[Construction Company Risk Check] ①

Sharp Increase in Accounts Receivable, Higher Risk of Non-Collection... Intensifying 'Cash Drought'

PF Default Risks Remain... Regional Construction Firm Bankruptcies Show Signs of Spreading to Large Companies

"Greater Possibility of Credit Rating Downgrades and Full-Scale Restructuring," Credit Rating Agencies Warn

Once again this year, concerns about an "April crisis" in the construction industry were raised, but most analysts agree that the sector has managed to avoid immediate trouble. However, warnings about financial risks continue to persist. Recently, Korea’s leading credit rating agencies, NICE Investors Service and Korea Ratings, have both released reports diagnosing that "profitability deterioration and liquidity pressures are continuing across the construction sector." While short-term risks have been avoided, there is a growing possibility that mid- to long-term restructuring and credit rating downgrades will become more pronounced. Analysts point out that fundamental weaknesses?such as the accumulation of unsold housing, the burden of project financing (PF) contingent liabilities, and the increase in accounts receivable?are deepening structurally.

Sharp Increase in Accounts Receivable, Higher Risk of Non-Collection... Intensifying 'Cash Drought'

Recently, NICE Investors Service issued a report titled "Continued Weak Profitability and Poor Cash Flow Amid Real Estate Polarization," warning that credit risk in the construction sector is rising due to declining profitability and PF burdens. The report stated, "Last year, the major construction companies saw a decline in sales compared to the previous year, and operating profitability continued to fall." It added, "The sharp increase in construction costs in 2021 and 2022 is still being reflected in ongoing projects, and with additional costs now emerging in the non-residential sector, the ability to generate profits has weakened."

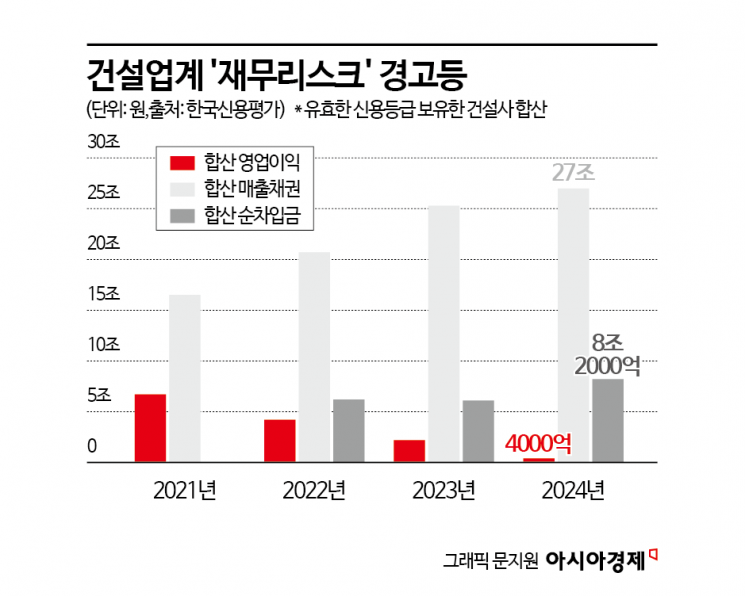

The report on the construction industry released by Korea Ratings on April 28 expressed concern about liquidity risks stemming from the potential default of accounts receivable. Accounts receivable refers to the amount owed by clients for completed work that has not yet been paid. The total accounts receivable for construction companies with valid credit ratings reached 27 trillion won last year, a 64% increase from 16.5 trillion won in 2021. In particular, accounts receivable at risk of non-collection amount to between 5.1 trillion and 8.8 trillion won. Korea Ratings warned that even if only half of these are recognized as losses, the average debt ratio of the construction sector could surge from 123% to 138%.

Construction companies are struggling with a "cash drought" as both unsold units and unpaid construction receivables have increased. As their ability to generate cash weakens, borrowings are rising every year. The combined net borrowings of construction companies soared from zero in 2021 to 6.2 trillion won in 2022 and 8.2 trillion won last year. In contrast, combined operating profit plummeted from 6.7 trillion won in 2021 to 400 billion won last year (1.6 trillion won excluding Hyundai Engineering & Construction). The main reason for the decline in profitability is the accumulation of unsold housing. The number of unsold apartments after completion has exceeded 25,000 units, marking a 20-month consecutive increase.

Liquidity Concerns Spreading from Mid-Sized to Large Construction Firms

The risks associated with PF remain latent. Although bridge loans have decreased due to financial regulatory measures, the balance of principal PF guarantees remains high. NICE Investors Service analyzed that "the ratio of PF contingent liabilities to capital for major construction companies rose from 71.2% in 2022 to 76.1% in 2024." As unsold units at regionally focused projects persist, the risk of PF defaults is growing especially among small and mid-sized construction firms. In fact, of the 26 general contractors that defaulted (based on dishonored bills) between 2022 and 2024, 25 were based in regional areas.

Liquidity concerns, which had previously been centered on regional construction firms, are now spreading to large companies. Korea Ratings analyzed, "The credit risk of regional construction firms is gradually spreading to leading nationwide construction companies," and added, "Financial risks due to liquidity burdens are increasing." In fact, large construction firms have recently been overcoming liquidity risks through asset sales, divestment of subsidiaries, and direct or indirect support from their parent groups. NICE Investors Service stated, "With the construction market downturn expected to continue, credit ratings will increasingly diverge based on each company's ability to secure liquidity." The agency also warned, "For construction companies with a high proportion of regional projects at risk of unsold units, financial burdens may increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.