NH Investment & Securities Portfolio Analysis for High-Net-Worth Individuals with Over 3 Billion Won

Domestic Stock Holdings Up 17.6% from Last Year-End

Gold Assets Also Rise by 19.0%

Foreign Stock Holdings Down 30.7%

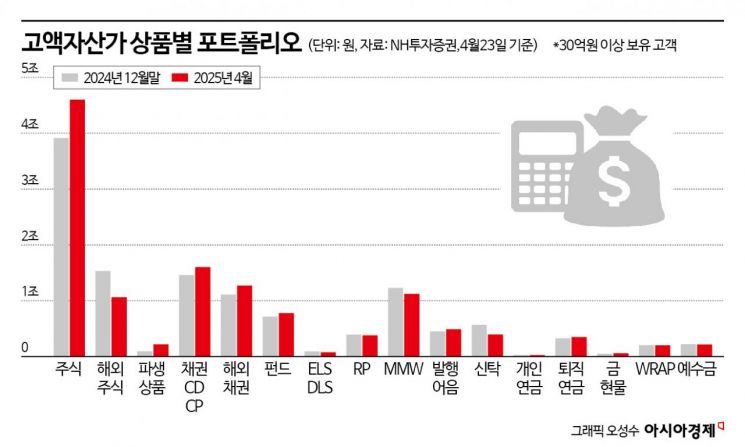

Since the beginning of this year, as tariff risks have increased market volatility, high-net-worth individuals have increased their investments in domestic stocks while reducing their holdings in foreign stocks. This shift is attributed to the relatively stronger performance of the domestic stock market compared to last year. Additionally, as gold prices continued to soar, these investors significantly increased their gold assets.

According to an analysis conducted by Asia Economy on April 28, based on data provided by NH Investment & Securities, the portfolio composition of high-net-worth individuals with assets exceeding 3 billion won showed that their domestic stock holdings (excluding major shareholder stakes) reached 4.6012 trillion won as of April 23. This represents a 17.6% increase compared to the end of last year. In contrast, their foreign stock holdings decreased by 30.7% this year to 1.0612 trillion won.

This trend is seen as a result of the domestic stock market outperforming the US stock market this year. The KOSPI has risen by more than 6% since the beginning of the year. Although it experienced a sharp drop earlier this month due to concerns over the US-China trade war, it has since fully recovered those losses. By contrast, the S&P 500 has fallen by more than 6% this year. While the US stock market showed overwhelming strength among global markets last year, it has been sluggish so far this year. Yoo Seungmin, a researcher at Samsung Securities, commented, "The US stock market is attempting a technical rebound due to President Donald Trump's tariff postponement and excessive declines, but the possibility of a sustained rally remains low. If the tariff negotiations are delayed, there is a latent risk of a second shock to the stock market."

Although investments in foreign stocks have been reduced, investments in foreign bonds have increased, driven by expectations of US interest rate cuts. Foreign bond holdings reached 1.2714 trillion won, a 14.6% increase compared to the end of last year.

Looking at individual stock holdings, Hanwha Aerospace showed a particularly notable increase among domestic stocks. Hanwha Aerospace did not make it into the top 20 stocks held by high-net-worth individuals at the end of last year, but this year it ranked as the fourth most held stock, following Samsung Electronics, Alteogen, and SK Hynix.

Holdings in shipbuilding stocks, which have performed strongly this year, also increased. Last year, Samsung Heavy Industries was the only shipbuilding stock in the top 20 holdings, but this year Hanwha Ocean, HD Korea Shipbuilding & Offshore Engineering, and HD Hyundai Mipo Dockyard were also included.

As gold prices continued their steep rise this year, gold holdings also increased significantly. The gold spot balance held by high-net-worth individuals rose by 19.0%, from 48.7 billion won at the end of last year to 57.9 billion won this year.

Gold prices have maintained a sharp upward trend throughout this year. The price of gold, which was $2,669 per ounce at the beginning of the year, recently surpassed the $3,500 level during trading, marking an increase of more than 25% since the start of the year.

Several factors have driven gold prices to record highs: increased demand for alternative assets due to economic uncertainty stemming from US tariff policies; a preference for safe-haven assets amid expectations of interest rate cuts; and continued gold purchases by central banks in emerging markets, including the People's Bank of China.

Hwang Byungjin, a researcher at NH Investment & Securities, explained, "Expectations for monetary policy easing since the end of the Federal Reserve's aggressive tightening in the fourth quarter of 2023 have been the driving force behind the strong gold price rally. The heightened global tariff war and political and economic uncertainty following the launch of the Trump administration's second term have further strengthened the possibility of monetary policy easing over tightening, leading to repeated upward adjustments in the value of gold as a representative safe-haven and inflation-hedge asset." He added, "Concerns about stagflation due to the US government's universal and reciprocal tariff policies have also supported the record-high gold price rally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)