Four Years After MOU with Shanghai Electric

Targeting Next Month's Wind Power Auction by the Ministry of Trade, Industry and Energy

Importing Parts for Manufacturing and Maintenance

Approximately 30% Cheaper Than European Products

National Security Evaluation Seen as a Major Obstacle

Concerns Over Declining Competitiveness of Domestic Companies

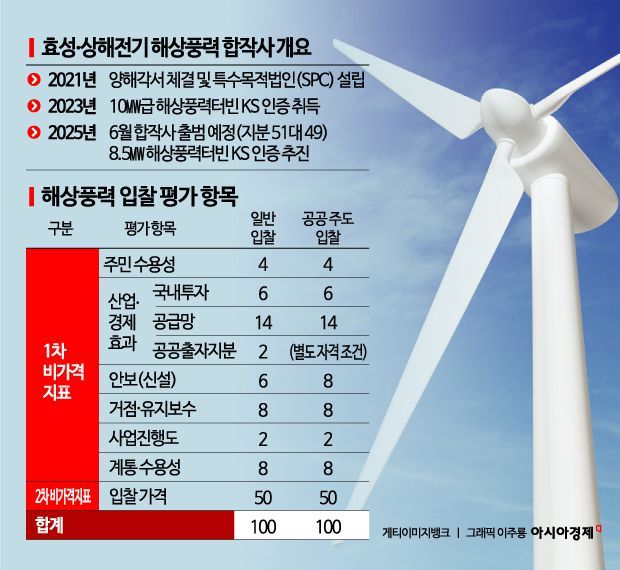

Hyosung Heavy Industries has set June as the date for establishing a joint venture with Shanghai Electric, a Chinese offshore wind turbine manufacturer. This comes four years after the two companies signed a memorandum of understanding (MOU) in 2021.

The company will begin producing offshore wind turbines domestically, with the primary goal of securing orders from developers participating in the wind power auction scheduled by the Ministry of Trade, Industry and Energy next month. Chinese offshore wind turbines are estimated to be about 30% cheaper than European products, giving them a price advantage. However, the key issue will be how to address the "national security" concerns set as a bidding criterion by the government.

According to the wind power industry on April 24, Hyosung Heavy Industries will establish a joint factory in Changwon, Gyeongnam, with Shanghai Electric in June, holding a 51 to 49 ownership ratio, to produce offshore wind turbines. A Hyosung Heavy Industries official stated, "We have agreed to import parts from China, manufacture the turbines in Korea, and handle maintenance as well," adding, "We plan to gradually increase the proportion of Korean-made parts."

Since signing the MOU with Shanghai Electric in 2021, Hyosung Heavy Industries has established a special purpose company (SPC) and prepared for the construction of the joint factory. In 2023, it received KS certification for a 10MW-class offshore wind turbine and is also preparing KS certification for an 8.5MW-class turbine. A company representative explained, "We believe that an 8.5MW-class wind turbine is more suitable for Korea's wind conditions than a 10MW-class model." Hyosung Heavy Industries plans to eventually produce 16MW-class turbines at its Korean plant to suit the local market conditions.

Shanghai Electric, Hyosung Heavy Industries' partner, was ranked among China's top five wind turbine manufacturers in a 2021 assessment by BloombergNEF. In terms of offshore wind turbines alone, it is known to be the largest in China.

The decision by Hyosung Heavy Industries to establish the offshore wind turbine joint venture in June appears to be heavily influenced by the Ministry of Trade, Industry and Energy's fixed-price contract competitive bidding for wind power, expected next month. This year, the announced offshore wind capacity is about 2 to 2.5GW for fixed-bottom turbines and 0.5 to 1GW for floating turbines, totaling approximately 2.5 to 3.5GW. The bidding results will be released in July. The company is currently in contact with domestic and foreign developers, with a strong intention to secure a turbine supplier before the results are announced. The final bidding volume will be recalculated based on a demand survey.

However, for the offshore wind turbines that Hyosung Heavy Industries is bringing in with Shanghai Electric to be selected, the national security evaluation criteria are expected to be decisive. While Chinese turbines are about 30% cheaper than European products and therefore advantageous in price evaluation, many expect that having a foreign partner rather than a domestic company will be a disadvantage in the security assessment.

Last year, the government included the security score in the industrial economic impact category for the bidding process, but this year, following the enactment of the National Resource Security Special Act in February, it has been separated as an independent evaluation criterion.

A Hyosung Heavy Industries official explained, "We plan to address energy security concerns by transferring Chinese offshore wind turbine technology through a licensing agreement and securing a five-year inventory of key components." The official added, "We also understand that the proportion of domestic parts in European and locally developed offshore wind turbines is not particularly high."

The domestic offshore wind industry is divided over the entry of Chinese wind turbines into the Korean market. Introducing low-cost Chinese wind turbines could improve economic feasibility, accelerate project timelines, and revitalize the offshore wind industry. On the other hand, there are concerns that domestic offshore wind equipment companies could be pushed out of the competition.

At a recent forum titled "Discussion on Revitalizing the Wind Power Industry and Fostering Domestic Manufacturing," hosted by the Energy Transition Forum at the National Assembly, Son Chanhee, executive director at Hanwha Ocean, said, "Rather than unconditionally rejecting Chinese wind turbines, we should consider the opportunity to quickly acquire technology and operational know-how." In contrast, Han Byunghwa, an analyst at Eugene Investment & Securities, argued, "If Chinese companies only perform simple assembly of low-cost equipment in Korea, it will hinder the growth of our companies and prevent exports."

Starting with this year's offshore wind power competitive bidding, the government plans to open a separate bidding market for public entities such as power generation and local public corporations. About 30% of the total bidding volume is expected to be allocated to public-led bidding. The government also plans to provide incentives in the evaluation process when wind turbines developed through government R&D projects, such as those by Doosan Enerbility and Unison, are used.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)