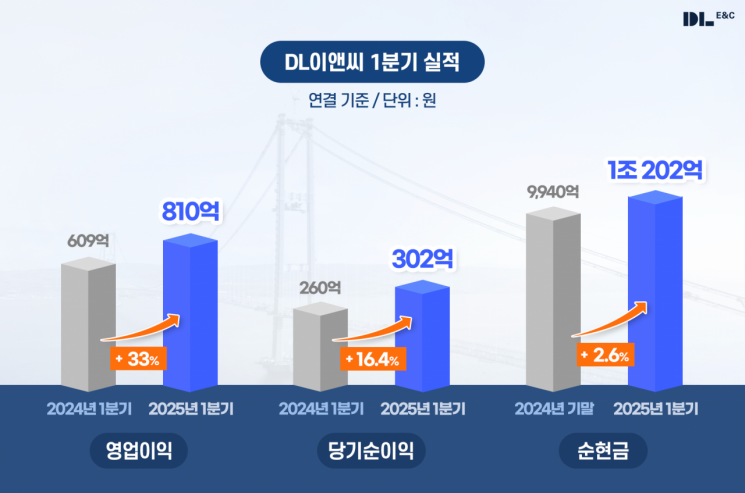

On April 29, DL E&C announced that its provisional consolidated results for the first quarter showed sales of KRW 1.8082 trillion and operating profit of KRW 81 billion. Compared to the same period last year, sales decreased by 4.36%, but operating profit increased by 33%. The operating margin also improved by 1.3 percentage points.

Profitability indicators showed a clear improvement. The consolidated cost ratio for the first quarter was 89.3%. Since the third quarter of last year, the company has maintained a cost ratio below 90% for three consecutive quarters. In particular, the cost ratio in the housing division dropped significantly from 93.0% in the same period last year to 90.7%, contributing to the overall recovery of profitability.

Robust order intake also continued. New orders in the first quarter amounted to KRW 1.5265 trillion. By business segment, housing recorded KRW 1.0463 trillion, civil engineering KRW 166 billion, plant KRW 103.2 billion, and the subsidiary DL Construction posted KRW 211 billion. The housing business segment led the order performance. Large-scale urban renewal projects stood out, including the redevelopment of Sujin 1 District in Seongnam (KRW 311.7 billion), Sillim 1 District redevelopment (KRW 288.5 billion), and Samsung 1 District redevelopment in Daejeon (KRW 217.3 billion).

DL E&C continues to maintain outstanding financial stability among major construction companies. As of the end of the first quarter, the debt ratio was 102.8%, and the dependency on borrowings was 11%. Cash and cash equivalents amounted to KRW 2.1263 trillion, and net cash stood at KRW 1.0202 trillion. The credit rating has remained at 'AA-' for six consecutive years.

A DL E&C official stated, "Despite challenging industry conditions, crisis response and efficient business management drove the improvement in performance," adding, "We will further accelerate our upward performance trend by continuing to win new orders centered on high-quality projects with secured profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)