"Even a Slight Change in Food, Our Cat Notices Right Away"

Royal Canin Korea Achieves Overwhelming Market Dominance

Sales Triple and Net Profit Grows Sixfold in Five Years

Strong Brand Loyalty Enables February Price Hike

"Even if we mix just a little bit of the new food, our cat detects it instantly."

Choi Junho and his spouse, who live with their 9-year-old cat, recently tried to switch their cat's food but failed. As their cat entered old age, vomiting became more frequent, so they attempted to feed it functional food designed for such issues. However, the cat refused to eat even a single bite, causing them considerable trouble. Choi explained, "The veterinarian said there was no particular illness, but rather a decline in digestive function due to aging, and recommended functional food." He added, "As our cat got older, the costs kept increasing, so we tried to replace part of the food with a slightly cheaper domestic brand, but our cat simply refused to eat it." He continued, "When we switched to a similar functional food from the Royal Canin brand, our cat ate it as if nothing had happened, resolving the issue. However, in the process, we ended up wasting two to three times the cost on food that our cat wouldn't even touch."

Global pet food company Royal Canin is experiencing rapid growth in the Korean market. As the economy improves and demographic changes accelerate the annual growth of the pet industry, Royal Canin, having entered the domestic market early, has adapted local pets' tastes to its products. Through aggressive sales strategies, Royal Canin Korea secured initial demand and has not hesitated to raise prices.

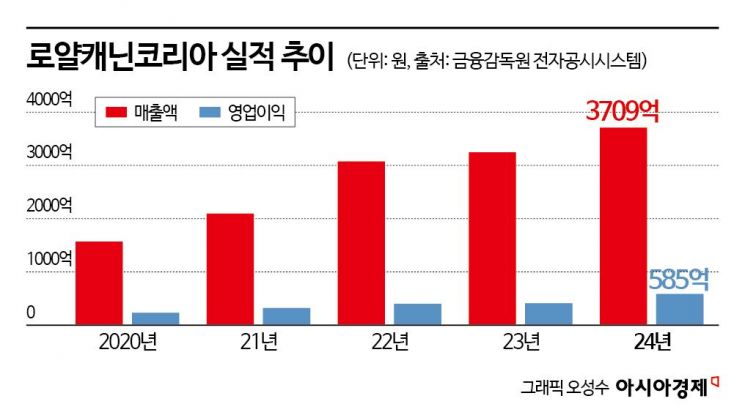

According to the Financial Supervisory Service’s electronic disclosure system on the 29th, Royal Canin Korea, the Korean subsidiary of the France-based Royal Canin, posted sales of 370.9 billion won last year, a 14.3% increase from 324.4 billion won the previous year. The improvement in profitability was even greater. Operating profit reached 58.5 billion won, up 43.0% from 40.9 billion won the previous year, and the operating margin was a high 15.8% thanks to strong profitability.

Royal Canin Korea holds an overwhelming No. 1 position in both the dog and cat food markets in Korea. Based on the rapid increase in the domestic pet population, the company has more than tripled its sales in five years, from 115.4 billion won in 2019 to last year's 370.9 billion won. Over the same period, net profit surged nearly sixfold, from 9.1 billion won to 53.9 billion won. As a result, the amount of money transferred overseas has also increased. Royal Canin Korea currently has a contract to pay 9% of its domestic sales as royalties to its global headquarters, Royal Canin S.A.S, which owns 100% of its shares. Due to this agreement, royalty payments rose from 5.1 billion won in 2019 to 17.7 billion won last year.

Royal Canin, founded in 1968 by French clinical veterinarian Jean Cathary, is a leading global pet food company. The foundation of Royal Canin Korea’s dominant performance lies in the brand’s high awareness and trust. Additionally, compared to other imported brands, Royal Canin offers relatively reasonable prices, which is another reason why many pet owners choose the brand.

In particular, the company has recently strengthened its focus on veterinary channels, solidifying its image as "the food recommended by veterinarians." Building on this, Royal Canin is expanding sales of its prescription line as a nutritionally specialized brand.

The characteristic of pets being resistant to changes in their food is also a key factor behind Royal Canin’s strong market dominance. Most pets perceive familiarity as safety, so those accustomed to the taste and smell of a specific product from a young age are highly likely to refuse any food other than what they are already familiar with. In reality, even if pet owners try to switch food based on price, nutrition, or other factors, if their pets refuse to eat, there is no option but to return to the original product.

Royal Canin’s solid market position, built over a long period based on high pet preference, has given the company confidence to raise prices. In February, Royal Canin Korea increased the average price of some products, including regular and prescription food, by 4.8%. The company explained that the price hike was due to sustained increases in overall costs, including raw materials, packaging, transportation, and production, driven by inflation and supply chain instability caused by rapidly changing global conditions.

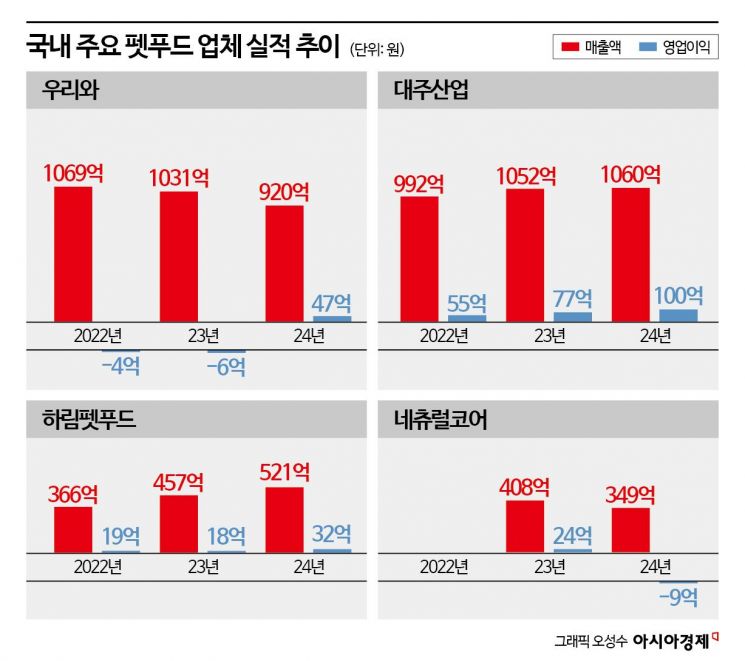

Major domestic companies are also expanding in the growing pet industry, but they continue to lag behind. Wooriwa, which sells brands such as "ANF" and "Welz," turned a profit last year with an operating profit of 4.7 billion won, but sales fell by 10.8% to 92.0 billion won from 103.1 billion won the previous year. During the same period, Natural Core’s sales dropped by 14.5% to 34.5 billion won. In contrast, Harim Pet Food saw sales increase by 14.0% year-on-year, surpassing 50.0 billion won for the first time. Daejoo Industries, which manufactures and sells both pet food brands like "Catsrang" and "Dograng" as well as livestock feed, performed well with operating profit exceeding 10.0 billion won.

As the number of single-person households increases and demographic changes such as aging and low birth rates accelerate, the population raising pets is growing both in Korea and worldwide. As a result, demand for related products and services is rising rapidly, fueling expectations for further industry growth. According to market research firm Global Market Insights, the global pet food market is expected to reach $143.7 billion (about 207 trillion won) this year and grow to $224.6 billion (about 324 trillion won) by 2032.

At the government level, there is a strong commitment to fostering the pet industry as a new growth engine. The Ministry of Agriculture, Food and Rural Affairs has established a dedicated team for the pet industry and animal healthcare and announced a series of policies to nurture related industries. Starting next year, the government will implement "pet food labeling standards" under the Feed Management Act, referencing nutrition standards developed by the Rural Development Administration. The pet food labeling standards are a core policy in the pet food sector, one of the four major industries (pet food, pet healthcare, pet services, and pet tech) that the government is focusing on to promote the pet-related industry.

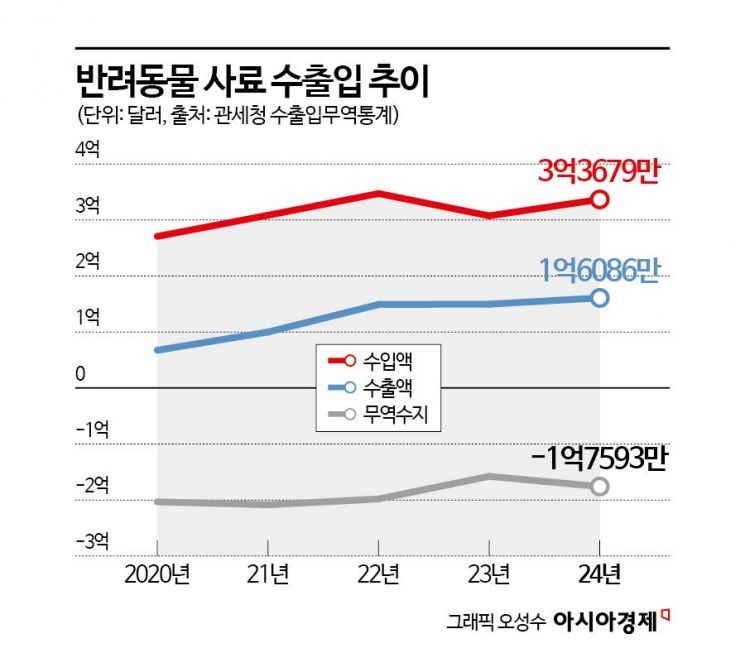

Earlier this month, Kwon Jaehan, head of the Rural Development Administration, visited Wooriwa and stated, "The pet food nutrition standards provide guidelines for the minimum recommended levels of essential nutrients necessary for pets to maintain a healthy life and normal physiological condition." He emphasized, "Setting pet food nutrition standards will support policies and systems, strengthen the overall competitiveness of the feed industry, and is expected to have a positive impact on pet food exports as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.