"The Industry with the Highest Closure Rate Among Young Entrepreneurs in Their 20s and 30s Is Restaurants"

NH Nonghyup Bank and Card Data Analysis Results

Closure Rate Compared to New Openings Reaches 127.5%

General Bars Also Mark 99.1%

Higher Survival Rate for Young Entrepreneurs in Seoul Than in Other Regions

It has been found that the business sector with the highest closure rate among young self-employed entrepreneurs is restaurants. In the early stages of starting a business, young entrepreneurs faced greater financial difficulties compared to other age groups. There were also clear regional disparities, with the business closure rate among young entrepreneurs being higher in non-metropolitan areas than in the Seoul metropolitan area.

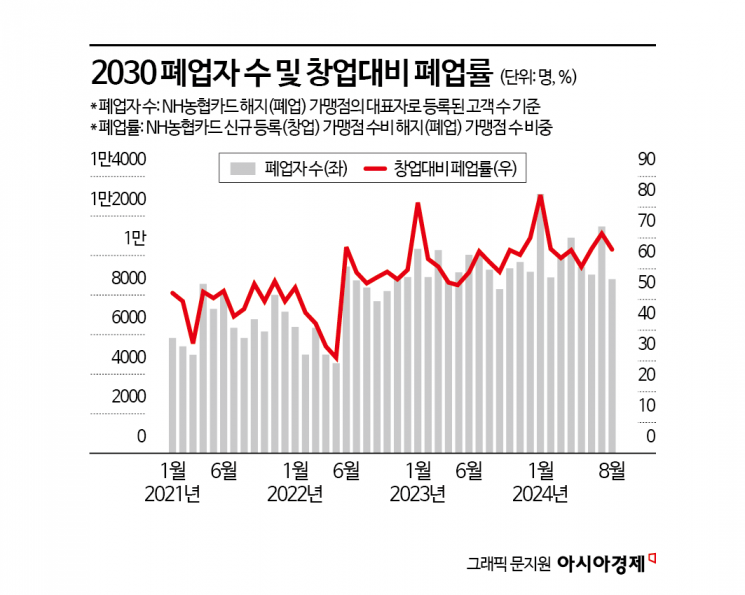

On April 28, NH Nonghyup Bank and NH Nonghyup Card analyzed financial transaction (deposit and loan) data and merchant (active and closed) information from January 2021 to August 2024. The results showed that over the past three years, both the number of young (those in their 20s and 30s) business closures and the closure rate compared to new business openings have been increasing. The number of business closures refers to the number of customers registered as the representative of a closed merchant (as indicated by the cancellation of NH Nonghyup Card merchant registration). The closure rate compared to new openings is the ratio of the number of closed merchants to the number of newly registered merchants with NH Nonghyup Card.

The number of business closures in January 2021 was about 6,000, which increased to 9,000 by August 2024. The closure rate rose from 50% to 62% during the same period. The highest closure rate in the past three years was recorded in January 2024, reaching approximately 90%. In April 2025, the number of business closures exceeded 12,000, marking the highest monthly figure in three years. NH Nonghyup Bank explained, "Unlike the simple closure rate, the closure rate compared to new business openings is an indicator that can reflect the current economic conditions of the market. This figure tends to rise during economic downturns."

According to the analysis of closure rates compared to new business openings from September 2023 to August 2024, the business sector with the highest closure rate among young self-employed entrepreneurs was restaurants (127.5%). This means that for every 100 new restaurants opened by young entrepreneurs during this period, 127 restaurants previously opened by young entrepreneurs closed down. General bars ranked second with a closure rate of 99.1%. NH Nonghyup Bank interpreted these results as a consequence of reduced dining-out consumption due to rising prices and economic stagnation. Ready-to-wear stores, coffee shops, convenience stores, and snack bars were among the top ten sectors for closure rates only among the youth, unlike other age groups. In other age groups, the sector with the highest closure rate was supermarkets (181.7%), followed by general restaurants (169.4%), cosmetics stores (138.3%), general bars (136.2%), and sporting goods stores (128.1%).

Young self-employed entrepreneurs also showed regional disparities. The region with the highest closure rate compared to new business openings was Gyeongnam (69%), followed by Ulsan (68%) and Gwangju (67%). Gyeongnam and Ulsan also ranked fourth and first, respectively, among other age groups. In contrast, Seoul had the lowest closure rate among young entrepreneurs, ranking 17th (58%). Among other age groups, Seoul ranked 11th (88%), indicating that young entrepreneurs in Seoul have a higher survival rate than those in other age groups.

The youth demographic exhibited particularly high closure rates in the early stages of business (within five years). When examining the proportion of closed and active merchants by business duration, the proportion of closed merchants among young entrepreneurs in their first to fifth year was 68%, which is 8 percentage points higher than other age groups (60%). This suggests that young self-employed entrepreneurs face greater difficulties in the early stages of their businesses compared to other age groups.

Young self-employed entrepreneurs who were forced to close their businesses were found to have very little money left and high overdue debts. An analysis of the financial assets and transaction characteristics of closed business owners showed that the average deposit balance of closed business owners (2.85 million won) was 26% lower than that of active business owners (3.87 million won). The average overdue loan amount was 20.84 million won for closed business owners and 19.33 million won for active business owners, meaning closed business owners had 8% more overdue loans. The average overdue card amount was 3.62 million won for closed business owners and 2.75 million won for active business owners, with closed business owners having 32% more overdue card debt.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.