Political Theme Stocks Surge: Sangji Construction, Samryung Materials, and 4by4 Soar

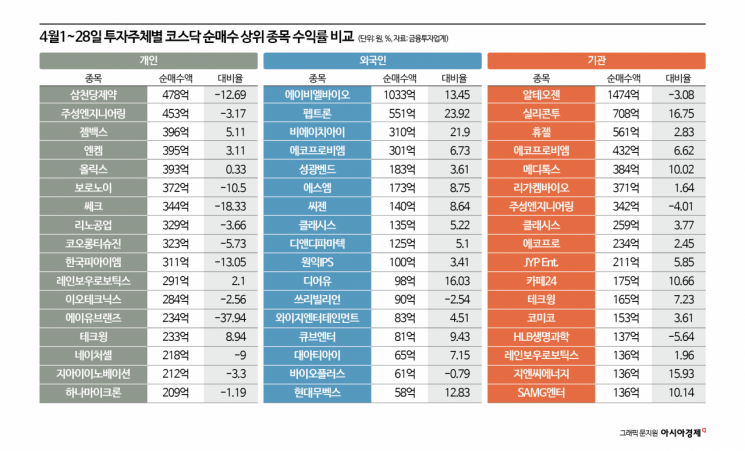

Most Top Individual Net Purchases in April End in Losses

Foreign and Institutional Investors Fill Portfolios with Winning Stocks

This month, political theme stocks such as Sangji Construction, Samryung Materials, and 4by4 have surged sharply. Some stocks have even soared tenfold in a short period, but individual investors have not seen impressive returns. Stocks bought by foreign and institutional investors have continued to rise, while the companies chosen by individual investors have struggled to perform.

According to the financial investment industry on April 29, individual investors recorded a cumulative net purchase of 624 billion KRW in the KOSDAQ market from April 1 to April 28. The top ten stocks in individual investors' portfolios by net purchases were Samchundang Pharm, Jusung Engineering, GemVax, Enchem, Olix, Boronoi, Sec, Lino Industrial, Kolon TissueGene, and Korea P.I.M. Among these, only three companies-GemVax, Enchem, and Olix-are currently showing valuation gains for individual investors.

Individuals purchased 47.8 billion KRW worth of Samchundang Pharm. Despite this net buying, the stock price of Samchundang Pharm has fallen 17.8% since the beginning of the month. The average valuation loss rate for individuals stands at -12.7%, reflecting poor performance. Investments in Boronoi, Sec, and Korea P.I.M. have resulted in double-digit losses, with valuation loss rates of -10.5%, -18.3%, and -13.1%, respectively.

Although not among the top ten net purchases, individual investors who bought AU Brands, Bridge Biotherapeutics, or Orum Therapeutics have suffered losses exceeding -30%. Hyungji Global, considered a political theme stock, has a valuation loss rate of -43.7%. This month, individuals have accumulated net purchases of 12.9 billion KRW in Hyungji Global. Many individual investors saw more than 40% of their principal disappear in less than a month after investing in Hyungji Global.

In contrast to individuals, foreign and institutional investors have posted strong investment results this month. The top three stocks by foreign net purchases are ABL Bio, Peptron, and BH. Their valuation returns reached 13.5%, 23.9%, and 21.9%, respectively. All of the top ten stocks by foreign net purchases, including Ecopro BM, Sung Kwang Bend, and SM, are maintaining positive valuation returns.

Institutions have also achieved valuation gains in eight out of their top ten holdings. Their investment in Silicon Two yielded a 16.8% return, while their investment in Medytox produced a valuation return exceeding 10%.

Some in the financial investment industry believe that the relatively large gap in returns between individuals and foreign/institutional investors this month is related to the sharp rise in political theme stocks. Samryung Materials' stock price surged 270% in just five trading days from April 22. The price, which had been below 3,000 KRW, broke through the 10,000 KRW mark. Sangji Construction's stock price soared 1,176% by April 17. The continued appearance of rapidly rising stocks seems to be fueling speculative sentiment.

An industry official commented, "After Sangji Construction, 4by4 and Samryung Materials also showed sharp increases. It appears that individual investors focused on relatively volatile stocks, which contributed to the low average returns for individuals in April."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)