Analysis of Factors and Spillover Effects of Covered Interest Parity Deviation in Korea

Understanding the Interplay Between Supply and Demand in the Dollar Funding Market

CIPD Fluctuations: Impact on FX and Bond Markets Through Market Linkages

"In the domestic dollar funding market, the deviation from covered interest parity (CIPD) is often simply explained as a 'factor for foreign arbitrage.' However, for a more thorough understanding of CIPD, it is necessary to consider not only the supply side (foreign investors) within the dollar funding market, but also the demand side (residents). Only by assuming the complex interplay between supply and demand, as well as the connections with related derivative markets, can we explain situations where dollar liquidity is ample but the won-dollar exchange rate rises."

Kim Jihyun, head of the International Finance Research Team at the Bank of Korea's International Department, emphasized this point on April 29 in the BOK Issue Note titled "Analysis of the Factors and Spillover Effects of Covered Interest Parity Deviation in Korea."

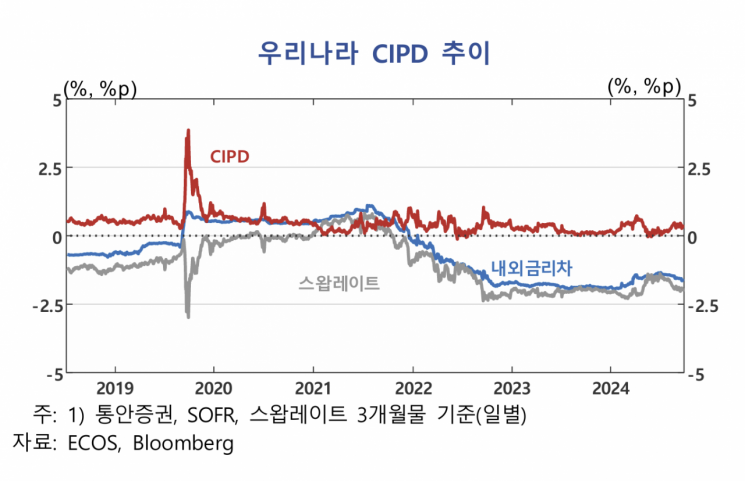

CIPD refers to the gap between the dollar funding rate in the spot market and the dollar funding rate obtained through derivatives. It is a type of additional interest rate that won-based investors must pay to borrow dollars in the foreign exchange derivatives market by providing won as collateral. Global banks supply dollars obtained in the repo market, using dollar-denominated assets such as US Treasury bonds as collateral, through FX swap transactions, and invest the received won in won-denominated bonds and other assets. In this process, dollar suppliers earn the CIPD?the difference between the dollar funding rate via derivatives and the spot market rate?while dollar demanders pay an additional interest rate equivalent to the CIPD. Thus, CIPD serves both as an arbitrage factor for foreign investors and as an additional interest rate for residents. From 2019 to 2024, CIPD averaged 46 to 47 basis points, and recently has been around 40 basis points.

Therefore, CIPD can be seen as a price variable within the dollar funding market, determined by the interaction between demanders?won-based investors willing to bear the cost at the level of CIPD to obtain dollars in the derivatives market?and suppliers?those willing to supply dollars to gain the same level of benefit.

Kim explained that after decomposing CIPD into demand factors (residents) and supply factors (foreign investors) and calculating their respective contributions, the fluctuations in Korea's CIPD were found to result from the combined effects of both sides. Between 2019 and 2024, periods in which CIPD fluctuations were mainly driven by foreign investors accounted for 61%, while periods driven by residents accounted for 39%. This is approximately a 6-to-4 ratio.

Kim analyzed, "CIPD fluctuations spill over into the spot FX market and the bond market, affecting different economic agents in different ways. In particular, net offshore NDF purchases lead to spot FX purchases and dollar funding by the counterparty, which is the foreign bank branch, causing CIPD to fall and the won-dollar exchange rate to rise." An increase in dollar funding demand or a decrease in supply?both of which raise CIPD?were found to increase foreign investors' investment in won-denominated bonds and decrease residents' investment in overseas bonds, respectively.

This analysis was conducted by reclassifying the derivative transaction data between the Korean won and US dollar from foreign exchange banks according to the counterparty, thereby constructing panel data on dollar funding demand and supply for each participant. Residents were divided into ten categories, including domestic banks, foreign bank branches, insurance companies, securities firms, asset management companies, and corporations. Foreign investors were classified into two groups based on whether the traded product was settled by netting the difference. Using this, the study established and estimated a supply-demand model for each participant in the dollar funding market and decomposed CIPD fluctuations by participant factor. The model-based decomposition of CIPD fluctuations was then used to analyze the interconnections between the foreign currency funding market, the spot FX market, and the bond market.

Kim stated, "Given that Korea's foreign exchange and financial markets are closely interconnected through instruments such as foreign exchange derivatives, it is essential to analyze the underlying causes in order to thoroughly understand the spillover effects of CIPD fluctuations. For this, rather than a fragmented approach to individual markets, comprehensive analysis utilizing micro-level data from financial institutions and considering inter-market linkages is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)