All Four Major Financial Holding Companies See CET1 Ratio Improve in Q1

Efficient Capital Management Drives CET1 Increase

Shareholder Return Policies Expected to Strengthen This Year

Major financial holding companies have not only reported surprise earnings in the first quarter of this year, but have also succeeded in improving their capital soundness. Despite sluggish economic conditions, efficient asset management has led to improvements in banks' soundness indicators, fueling expectations that these institutions will continue their aggressive shareholder return policies throughout the year.

All Four Major Financial Holding Companies Improve CET1 Ratio in Q1

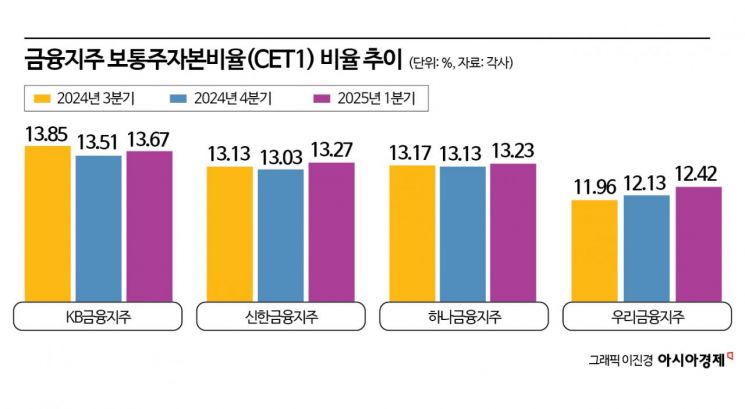

According to the financial sector on April 28, KB Financial Group's Common Equity Tier 1 (CET1) ratio for the first quarter of this year stood at 13.67%, up 0.16 percentage points from the previous quarter. The sharp increase in net profit for the first quarter, which surged 62.9% year-on-year to 1.6973 trillion won, contributed to the improvement in CET1.

CET1, a key indicator of a bank's financial soundness, is calculated by dividing common equity by risk-weighted assets (RWA). The Bank for International Settlements (BIS) recommends maintaining a ratio of at least 8%, but South Korean financial authorities and financial holding companies set a more stable target of 13% or higher. Capital exceeding the 13% CET1 target can be used for more active shareholder returns, such as share buybacks, cancellations, and dividends.

KB Financial's CET1 is the highest among domestic financial holding companies. The continued high CET1 level is attributed to growth in banking profits during the first quarter, strong performance from insurance subsidiaries, and stable RWA management. A KB Financial official explained, "Thanks to improved first-quarter results, efficient capital allocation, and stable RWA management, we have succeeded in maintaining the industry's highest level of capital adequacy."

Shinhan Financial Group also announced an improved CET1 ratio along with record-high first-quarter profits. Shinhan Financial's net profit for the first quarter was 1.4883 trillion won, up 12.6% year-on-year and marking the highest first-quarter result in its history. The first-quarter CET1 ratio was 13.27%, an improvement of 0.24 percentage points from the previous quarter. A Shinhan Financial official stated, "Despite an increase in the amount of share buybacks compared to last year, well-managed RWA and stable net profit have led to a higher CET1 ratio compared to the end of last year," adding, "We are also raising our CET1 management target from 13.0% to 13.1%."

Hana Financial Group's CET1 ratio for the first quarter also rose by 0.10 percentage points from the previous quarter to 13.23%. With net profit for the first quarter reaching 1.1277 trillion won, up 9.1% year-on-year and the highest ever for a first quarter, CET1 also improved. A Hana Financial official said, "We are stably managing the common equity tier 1 ratio, which forms the basis for shareholder returns, within the target range of 13.0% to 13.5%."

Woori Financial Group's CET1 ratio for the first quarter was 12.42%, up 0.29 percentage points from the previous quarter. However, net profit decreased by 2.084 trillion won (25.2%) from 824 billion won in the first quarter of last year to 615.6 billion won in the first quarter of this year. Due to spending approximately 169 billion won on voluntary retirement expenses in the first quarter, Woori Financial was the only one among the four major financial holding companies to see a decline in earnings.

Shareholder Return Policies Expected to Strengthen This Year

As CET1 ratios improved, shareholder return policies were also strengthened. On April 24, KB Financial announced a 300 billion won share buyback and cancellation alongside its earnings release, signaling an expansion in shareholder returns. This is considered a faster-than-expected share buyback and cancellation policy by the market.

A KB Financial official emphasized, "Although we decided to execute part of the funds earmarked for share buybacks in the second half during the first half, the amount for shareholder returns in the second half will not be insufficient." Kim Jae-woo, a researcher at Samsung Securities, predicted, "KB Financial is leading the industry in shareholder returns, based on differentiated earnings improvement and capital ratios," adding, "The annual shareholder return rate this year could reach around 48%, even higher than the previously expected 45%."

Shinhan Financial plans to raise its shareholder return rate from 40.2% last year to at least 42% this year. The first-quarter dividend was also increased by 5.6% year-on-year to 570 won. Hana Financial resolved to pay a cash dividend of 906 won per share for the first quarter, a 51% increase from the same period last year. Hana Financial also announced that it would complete its previously announced 400 billion won share buyback program early in the first half and gradually increase per-share dividends. Woori Financial also announced a first-quarter dividend of 200 won, up 11% from the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)