Acquisition of Treasury Shares Increases, but Cancellation Plans Remain Passive

Misused as a Means to Strengthen Control of Holding Companies

Lee Jaemyung, the presidential candidate of the Democratic Party of Korea, has drawn significant attention from the market by mentioning the institutionalization of treasury share cancellation as a measure to revitalize the stock market. There is growing support for the argument that making the cancellation of treasury shares mandatory, which has been reduced to a means for strengthening the control of major shareholders, is the best way to maximize shareholder return.

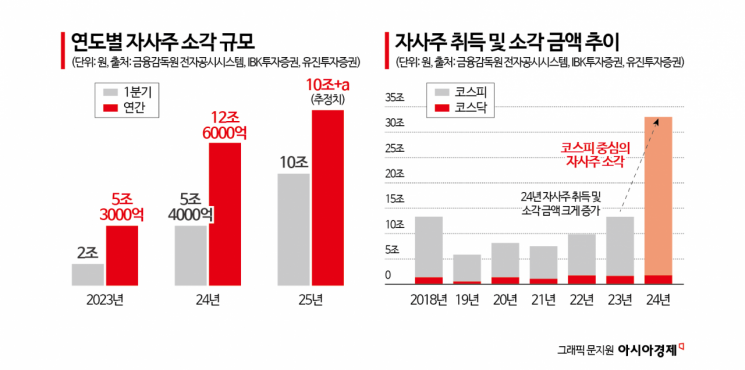

According to the financial investment industry on April 29, there were 93 disclosures of decisions to acquire treasury shares (excluding trust contracts) announced so far this year, representing an increase of about 34% compared to the same period last year. The volume of treasury shares cancelled in the first quarter also rose by 86% year-on-year, reaching 10 trillion won. However, among the 94 companies that stated they hold treasury shares for shareholder return purposes during the same period, more than half (about 60 companies) did not disclose specific plans for cancellation or disposal.

Previously, the Financial Services Commission revised the Enforcement Decree of the Capital Markets and Financial Investment Services Act, requiring from this year that companies holding more than 5% of their shares as treasury shares must disclose their future plans for cancellation or disposal. In addition, the allocation of new shares for treasury shares was prohibited in the event of a spin-off or merger. The purpose is not only to reduce the number of shares in circulation to improve earnings per share (EPS) and support the stock price, but also to curb the so-called 'treasury share magic,' in which an existing company holding treasury shares secures control over a newly established company without any capital contribution.

However, a significant number of companies subject to these new disclosure obligations have failed to present concrete cancellation plans, instead providing only general responses such as "we may review and implement this in the future." This has led to growing criticism. Major holding companies such as SK, which held 24.8% of its common shares as treasury shares at the end of last year, as well as Lotte Holdings, Hanwha, and CJ, are also only at the stage of reviewing cancellation plans.

Kim Junseok, Senior Research Fellow at the Korea Capital Market Institute, pointed out, "Only 2.3% of listed companies actually cancel treasury shares to use them as a means of returning value to shareholders, in line with the economic essence of treasury shares. In contrast, it is common to find cases where treasury shares are sold to friendly shareholders during management disputes to defend the controlling shareholder's position."

Lee Sangheon, a researcher at iM Securities, criticized, "Despite improvements to the treasury share system, companies are making uniform disclosures based on perfunctory board reviews and approvals, which goes against the intended purpose. This demonstrates that treasury shares are being used as a tool to strengthen the control of major shareholders." He argued that listed companies, taking advantage of the fact that treasury shares have restricted voting rights, are buying back treasury shares to reduce the number of voting shares in the market and thereby solidify their control.

The market is welcoming Lee's proposal for the principle of mandatory cancellation of listed companies' treasury shares. Lee Sangheon predicted, "As the issue of mandatory treasury share cancellation becomes a focal point in this presidential election, shareholder demands for cancellation will increase, and listed companies with high treasury share holdings will feel pressured to respond."

Kim Junseok emphasized, "If the contradictory situation of recognizing treasury shares as assets is left unaddressed, controlling shareholders will continue to have incentives to use treasury shares at their discretion, and controversies surrounding treasury shares will inevitably persist. Acquisition of treasury shares should mean their cancellation, which not only aligns with economic substance but also reduces the risk of abuse by controlling shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)